Commercial Property and Hays County Appraisal District Texas

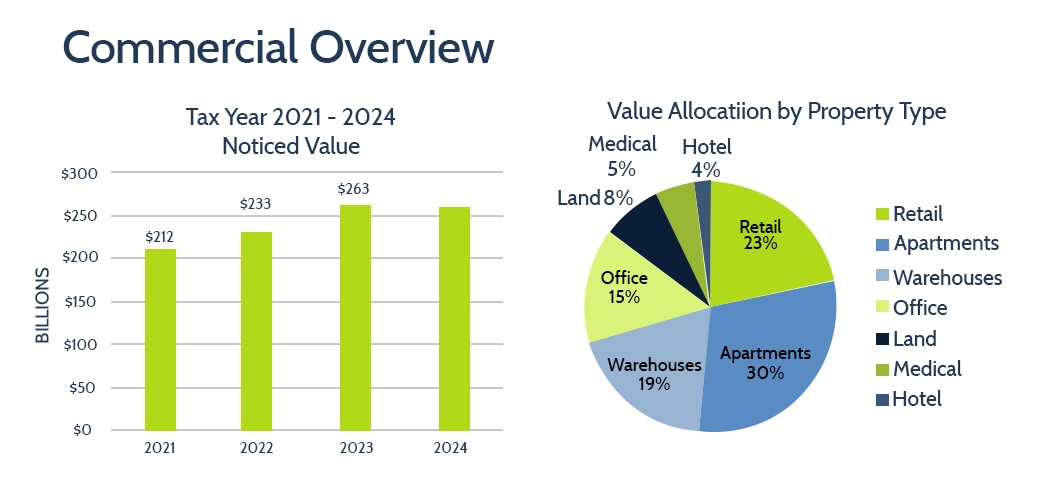

Value Allocation in the Commercial Property Market

This allocation highlights how various commercial property segments contribute to overall market value under Hays County Appraisal District assessments

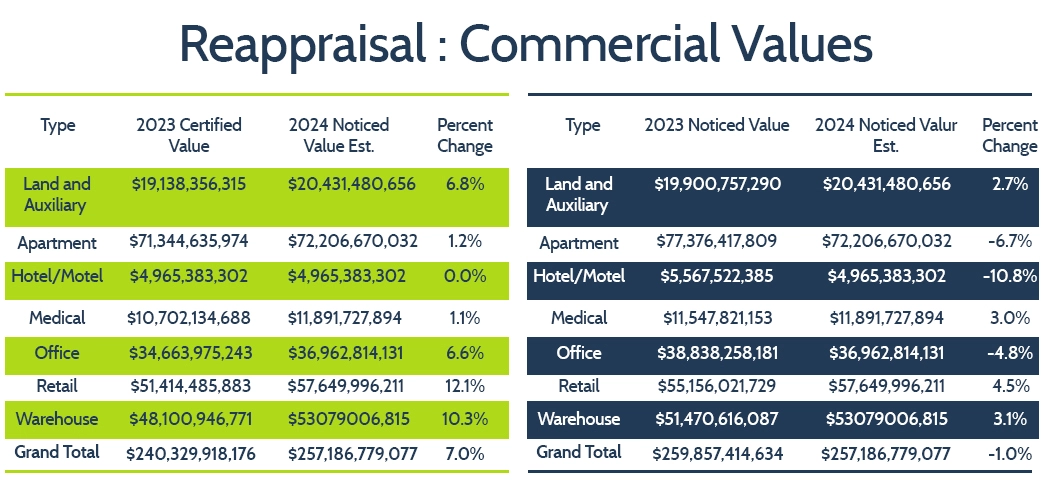

Commercial Property Value Trends

As noted in data from the Hays County Appraisal District Texas, the commercial market continues to shift, with varied trends across property types tracked by Hays County CAD.

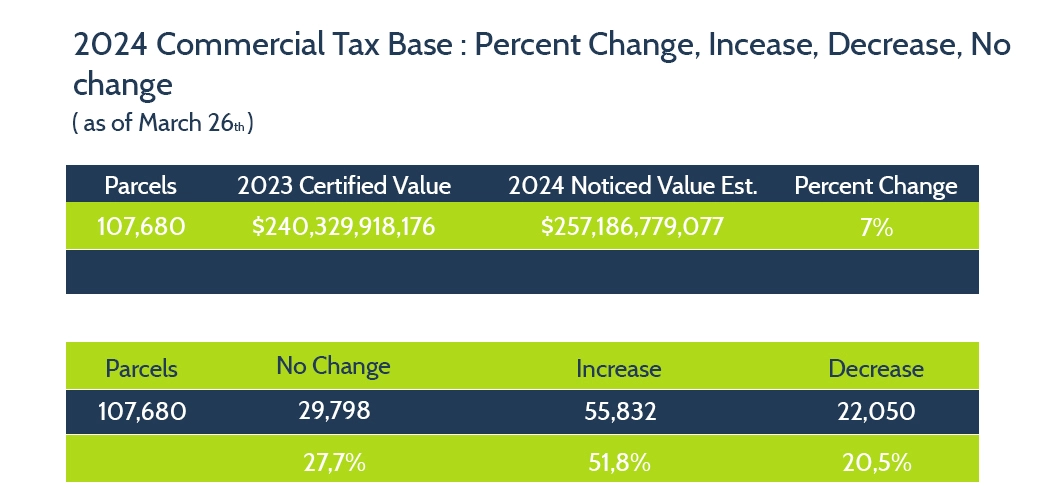

Rising Commercial Property Values Highlighted

These changes in valuation by the Hays County Central Appraisal District signal notable shifts in commercial assessments, directly impacting the tax obligations of local property owners.

Say Goodbye to Overpaying Property Taxes

Tax Cutter helps you hold onto more of your hard-earned money. Our experienced property tax analysts work directly with the Hays County Appraisal District Texas to challenge unfair valuations so you don’t have to.