Commercial Property Trends in Smith County Appraisal District Texas

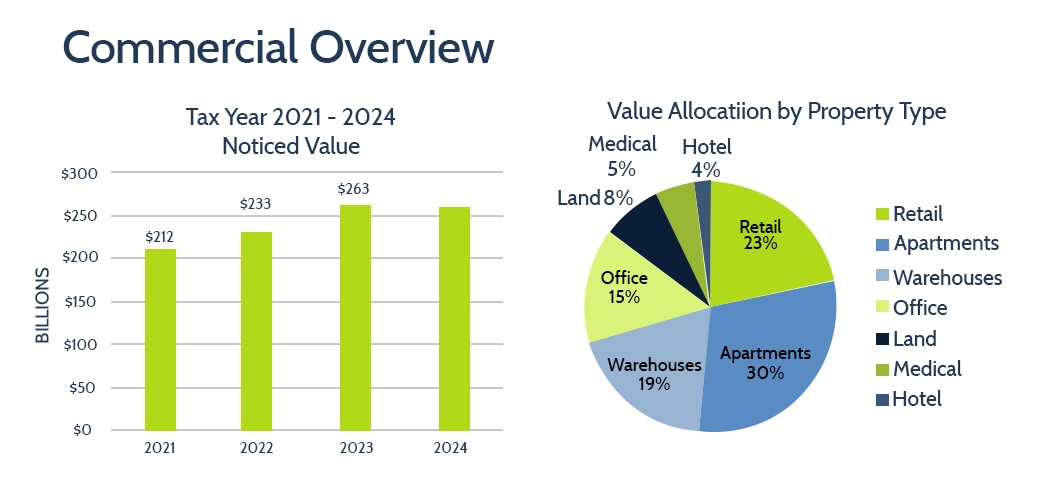

Value Allocation in the Smith County Commercial Property

This diverse mix highlights the vital role commercial property plays in Smith County’s economy and tax base.

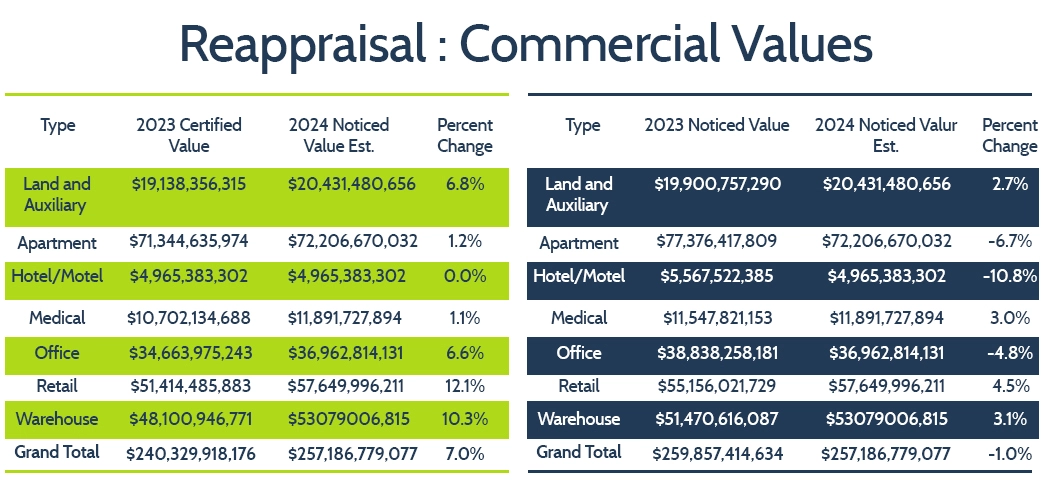

Smith County Appraisal District: Commercial Property Value Trends (2023-2024)

These shifts show that while some sectors are booming, others may face assessment challenges making now a critical time to review and, if needed, protest your appraisal with Smith County CAD.

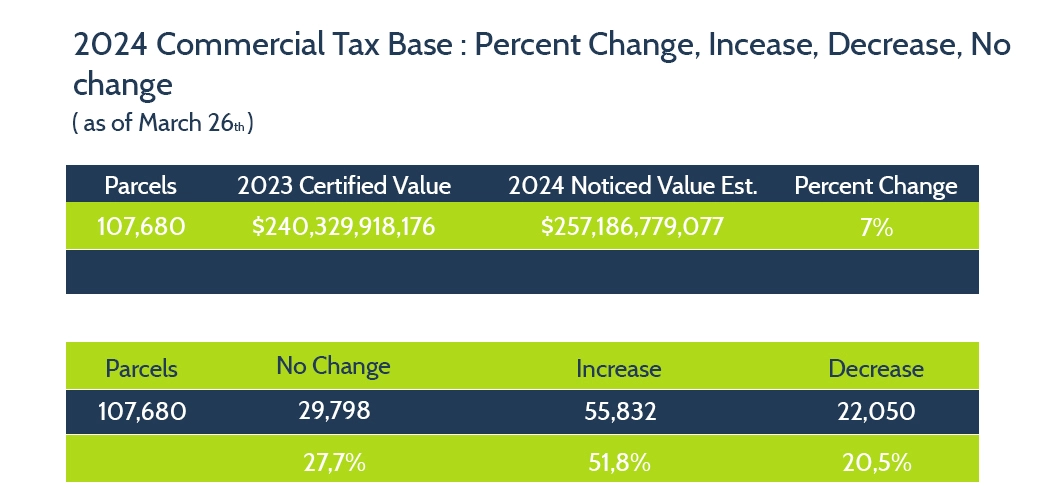

2024 Commercial Property Value Trends

Land values rose by only 4.4%, showing more modest growth compared to built-up commercial assets. These appraisal shifts are directly impacting property tax bills, driving many commercial property owners to file protests in 2024.

Say Goodbye to Overpaying Smith County CAD Property Taxes

At Tax Cutter, our dedicated analysts negotiate directly with the Smith County Appraisal District to reduce your assessed value and lower your tax payments.