Residential Market Trends Insights From Brazos Appraisal

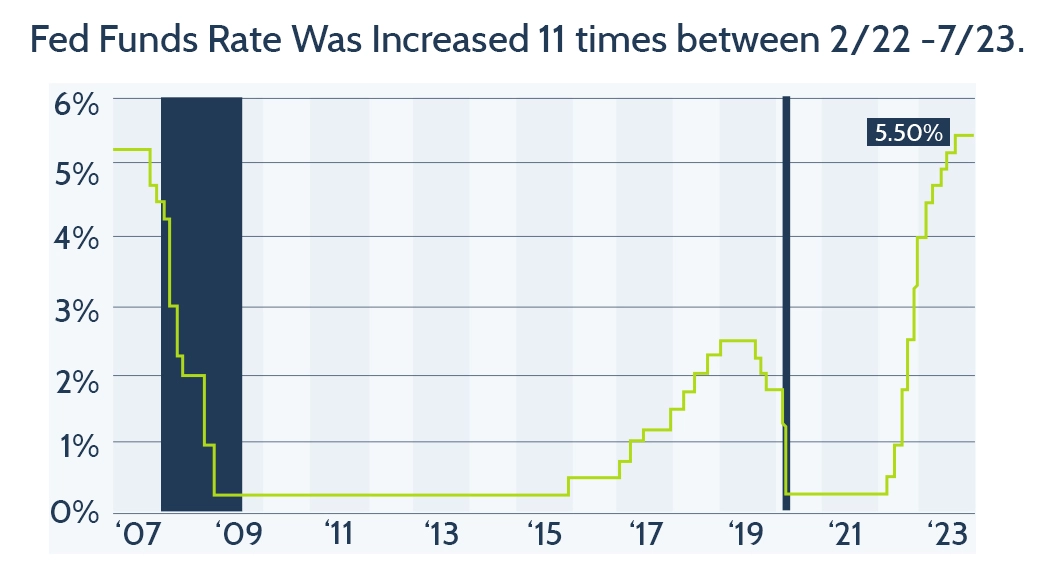

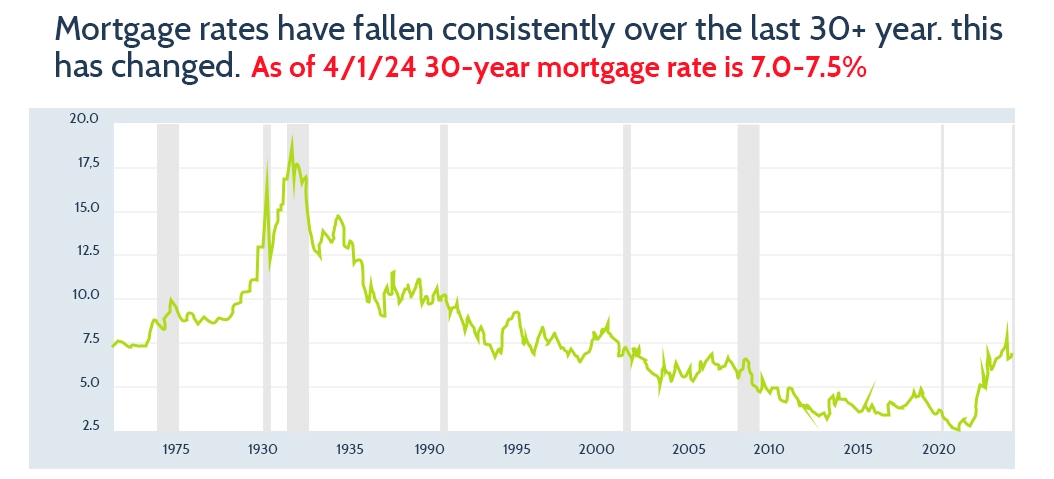

Impact of Rising Interest Rates

The Brazos County Appraisal District now factors in slower market activity and revised price patterns when setting assessed values.

