Residential Property Market Trends for Smith County Tax Protest

Smith County Tax Appraisal District: A Closer Look at Residential Property

In 2024, residential properties remained a key driver of Smith County’s property market. Single-family homes accounted for over $17.99 billion in market value across 72,000+ parcels. Multi-family properties reached $1.52 billion, showing steady demand for rental housing. Additionally, vacant residential land held a market value of $543 million from nearly 20,500 parcels. These numbers highlight the strength and diversity of the local housing market.

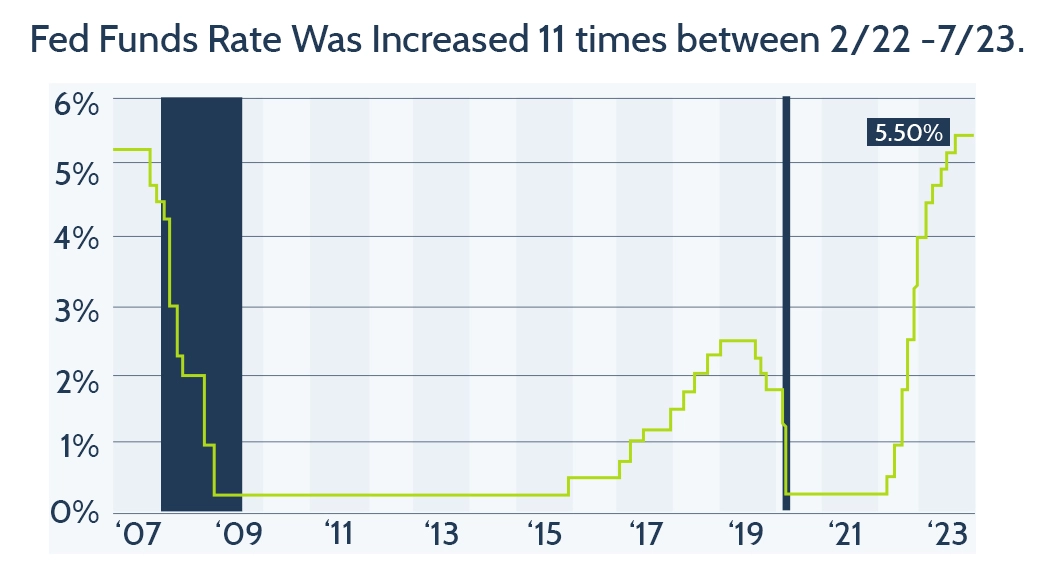

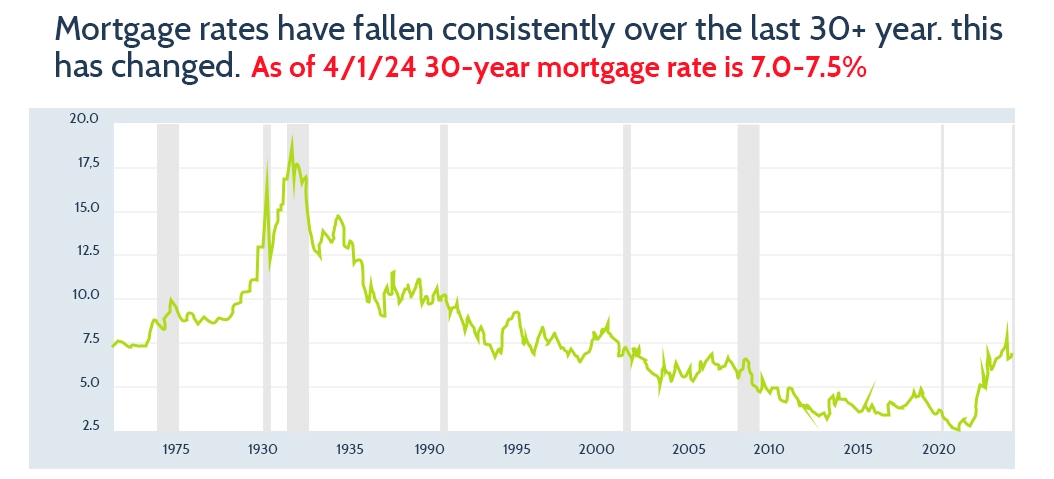

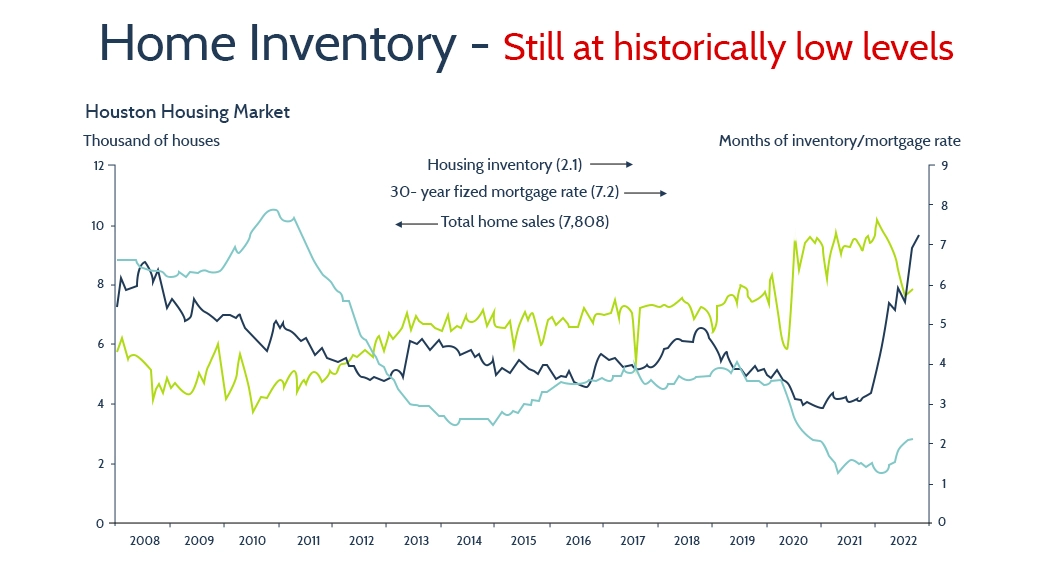

How Rising Interest Rates Are Affecting Property Values in Smith County

As rising interest rates strain affordability, more Smith County homeowners are taking action—challenging appraisals and securing real savings through Smith County Tax Protest. The trend shows no signs of slowing.

Tracking Housing Trends

Region`s housing stock in 2024 edged upward, while new construction lagged behind due to shifting economic dynamics.

Maximize your Property Tax savings with Tax Cutter

Take control of your property taxes while we work behind the scenes to secure the maximum savings you deserve.