Victoria County Property Tax Protest

Why Choose Tax Cutter for Your Victoria County Property Tax Protest?

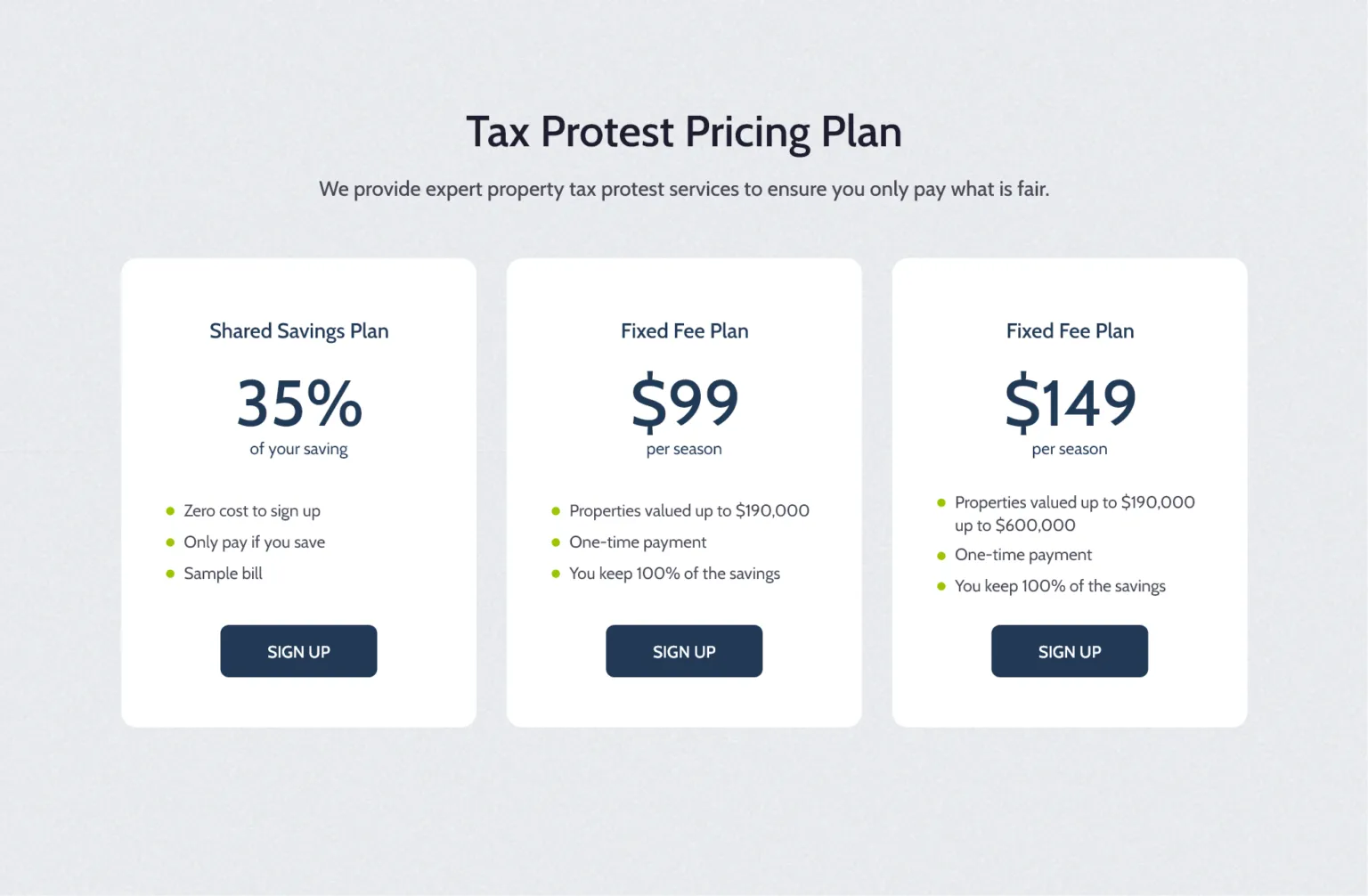

At Tax Cutter, we offer best property tax protest solutions built to maximize your savings while you focus on what matters most.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Why Protest Your Property Tax?

Are Victoria County property tax stretching your budget? Don’t settle for what you’ve been billed protest it! The appraisal district may have overvalued your home, resulting in unnecessarily high tax. Many clients in other counties have saved thousands. You should not pay more than your fair share, especially when mistakes happen. In many cases, incorrect measurements, overlooked repairs, or comparisons to higher-value properties can unfairly raise your assessment. Tax cutter knows the process of Victoria County Property Tax Protest inside out and can uncover errors that could cost you big. With the right strategy, you could see significant savings on your annual property costs. It’s time to take action get a free consultation and find out how much you could save this year.

