Ector County Tax Appraisal Residential Property

Market Overview

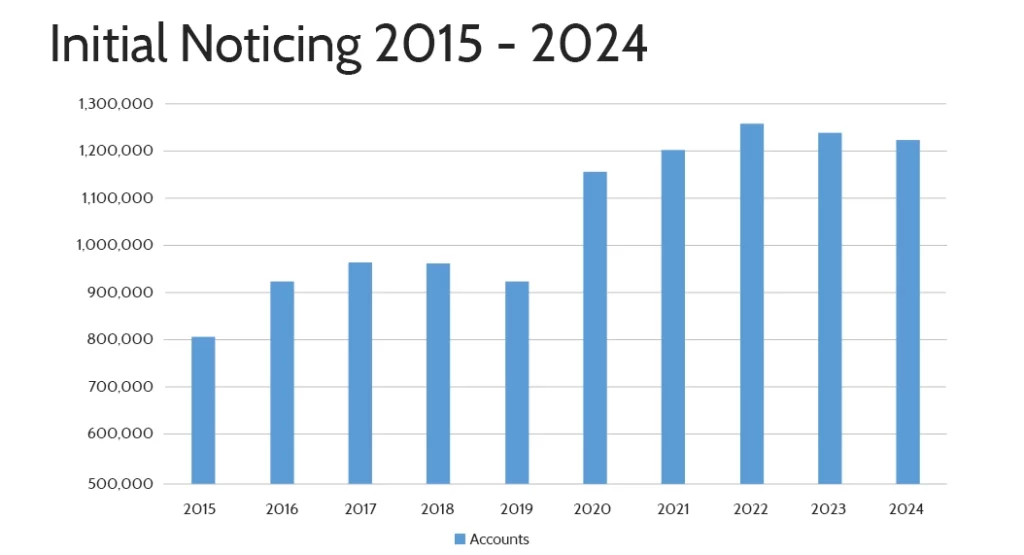

Trends in Initial Property Notices by Ector County Appraisal District

It’s clear that Ector County CAD is expanding quickly, with the most significant jump in initial noticing accounts happening in the last few years!

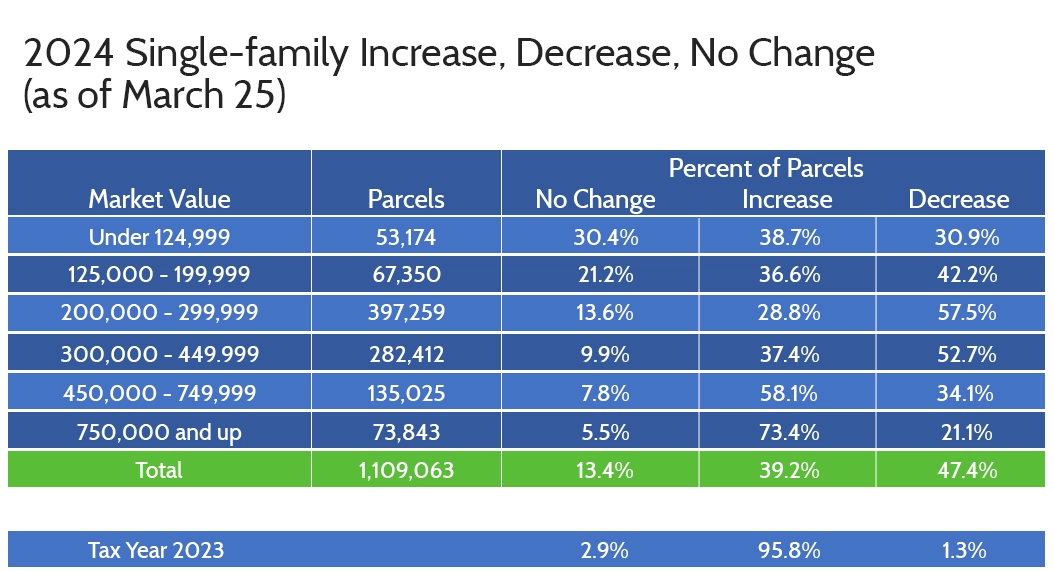

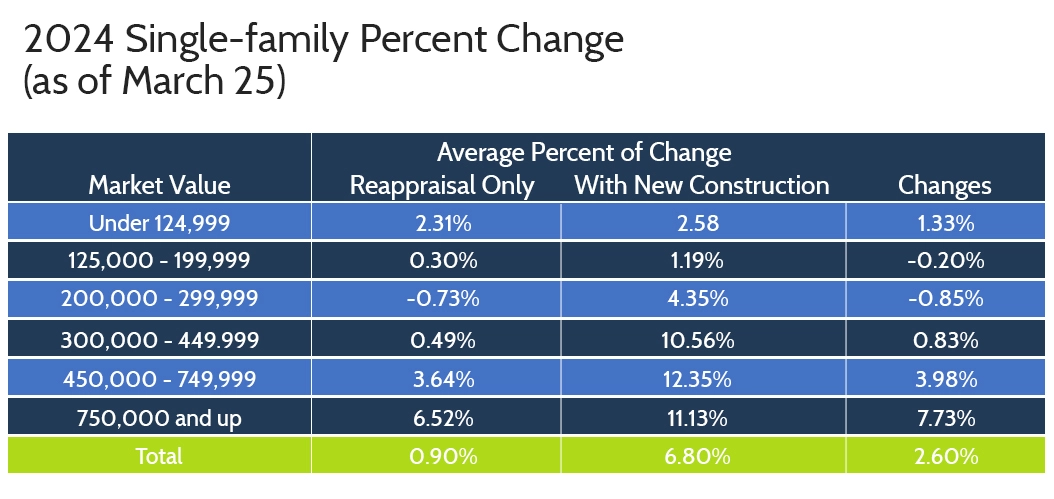

Ector County Single-Family Home Market Value Trends

Overall, property market has shown a steady increase in values, with key factors like new construction and high-value properties playing a significant role in these changes.

Boost Your Ector County Property Tax Savings with Tax Cutter

Take charge of your Ector County property tax protest with our dedicated team working hard to get you the best savings possible. With our expertise, you’ll enjoy a seamless protest process and keep more money in your pocket. Sign up today and let us do the heavy lifting!