Residential Market Trends and Hays Appraisal Insights

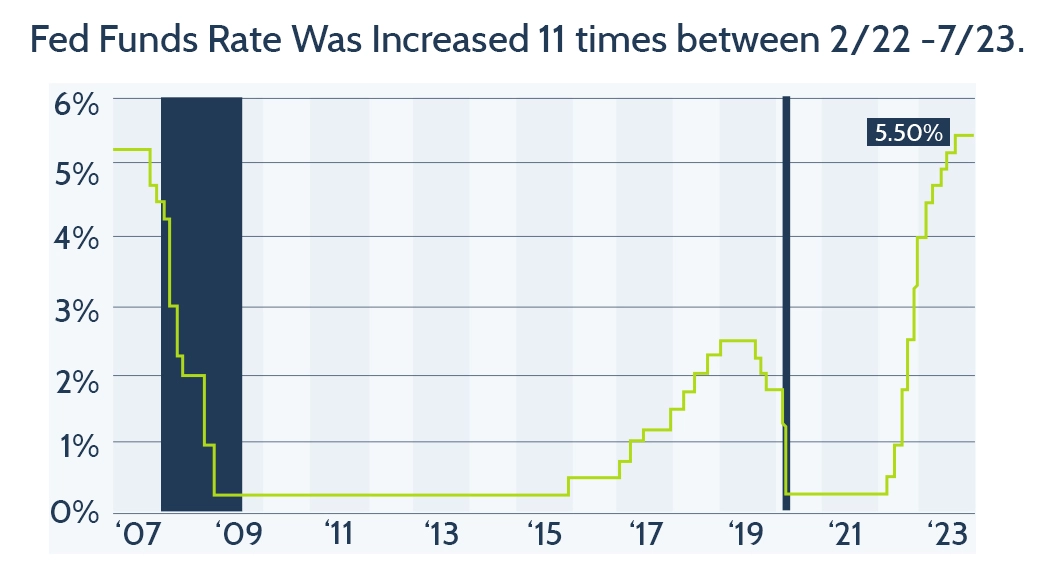

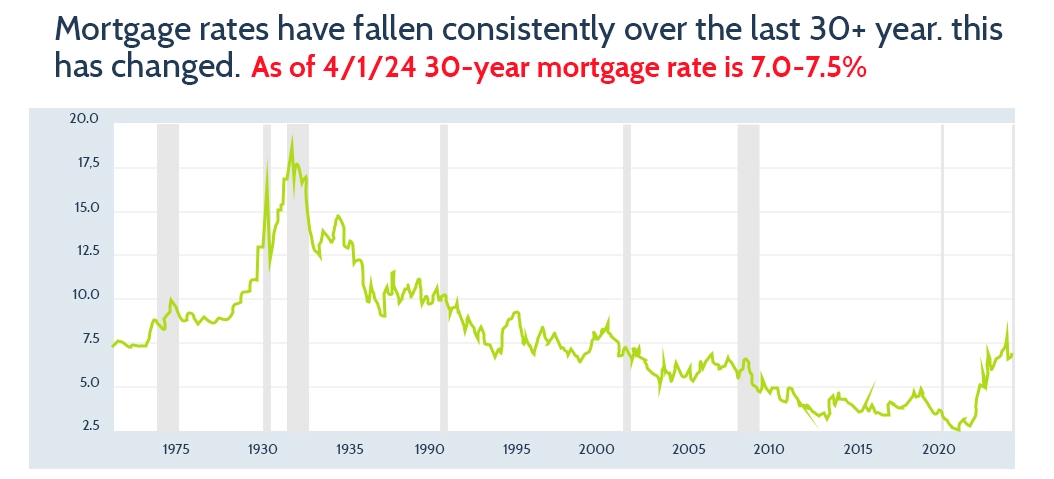

Impact of Rising Interest Rates

These market changes influence appraisals by the Hays County Appraisal District, as reduced buyer activity and extended listing times directly affect Hays Appraisal valuations.

