Commercial Property Trends in Ector County Appraisal District Odessa TX

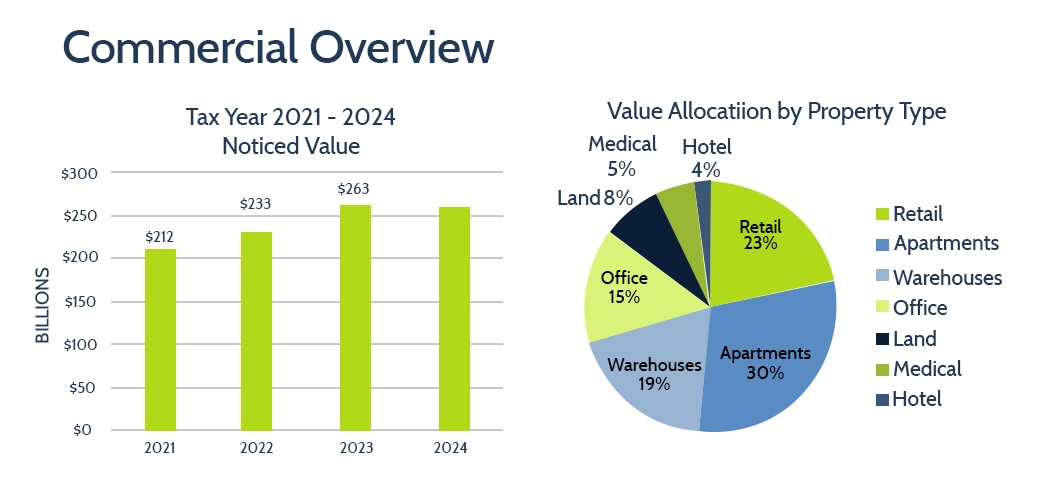

Allocation of Value in Ector County’s Commercial Real Estate

These numbers highlight the key role that specific property types play in shaping the commercial landscape, with apartments and retail spaces leading the charge in Ector County property tax protest market evaluations.

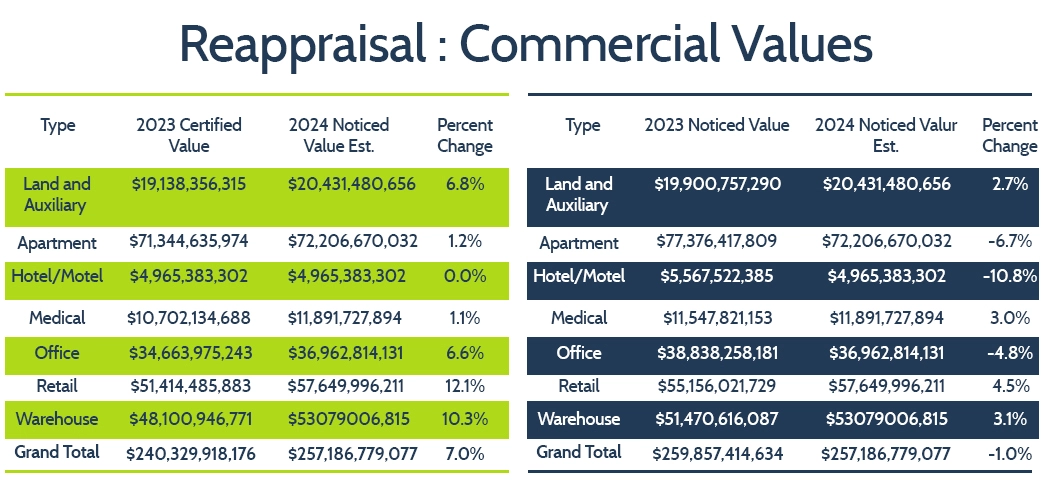

Trends in the Value of Commercial Properties

The Ector County Appraisal District data reveals a dynamic shift in the commercial property market, with certain sectors thriving while others face obstacles.

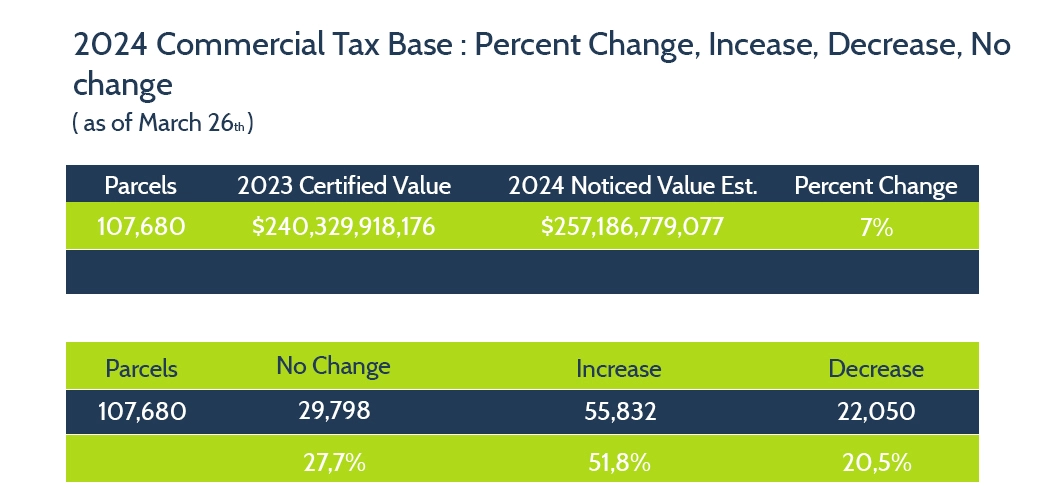

ECAD Highlights the Surge in Commercial Property Values in 2024

The 2024 Ector Appraisal District commercial tax base reflects significant changes in property valuations, affecting tax obligations for property owners.

Wave Goodbye to Overpaying ECAD Property Taxes

Tax Cutter helps you maximize savings with expert property tax analysts who aggressively protest on your behalf to the Ector County Appraisal District Odessa Tx