Cut Your Tax — Boost Your Savings

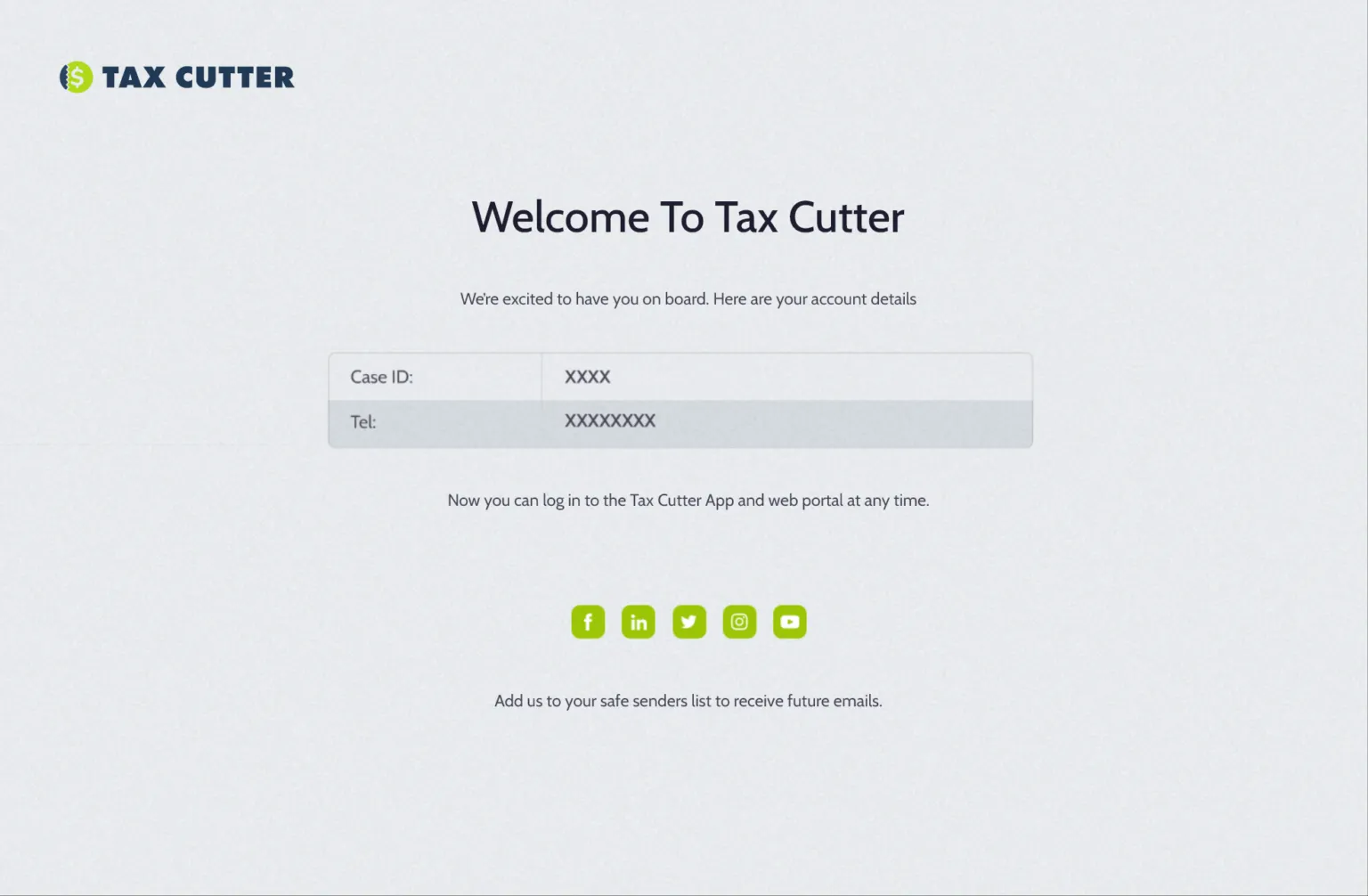

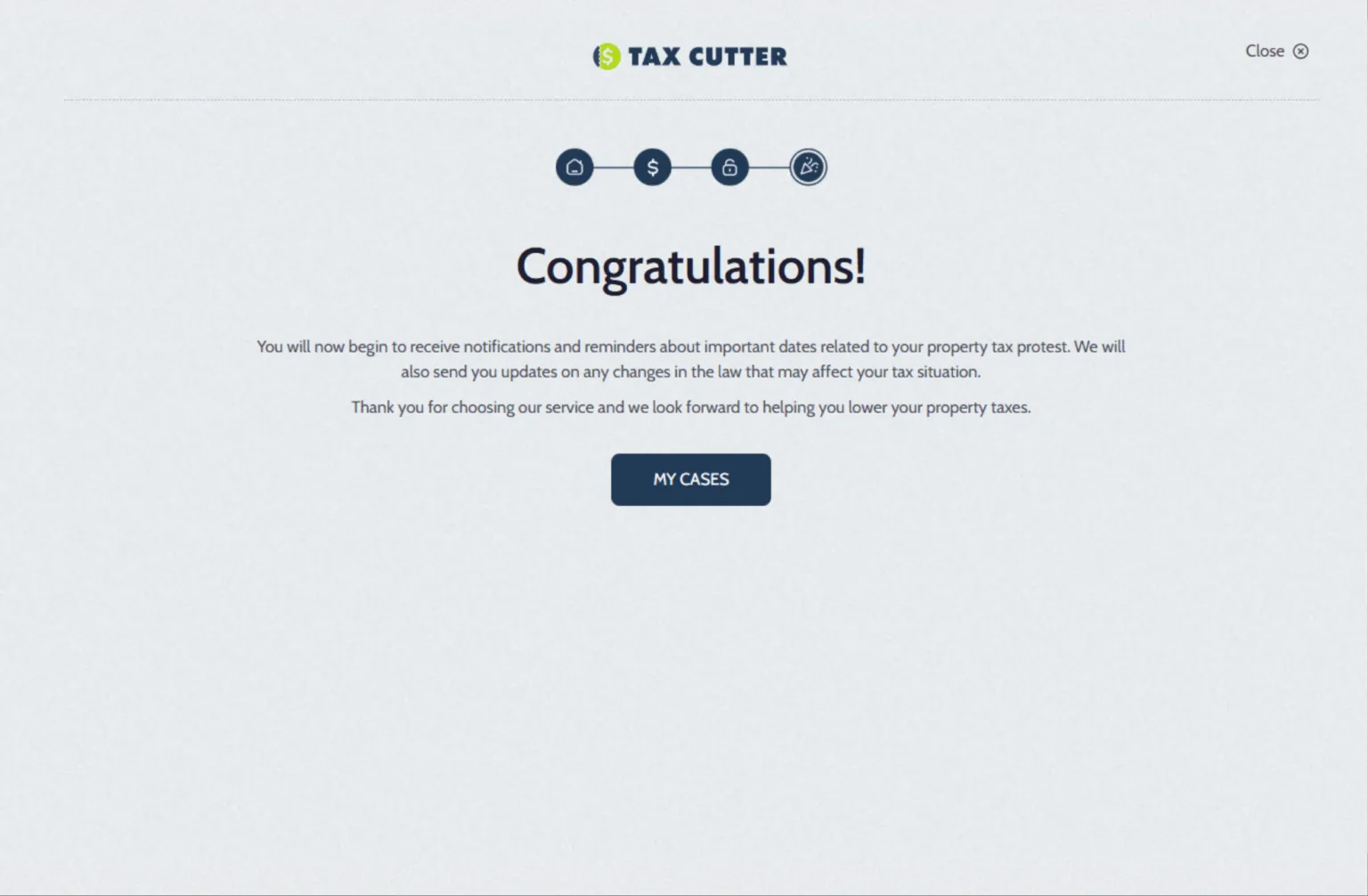

Is your Victoria County Appraisal property tax bill overwhelming? You might be paying too much due to incorrect appraisals. The good news is you have the right to challenge your property tax, and you don’t have to do it alone. Tax Cutter helps homeowners navigate the Victoria County Property Tax Protest process from start to finish, ensuring your case gets the attention it deserves and your rights stay protected.

With years of experience delivering massive tax reductions like average savings of over $24,000 for clients in comparable counties we know how to protest for fair assessments. Contact us today for your free savings estimate, and let’s work together to reduce your tax burden.

