Understanding Smith County Property Tax and Commercial Market Growth

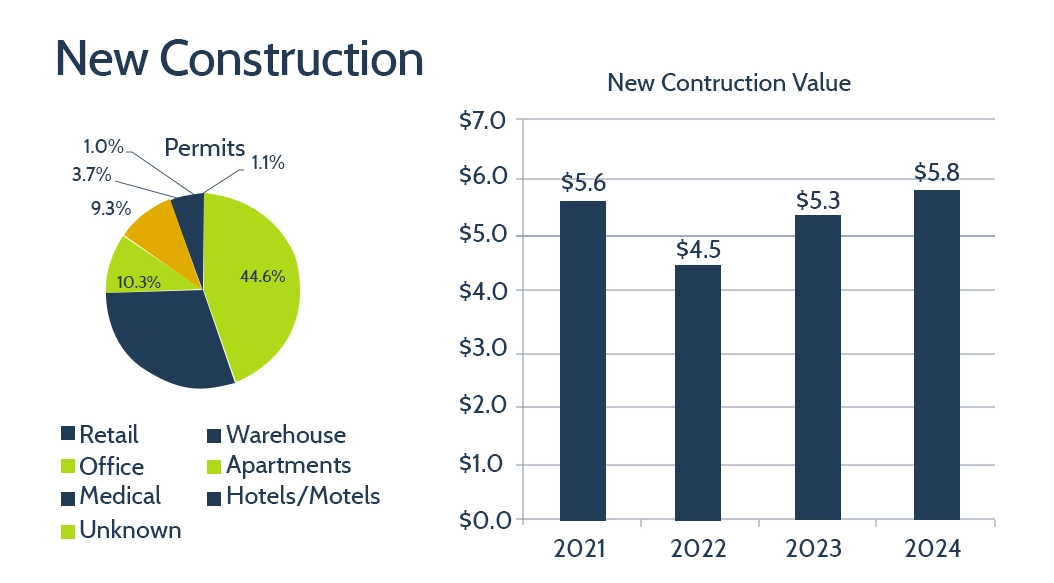

New Construction Trends in Smith County Property Tax (2023–2024)

It’s new construction shows steady residential demand and growth in diverse commercial sectors.

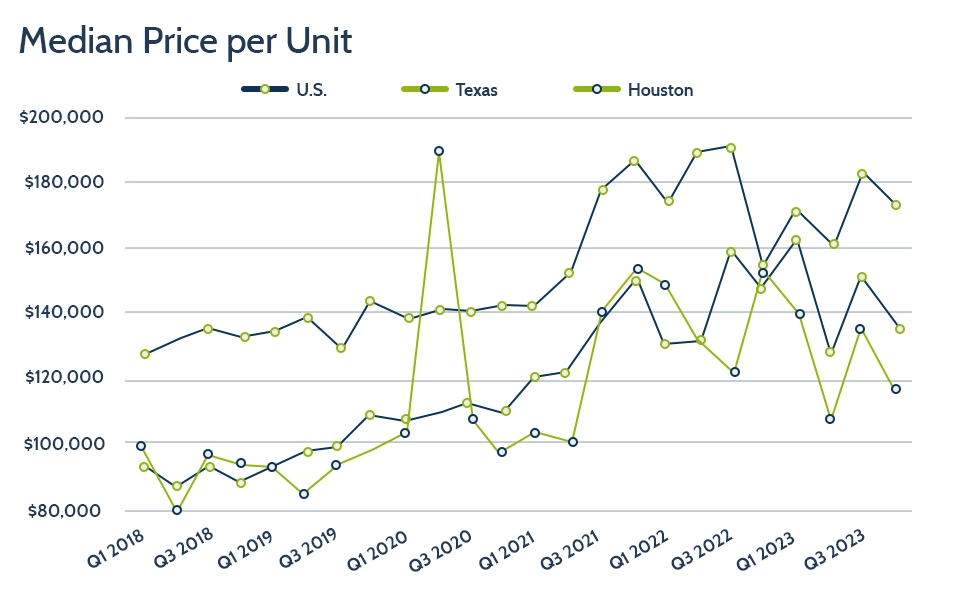

Office Market Trends in Smith County (2023–2024)

The office property values in the area rose sharply in 2024, reflecting new construction and shifting demand post-pandemic. If your workspace was reassessed, now’s the time to act.

