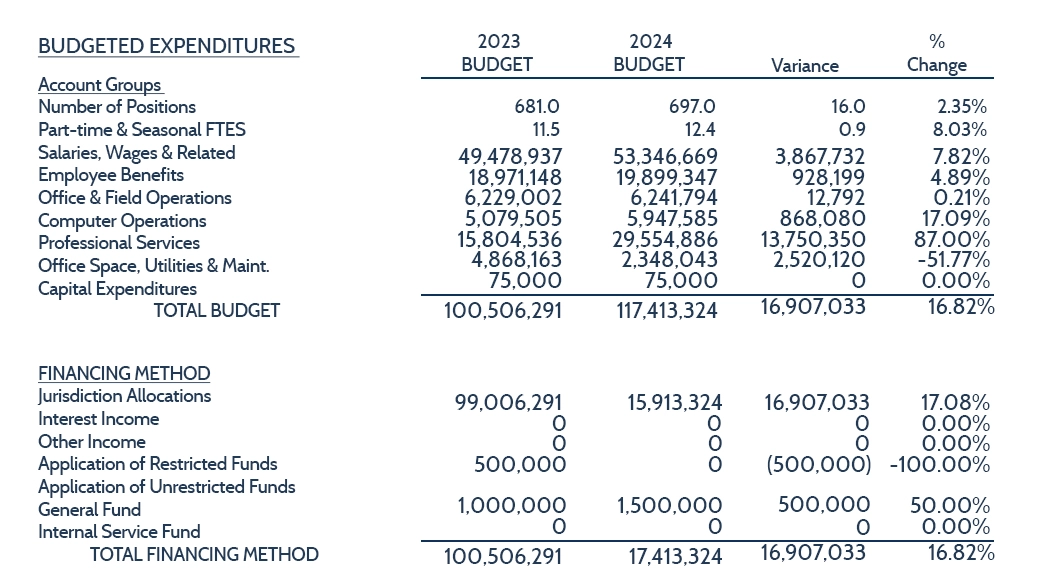

Smith County Appraisal District SCAD Annual Budget

2026 Budget Moves: What’s Changing at Smith County SCAD

These shifts reflect Smith County’s focus on more accurate valuations and efficient service—making it more important than ever for property owners to stay informed and review their assessments carefully.

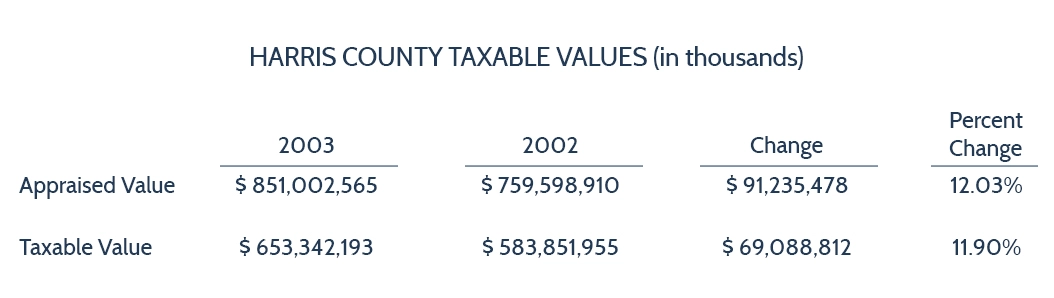

Smith County Property Values Overview

From 2022 to 2023, Smith County Appraisal District SCAD recorded a sharp uptick in both appraised and taxable values, fueling higher tax revenues and expanded county services.

As values rise, so does the importance of making sure your appraisal is fair and accurate. If your notice doesn’t reflect your property’s true worth, now is the time to challenge it—before it costs you more than it should.

Say Goodbye to High Property Taxes in Smith County

At Tax Cutter, our experienced property tax professionals go to work on your behalf, protesting directly with the Smith County CAD. Sign up today and let us take the stress out of your Texas property tax protest—while you keep more of your hard-earned money.