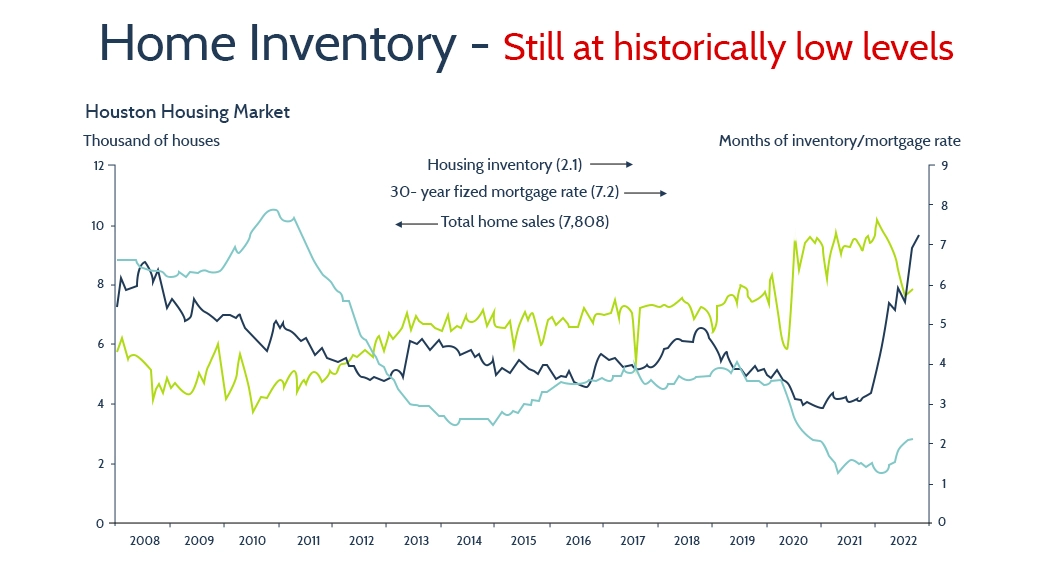

Housing Inventory Trends in Residential Market

These shifts impact annual valuations reported by Brazos Appraisal, and appraisers at Brazos County CAD are adjusting assessments to reflect slowing turnover and increased availability.

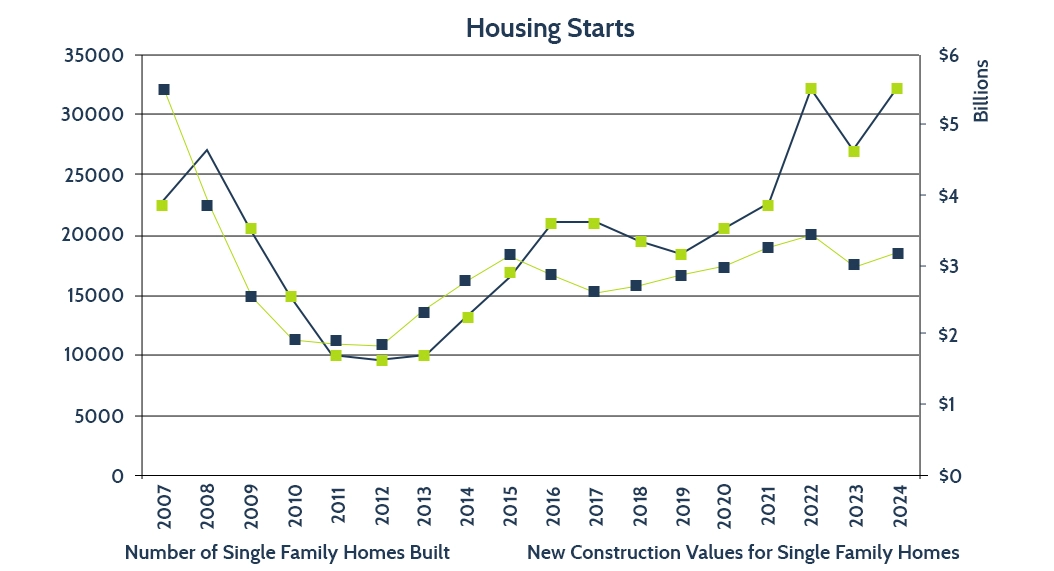

Single-Family Home Construction Overview

These trends in Brazos County show a housing market shaped by both new builds and adjustments to existing property values.