Houston Property Tax Protest

Why Choose Tax Cutter?

Tax Cutter helps property owners by providing the best property tax protest services that ensure the best savings. Meanwhile, you just sit back and relax.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Why Protest Your Houston Property Taxes?

Property values in Houston are appraised annually by the Harris County Appraisal District. But these mass assessments often overlook critical property-specific details—leading to unfair overvaluations and unnecessarily high Houston property tax bills.

Common issues include:

By filing a property tax protest, you can challenge these inaccuracies and ensure your home’s taxable value is fair.

Cut Your Houston Property Tax – Fast, Easy & Risk-Free!

Are you paying more than you should in Houston property tax? You’re not alone. Many homeowners in Houston are overcharged due to inaccurate property appraisals—and most don’t even know it. At Tax Cutter, we make it simple to challenge your property’s assessed value and lower your annual tax bill without the stress.

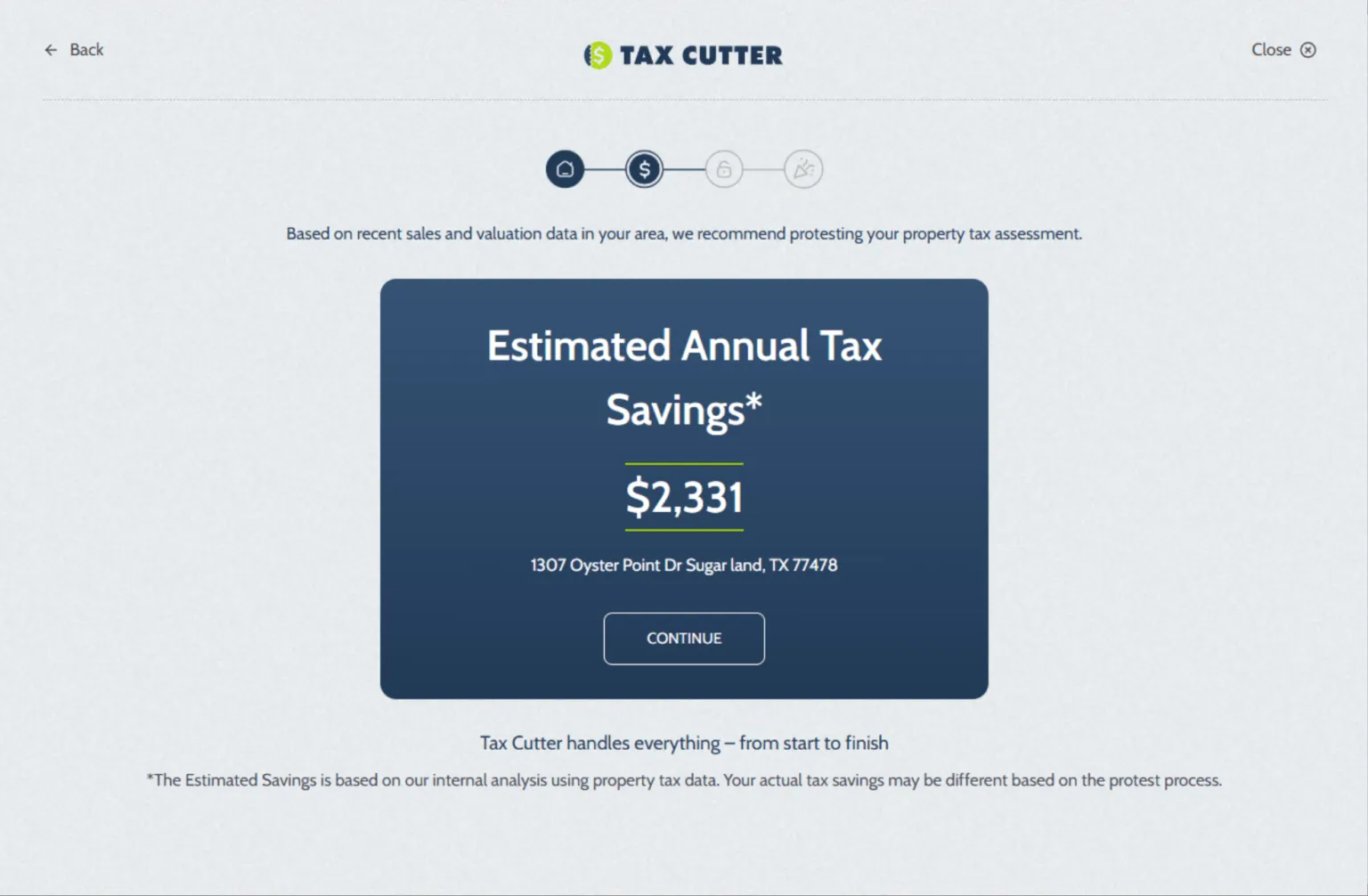

How Tax Cutter Works?

