Residential Property Assessments by Brazos Appraisal District

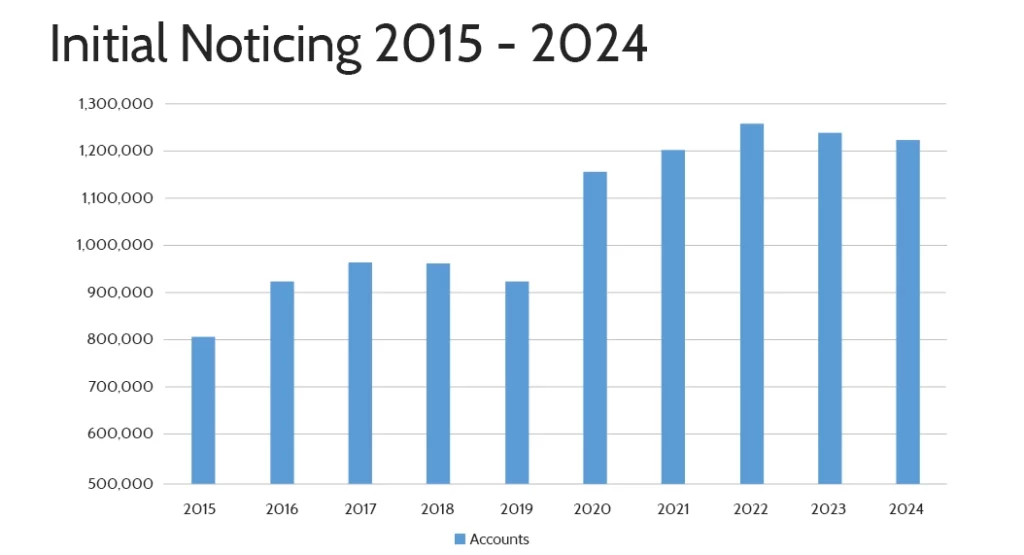

Trends in Initial Notices by Brazos Appraisal District

In Brazos County, the ongoing development boom has resulted in increased scrutiny and more properties entering the appraisal process each year.

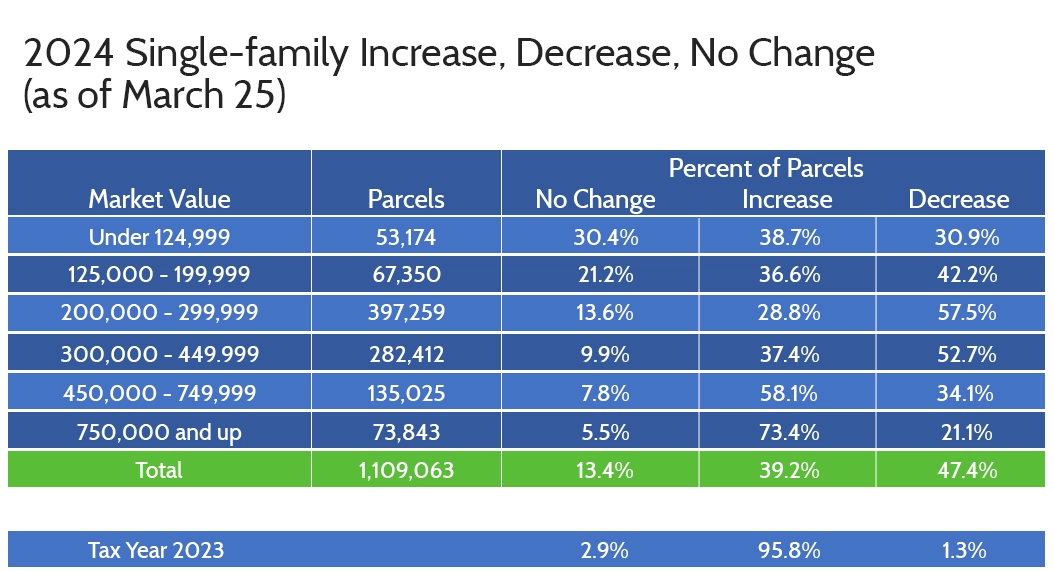

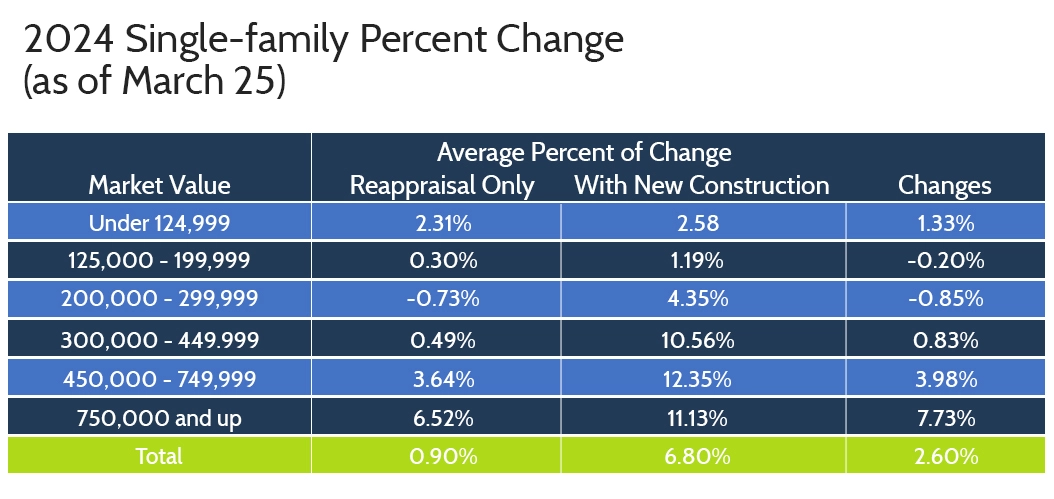

Market Value Trends for Single-Family Homes

The residential market reflects continued demand and regional growth, with assessed values steadily rising based on trends tracked by Brazos CAD.

Your Path to Lower Property Taxes Starts Here

Take control of your property taxes with our professional analysts working to maximize your savings. Our expertise ensures a seamless process so you save more without the hassle. Sign up today and let us handle everything for you!