Commercial Market Trends and Hays County Texas Property Tax

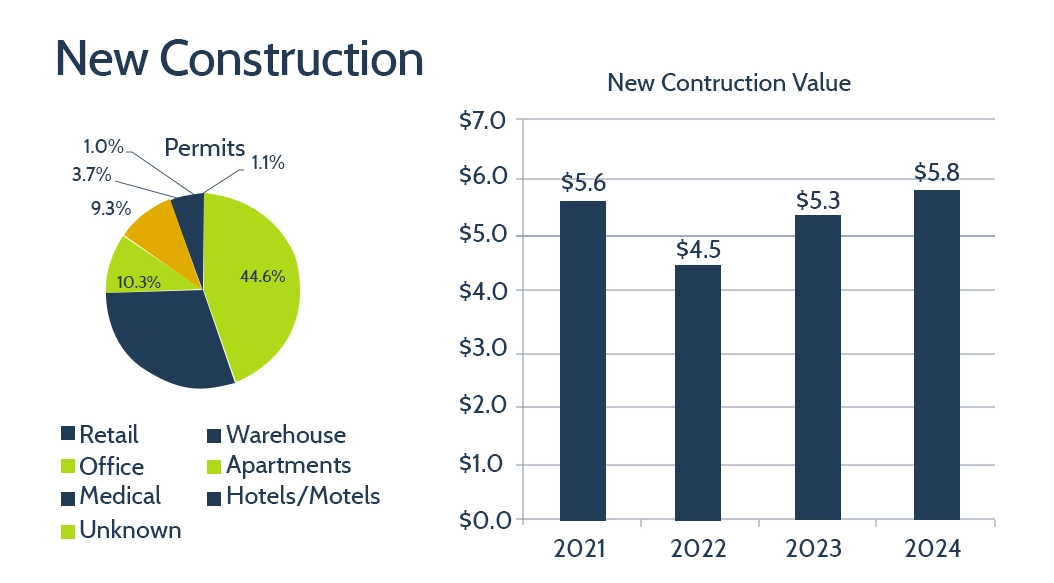

Trends in New Commercial Construction Permits and Values

These construction trends point to strong demand for both housing and commercial space, as reflected in updated valuations by the Hays County Appraisal District.