Our objective is to make the property tax protest process as easy and user-friendly as possible.

Benefits of Choosing Tax Cutter for Your Houston Property Tax Protest

We’re committed to providing top-notch Houston property tax protest services, tailored to help you get the fair valuation you deserve.

Stop Overpaying Taxes!

Thousands have saved with our Houston property tax protest services. We fight against inflated property appraisals to ensure you pay only what you truly owe. Let us handle the protest process and maximize your savings before the due date.

Fair Property Valuations!

Is your home overvalued? We ensure your Houston property tax appraisal is accurate. Our simple process guarantees you pay only what’s due—no more, no less.

Expert Analysis

Don’t overpay! Tax Cutter helps you secure a fair Houston property tax valuation by handling all the research and paperwork.

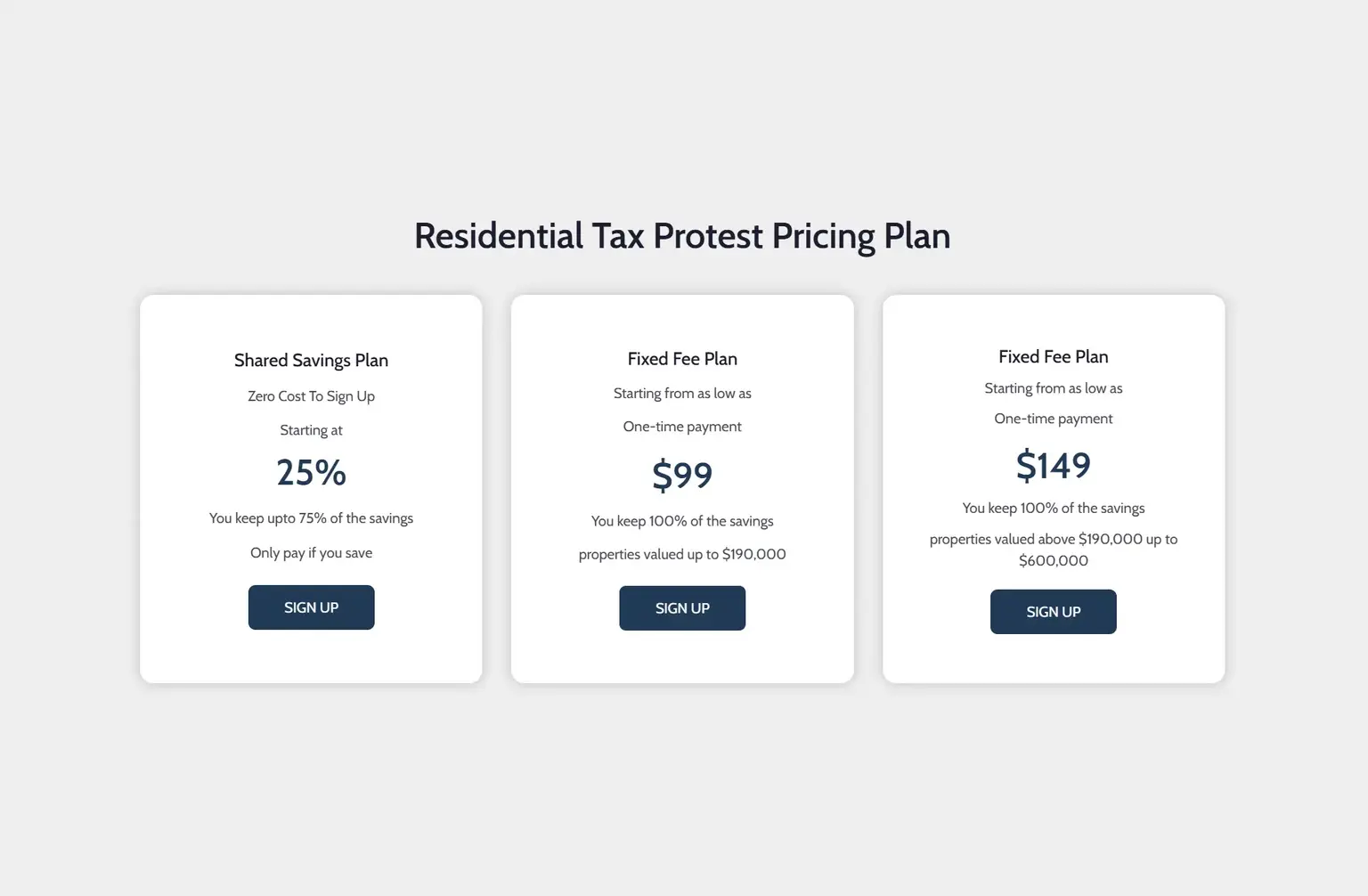

No Upfront Fees

You only pay when we save you money. No sign-up costs or hidden fees—just savings on your Houston property tax bill.

Proven Expertise

We uncover inaccuracies and legal loopholes to reduce your Houston property tax. Let Tax Cutter fight for the fair tax you deserve!

