Ector Appraisal District Residential Property Market Trends

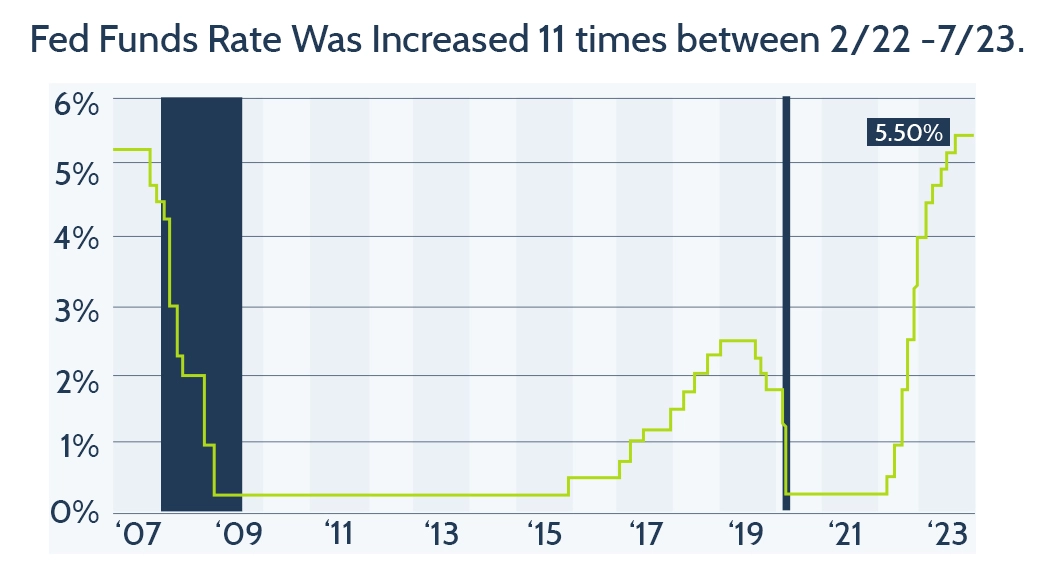

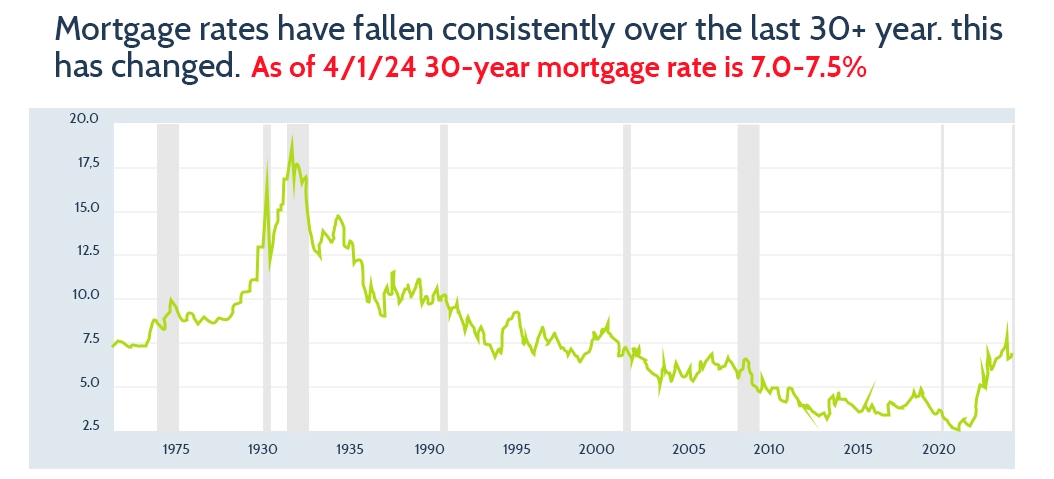

Taylor County Property and the Influence of Rising Interest Rates

As of April 1, 2024, mortgage rates have reached levels not seen in recent years, driven by actions from the Federal Reserve, influencing housing affordability and reflected in property assessments by the Ector County property tax.

