Your Guide to Brazos County Appraisal Annual Budget

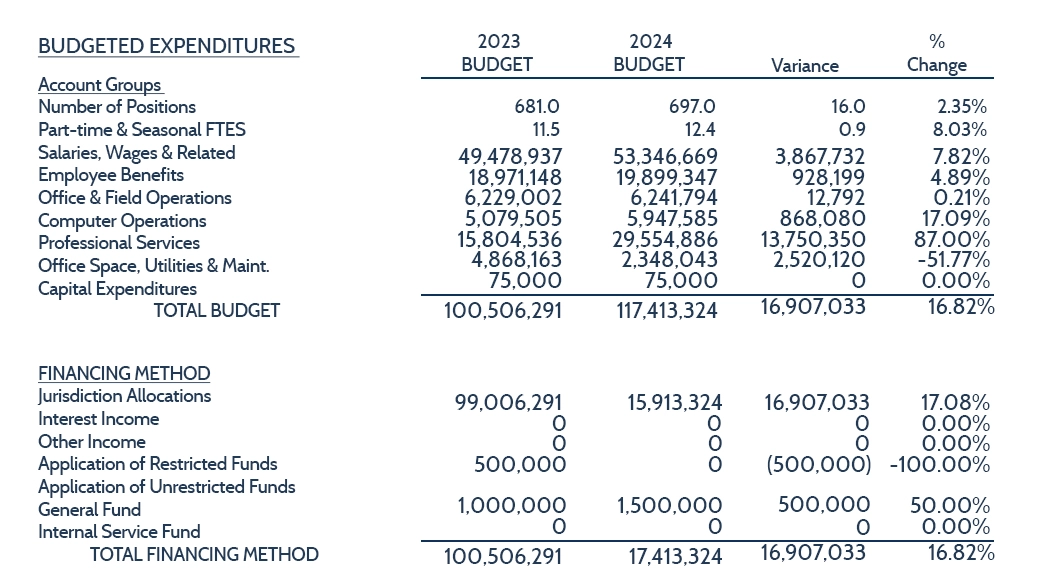

Key Changes and Trends

These budget shifts show how appraisal costs, county operations, and taxpayer contributions evolve offering vital context for the Brazos County appraisal process.

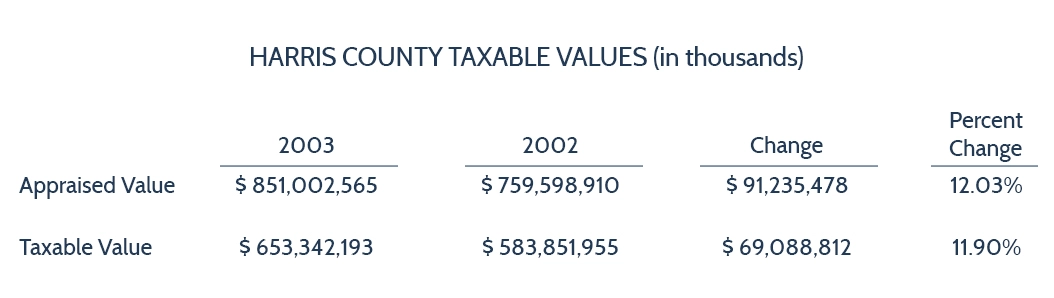

Property Values Overview

Rising property values have significantly impacted the local tax base, funding essential public services and infrastructure.

Say Goodbye to High Property Taxes

Tax Cutter works on your behalf to protest unfair assessments in Brazos County. Our experienced analysts manage every step of the process, helping you secure real savings with less effort. Sign up today to lower your property tax burden.