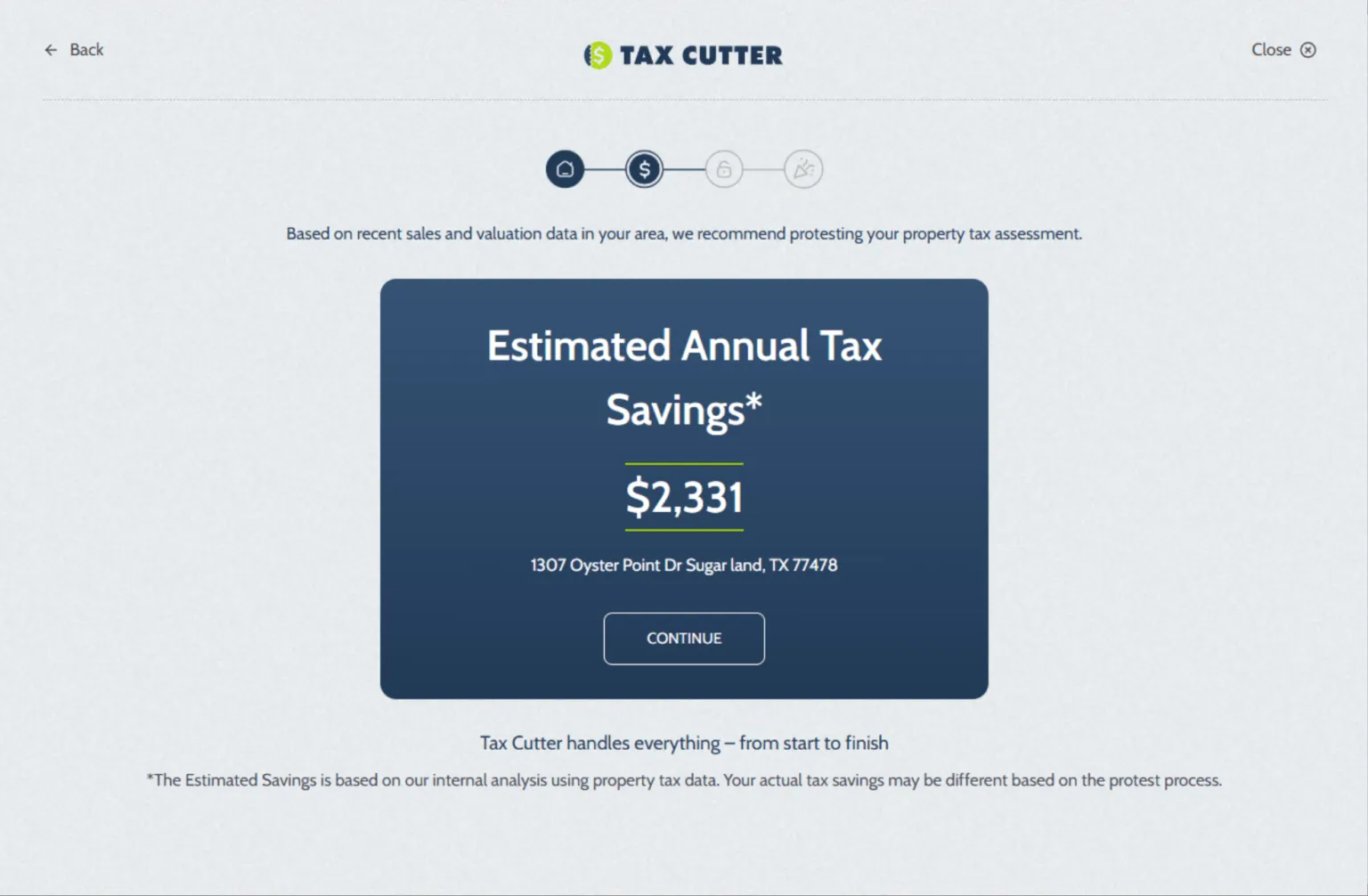

How Tax Cutter Works

Victoria County Property Tax Protest is easy when we handle every step for you.

The Benefits of Choosing Tax Cutter for Your Protest

Reduce Your Tax Burden

Stop overpaying simply because your home was overvalued. Even a small reduction in assessed value can lead to substantial yearly savings, putting more money back in your pocket.

Get Peace of Mind

Knowing you’re paying only what you owe, not a penny more, gives you financial confidence. We ensure your assessment reflects the true value of your property.

Enhance Your Property’s Appeal

Lower tax liabilities can make your property more marketable to potential buyers. Reduced carrying costs can also help you maintain a stronger return on investment.

Make It Easy

We handle the paperwork, deadlines, and hearings with the Victoria County Appraisal District so you don’t have to worry about a thing. Our team keeps you informed every step of the way.

Expert Guidance

Navigate the entire process of tax protest with the help of seasoned professionals. We use proven strategies to build a strong case for your property.

Avoid Overpayment

Ensure you are not overpaying taxes — only pay what is fair through the Victoria County Property Tax Protest process.

Your Guide to All Things: Navigate with Ease

Cut Your Victoria County Property Tax Bill — Start Your Protest Today!

You’re not alone. Many homeowners in Victoria County Texas overpay due to inaccurate appraisals by the property appraiser. But here’s the good news that it can help you reclaim thousands in overpaid costs. At Tax cutter, we’re a dedicated property tax protest service for Victoria County Texas appraisal district with a proven record of success. We guide you through the confusing protest process and protest for a fair, accurate property valuation. Our local expertise means we know exactly how the Victoria County CAD works and we use that knowledge to your advantage.