Stress-Free Service

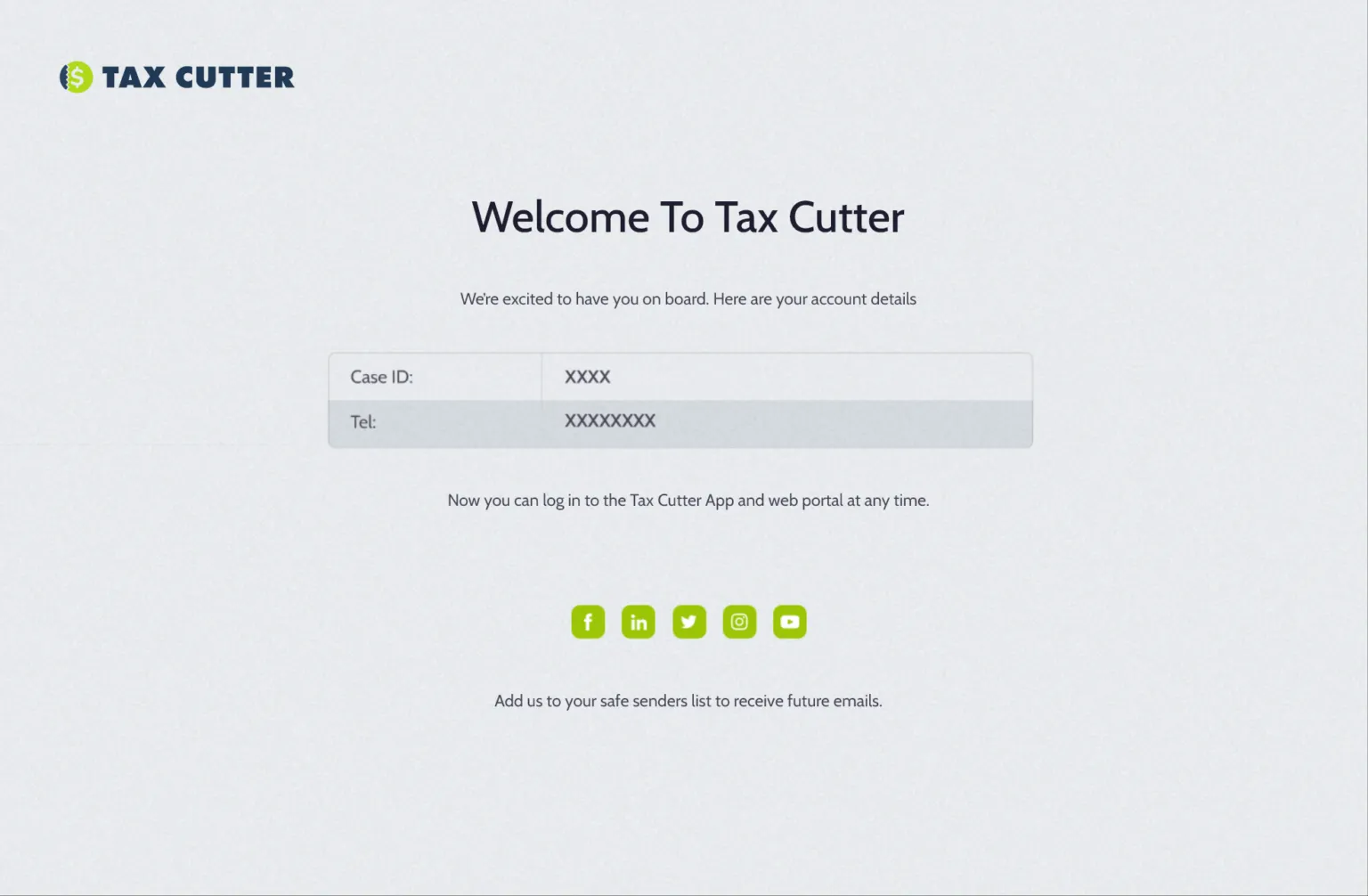

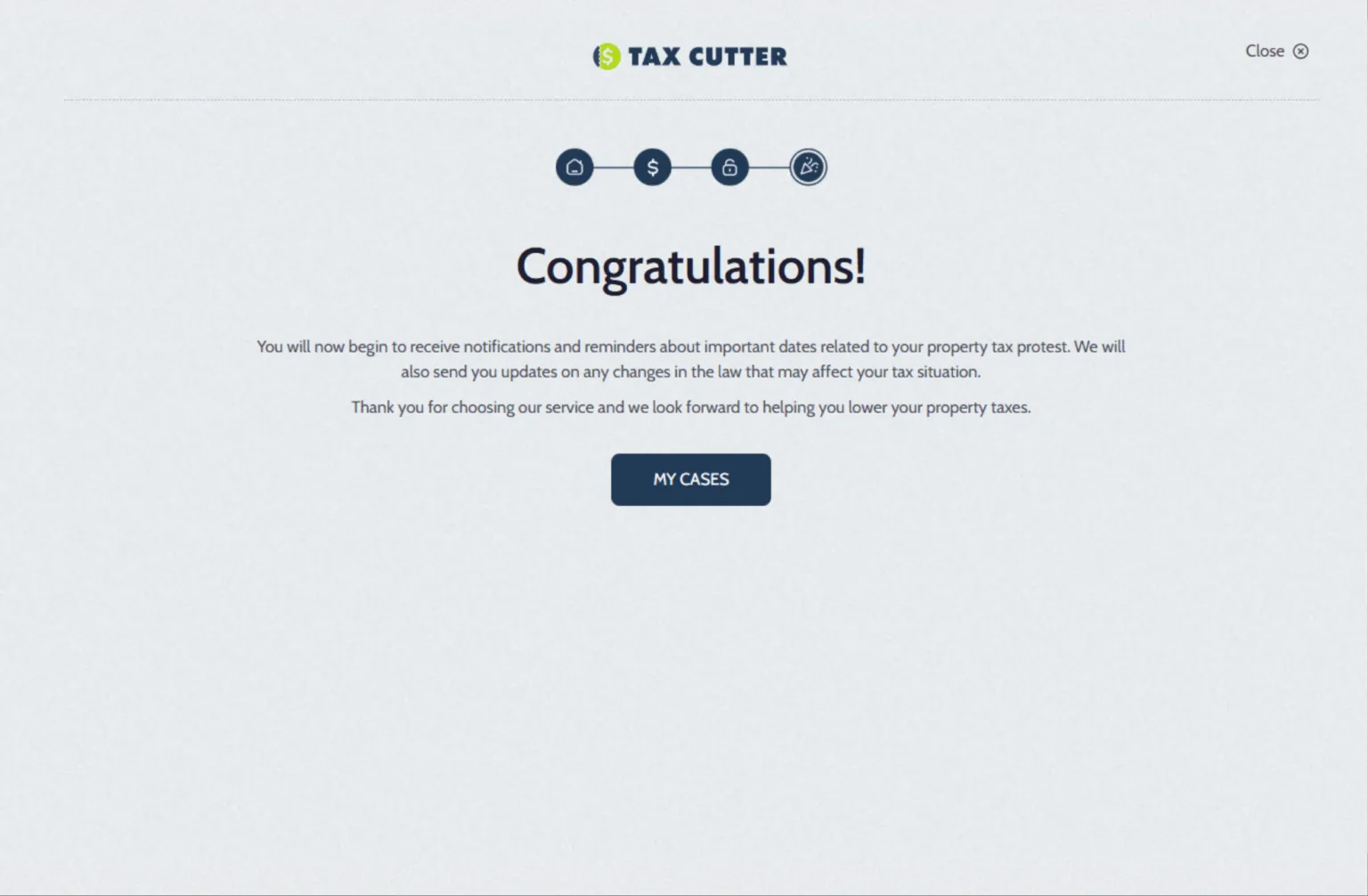

Our team makes the Houston property tax protest process easy. From start to finish, we handle the details, so you can focus on what matters.