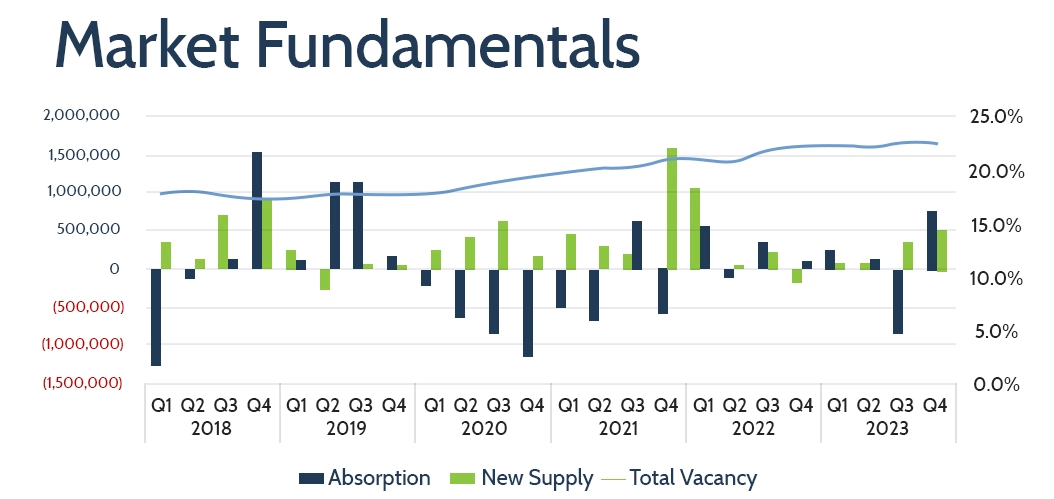

Smith County Apartment Market Update – 2024

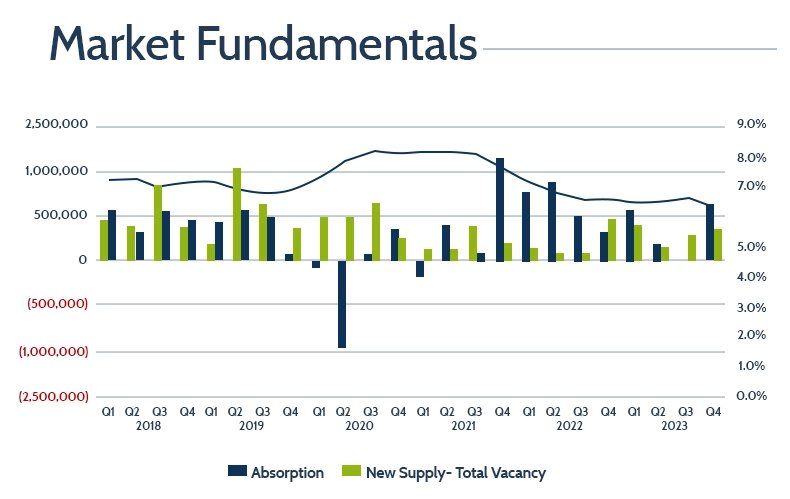

The apartment market closed 2023 with positive unit absorption, indicating steady demand alongside new construction activity. While rental rates remained stable, rising vacancy levels suggest a more balanced market, giving renters more options and landlords more reason to reassess Smith County’s property valuations.

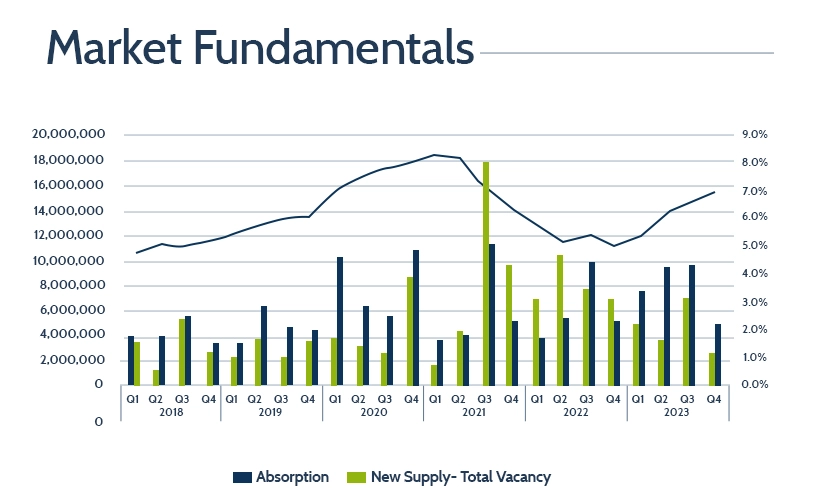

Retail Market Snapshot – Smith County (2023–2024)

This steady performance shows the retail sector remains a reliable component of Smith County CAD‘s portfolio. It’s important for property owners and investors to monitor these trends—especially when preparing for property tax protest reviews or considering protests.

Smith County Warehouse Market (2023–2024)

Although new construction has slowed, stable absorption and rising rental rates indicate Smith County’s warehouse market remains resilient and appealing for owners and investors.