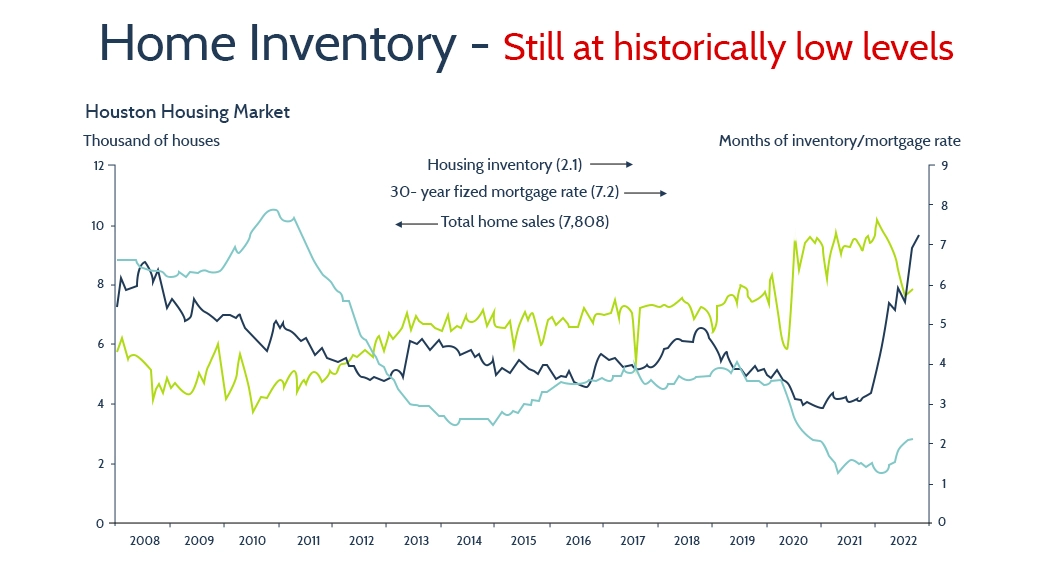

Housing Inventory Trends

These shifts in inventory directly influence local pricing trends and are reflected in current property valuations managed by Hays County CAD.

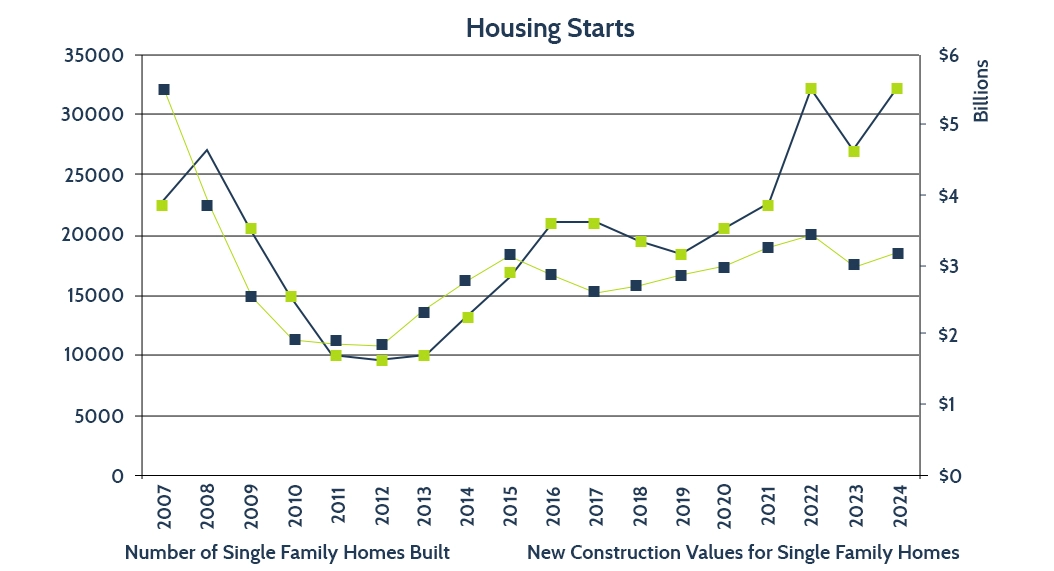

Single-Family Home Market Overview

Recent property records highlight key shifts in home construction and valuation trends across the residential market.