Residential Property and the Hays Appraisal District

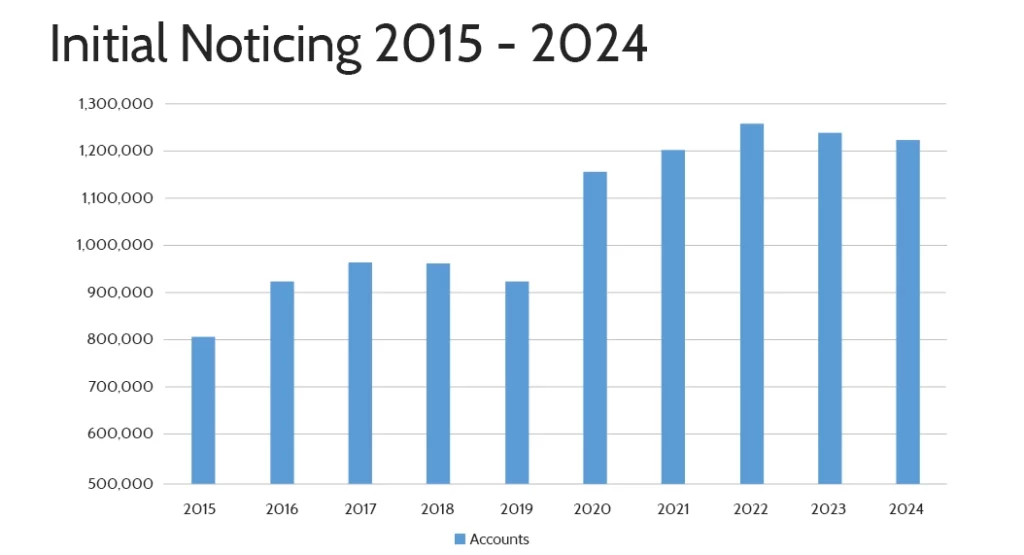

Trends in Initial Noticing accounts by Hays Appraisal District

This steady increase highlights more homeowners receiving Hays County CAD assessments and considering their right to protest property valuations.

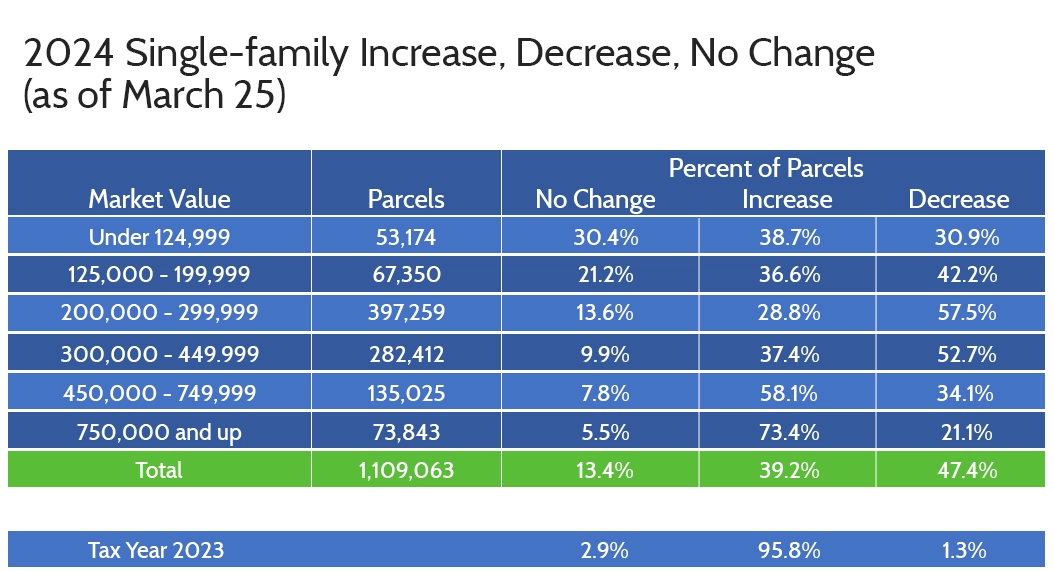

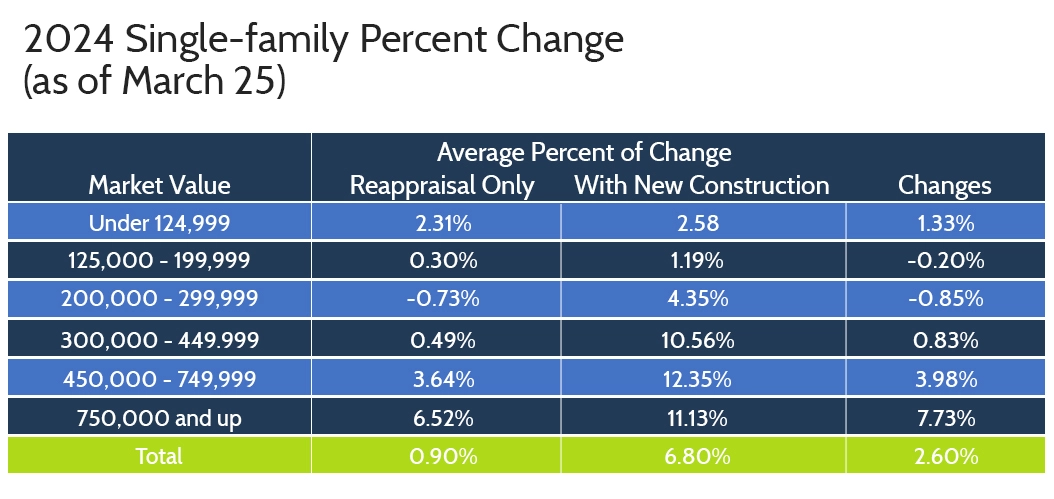

Market Value Trends for Single-Family Homes

The residential market remains on the rise, fueled largely by new developments and the appreciation of higher-value properties.

Maximize Your Savings with Tax Cutter

Take control of your property taxes with support from our expert team. We make the protest process easy, effective, and stress-free so you can focus on what matters while we focus on saving you money.