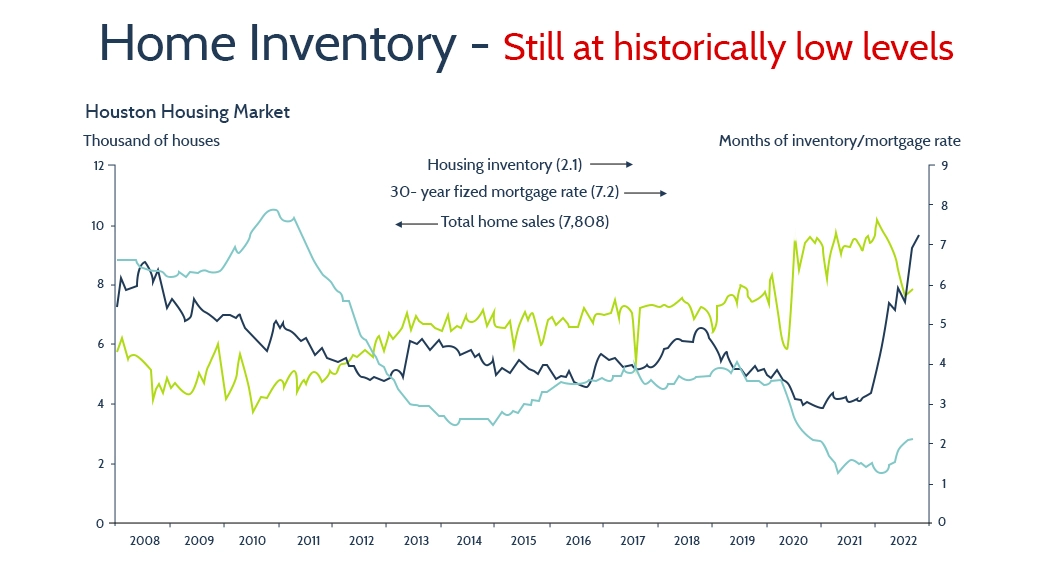

Shifts in Housing Inventory in Ector County

Over the last two years, the availability of homes has shifted dramatically, significantly influencing housing prices and ensuring a more balanced market, as shown in the Ector County Appraisal District data.

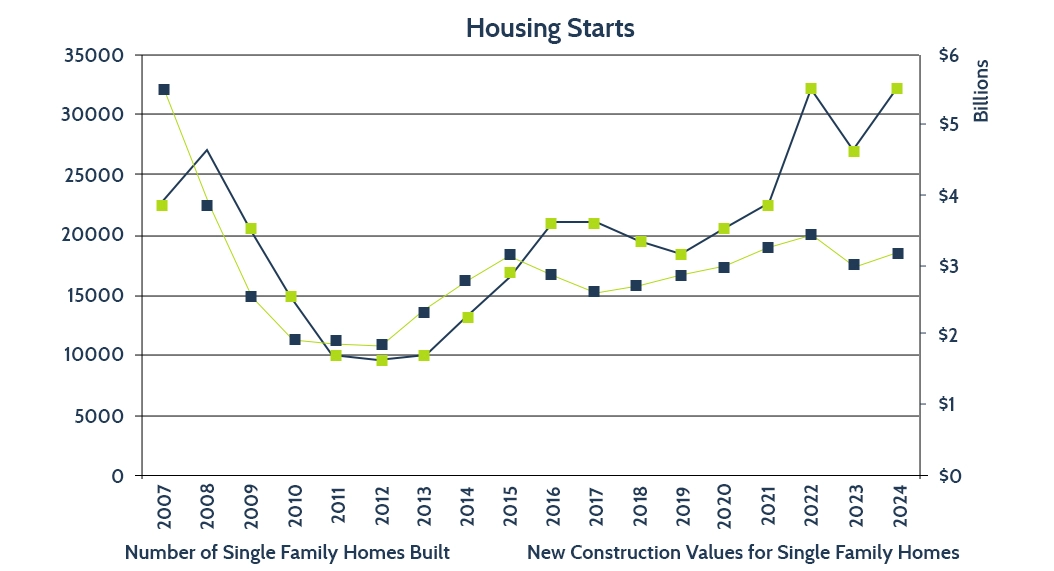

Exploring the Ector County Single-Family Home Market

These shifts housing market—marked by fluctuations in both single-family home construction and property values—show just how much the local real estate landscape has evolved in recent