Summary of Property Tax Protests with Tarrant County CAD

Tarrant County Property Tax Protests: Key Insights & Trends

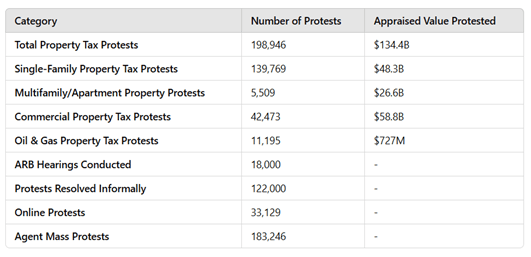

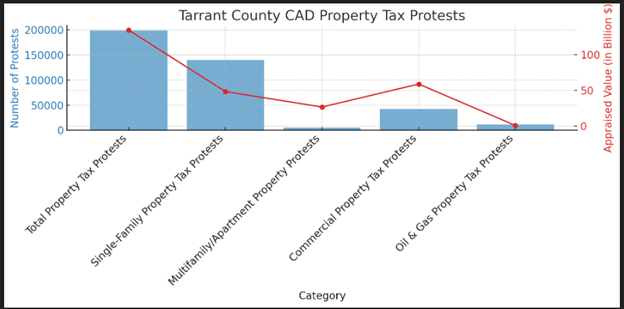

Tarrant County Appraisal District property owners filed 198,946 protests, disputing $134.4 billion in appraised value. Single-family homes accounted for 139,769 protests ($48.3B), while commercial properties had 42,473 protests ($58.8B). Oil & gas properties saw 11,195 protests, challenging $727M in value. 122,000 protests were resolved informally, with 18,000 ARB hearings conducted to determine final valuations.

Property Tax Protest Summary

The following images provide a detailed breakdown of property tax protests in Tarrant County Appraisal. The table presents key statistics, highlighting the total number of protests, property types affected, and the appraised values under dispute. The chart visually compares these categories, illustrating the distribution of protests and their financial impact. The data underscores the growing efforts of property owners to challenge rising valuations, particularly in the residential and commercial sectors.

Join Tax Cutter! No Upfront Cost, Only Pay When You Save

Take Control of Your Property Taxes

Tax Cutter provides expert analysts dedicated to securing maximum savings by managing your Tarrant County property tax protest from start to finish. Let us handle the process while you focus on what matters most.