Understanding Ector County Appraisal Property Tax and Commercial Market Growth

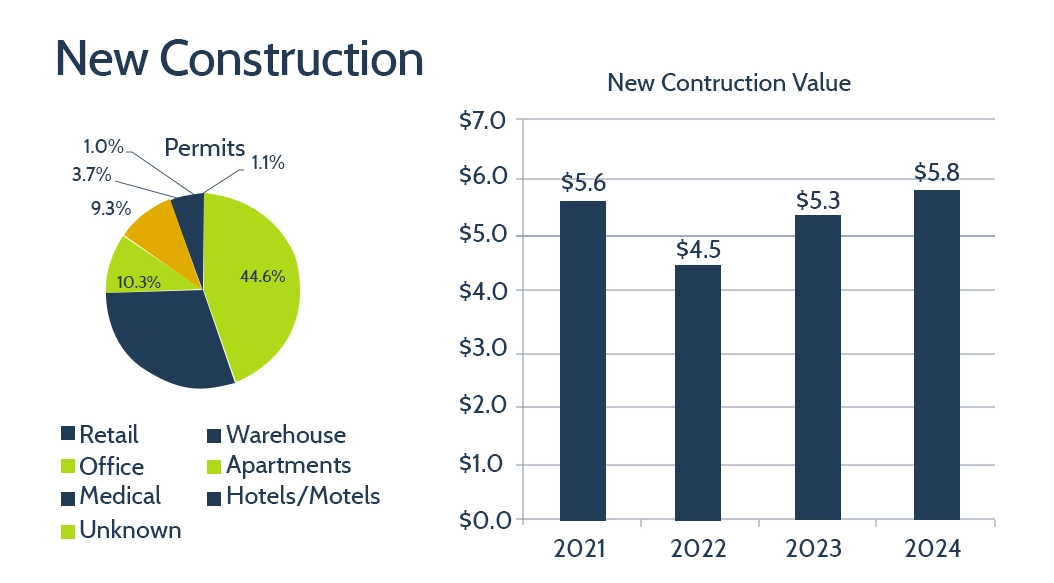

New Construction Permits and Value Trends in Harris County

These trends reveal a strong demand for multi-family housing and a booming commercial construction market, as highlighted by Ector County Appraisal District data. The future of real estate here is looking bright!