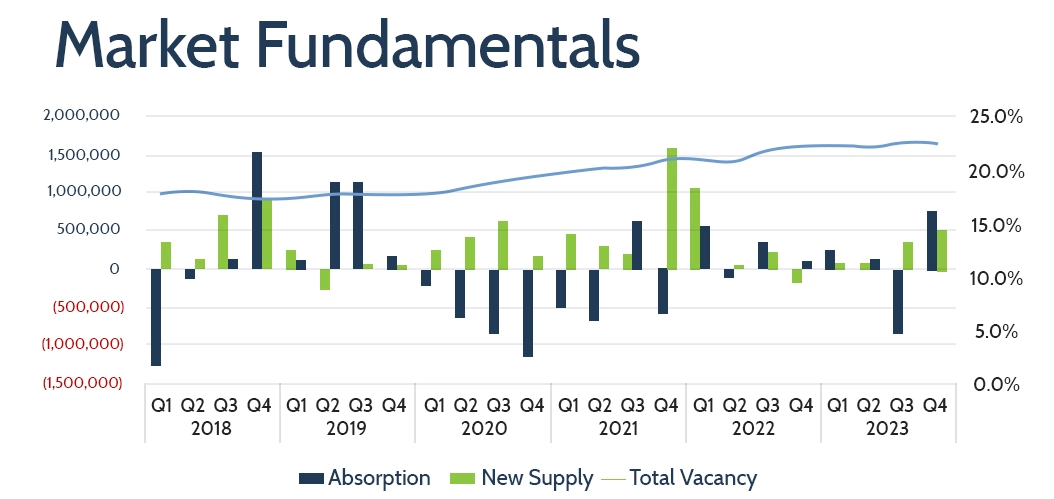

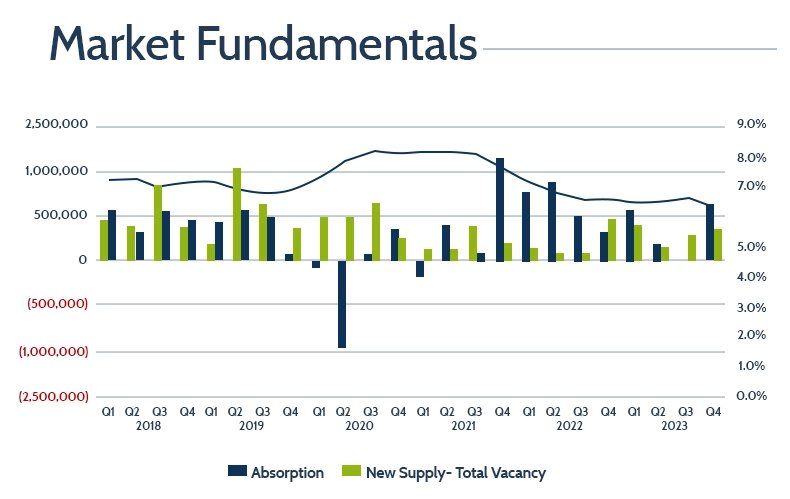

Adjustments in the Office Market

These trends reflect continued adjustments in the local office market, with changes in development, occupancy, and availability influencing property values and Hays County Texas property tax assessments

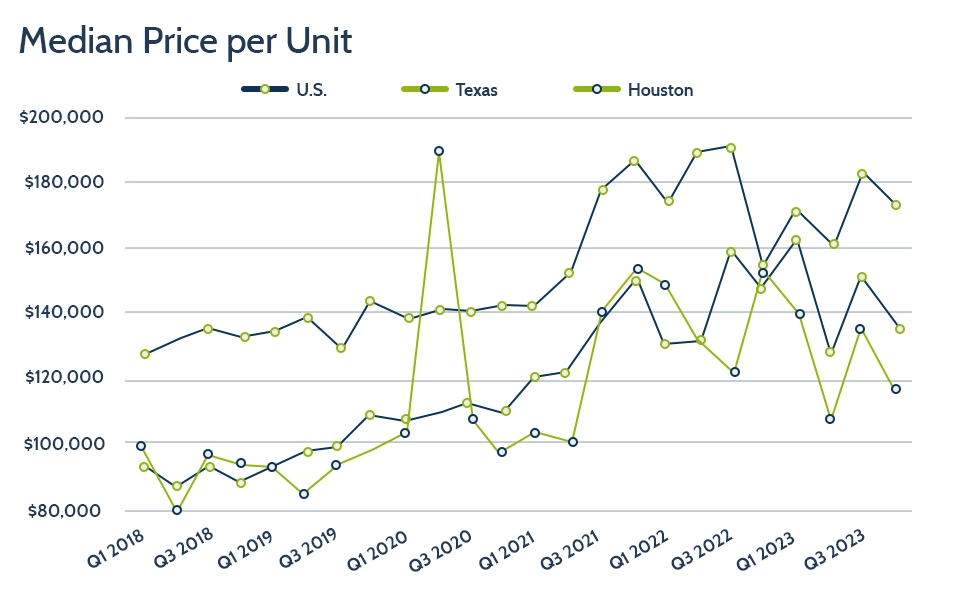

Apartment Market Overview

The apartment sector closed the year with steady absorption and continued construction activity. Data from Hays County CAD highlights a balanced yet shifting trend in occupancy and rental performance.

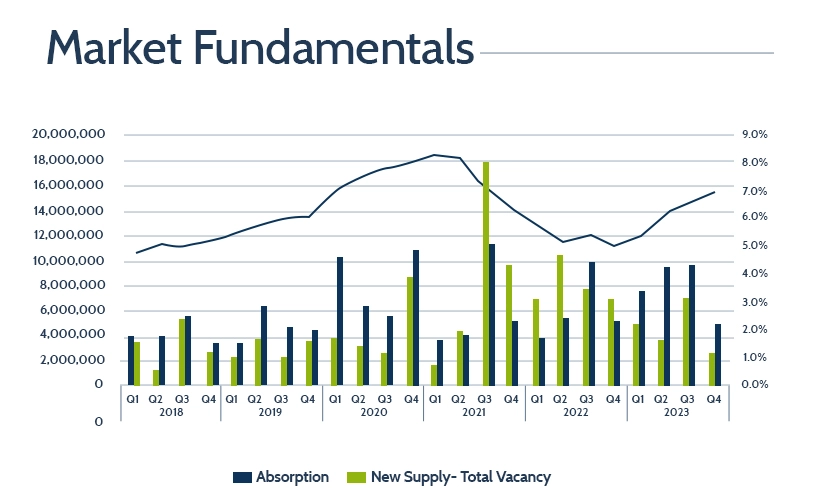

Texas Retail Sector

While new retail construction has slowed, the market continues to show resilience through strong absorption and stable lease rates. Data from the Hays County Central Appraisal District highlights ongoing demand and a healthy retail property environment.

Warehouse Market Overview

These figures point to a warehouse sector that is finding balance, with reliable absorption and steady rental pricing. Hays County Texas property tax assessments reflect these market dynamics in updated property valuations.