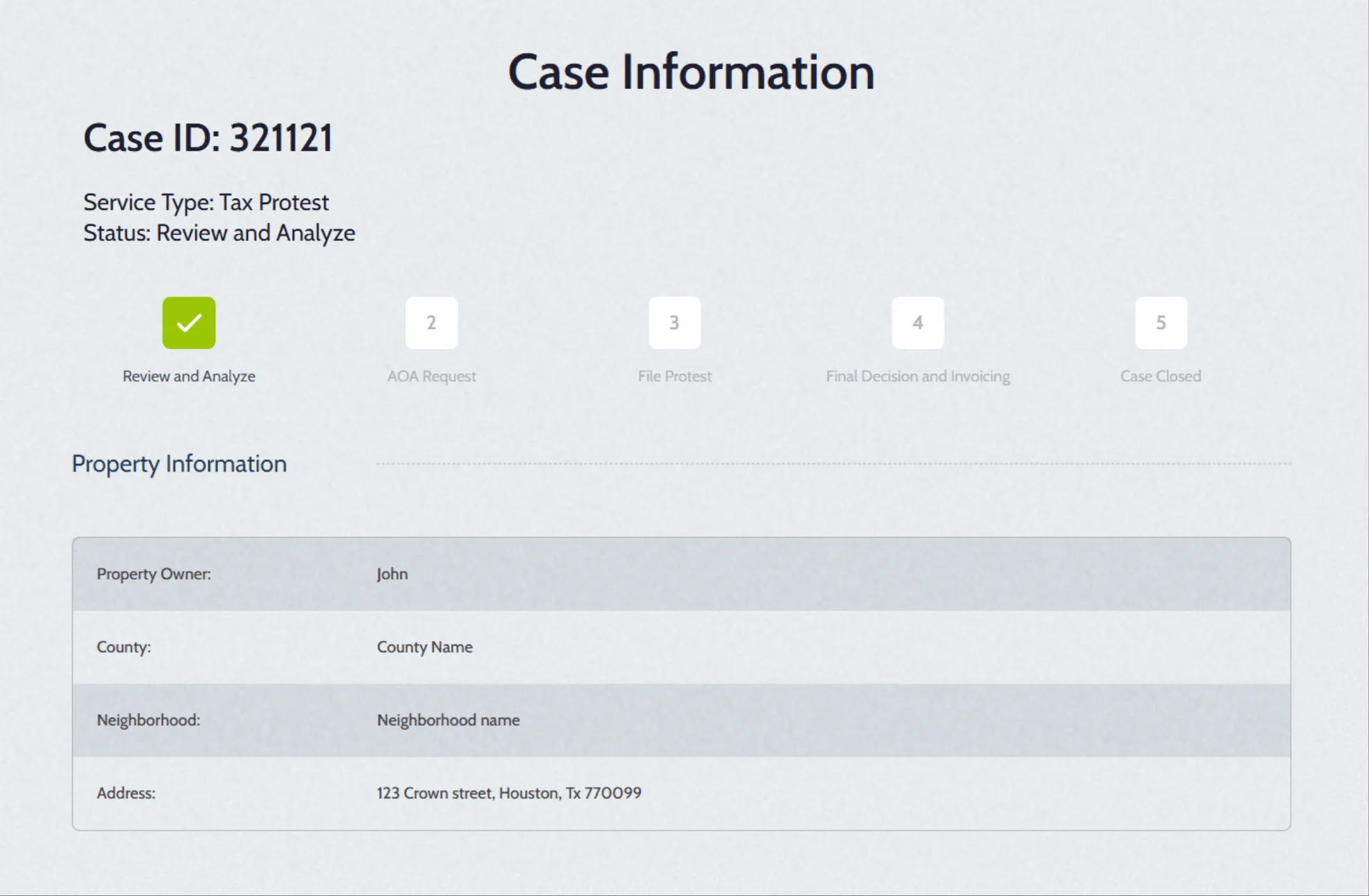

Your Guide to All Things: Navigate with Ease

Reduce Your Taxes with a Houston Property Tax Protest

A Houston property tax protest can be complex, but Tax Cutter is here to help. With our local expertise and proven track record, we ensure a fair tax assessment with no upfront fees. We’ll identify overvaluations and build a strong case to reduce your Houston property tax. Don’t let paperwork stop you from protesting—our service helps you review your appraisal, gather evidence, and navigate the process. Deadlines are crucial, so don’t delay. Trust Tax Cutter to fight for your property tax justice.