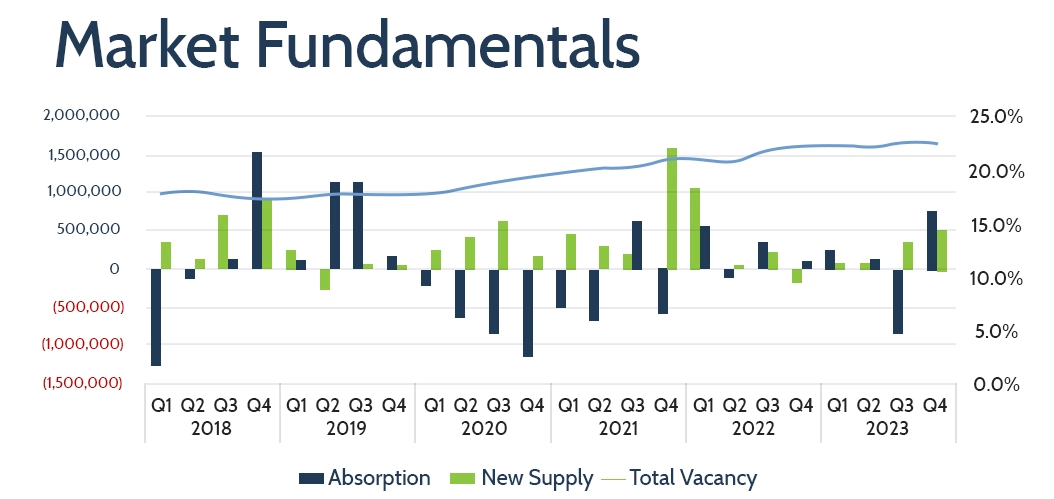

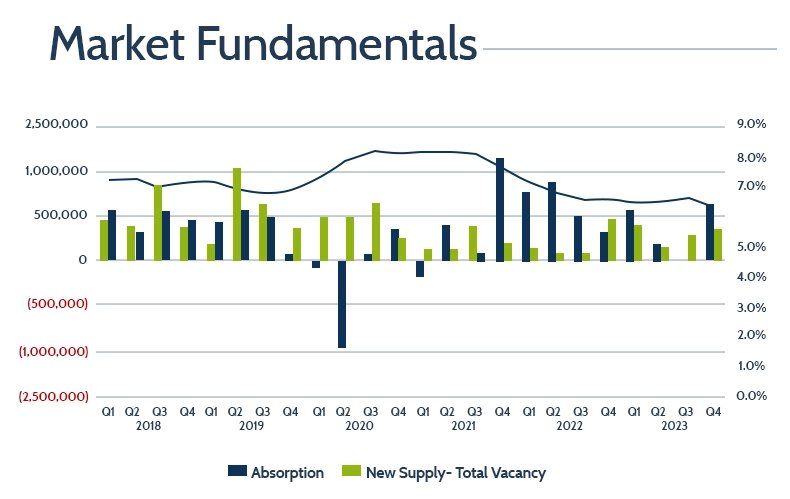

Developments in the Ector County Office Market

As the office market adapts to the ongoing changes post-pandemic, these key metrics highlight significant shifts in new construction, space absorption, and vacancy rates—offering a glimpse into the dynamic future of the local commercial real estate market.

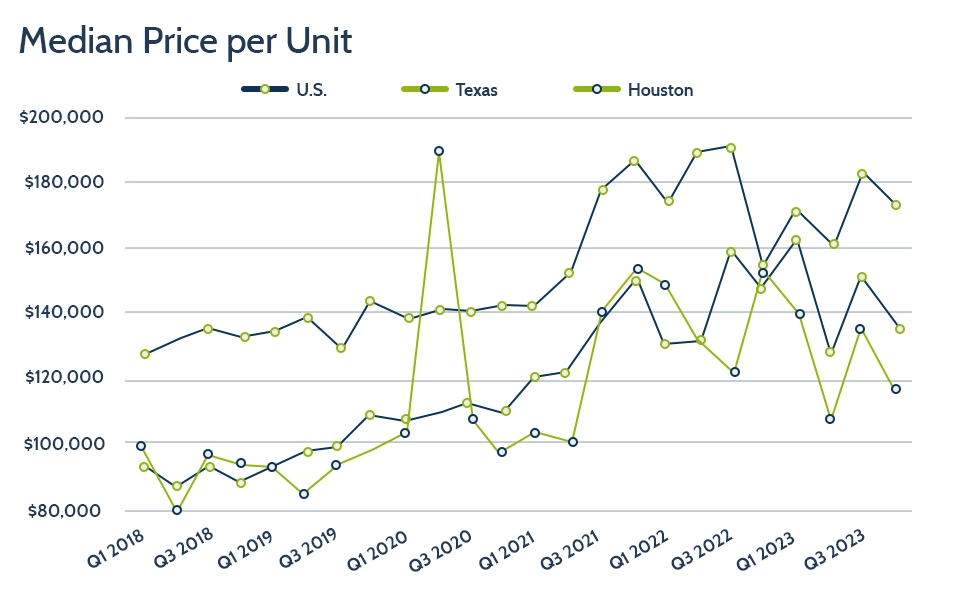

Overview of the Ector County Appraisal Apartment Market

The apartment market ended 2023 on a positive note with strong absorption, reflecting growth in new construction and continued demand for units. Key metrics from the Ector Appraisal District show a mixed trend in rental rates and occupancy, highlighting the dynamic nature of the local apartment market.

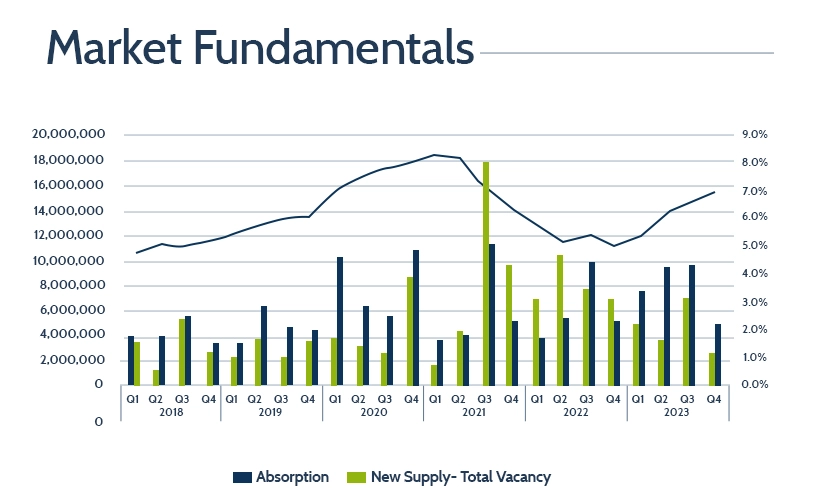

Houston’s Retail Sector Insights

Even amid market uncertainties, retail sector has shown impressive resilience, with consistent absorption and stable rental rates. The data highlights a decrease in both new construction and absorption, signaling a shift in the local retail landscape, but a market that continues to adapt and thrive.

Warehouse Market in Ector County Appraisal

While signs of a slowdown emerged in 2023, with fewer spaces under construction and lower absorption, the warehouse sector continues to command higher quoted rates, reflecting the ongoing demand and resilience in the market.