Fort Bend County Property Tax Protest

Why Choose Tax Cutter?

Tax Cutter helps property owners by providing the best property tax protest services that ensure the best savings. Meanwhile, you just sit back and relax.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Reduce Your Fort Bend County Property Taxes with Professional Tax Protest Services

Fort Bend County, one of the fastest-growing counties in Texas, has experienced substantial property value increases. The Fort Bend Central Appraisal District (FBCAD) is responsible for appraising all properties in the county for tax purposes. While market growth is positive for property values, it can result in tax assessments that don’t accurately reflect your property’s true market value or that exceed the 10% homestead cap allowed under Texas law.

Tax Cutter specializes in Fort Bend County Property Tax Protests, helping homeowners and property owners challenge unfair assessments and reduce their annual tax burden.

Why Choose Tax Cutter As Your Representative?

The Texas Comptroller reports that property owners who protest with professional representation achieve better results than those who represent themselves. Tax Cutter’s team understands:

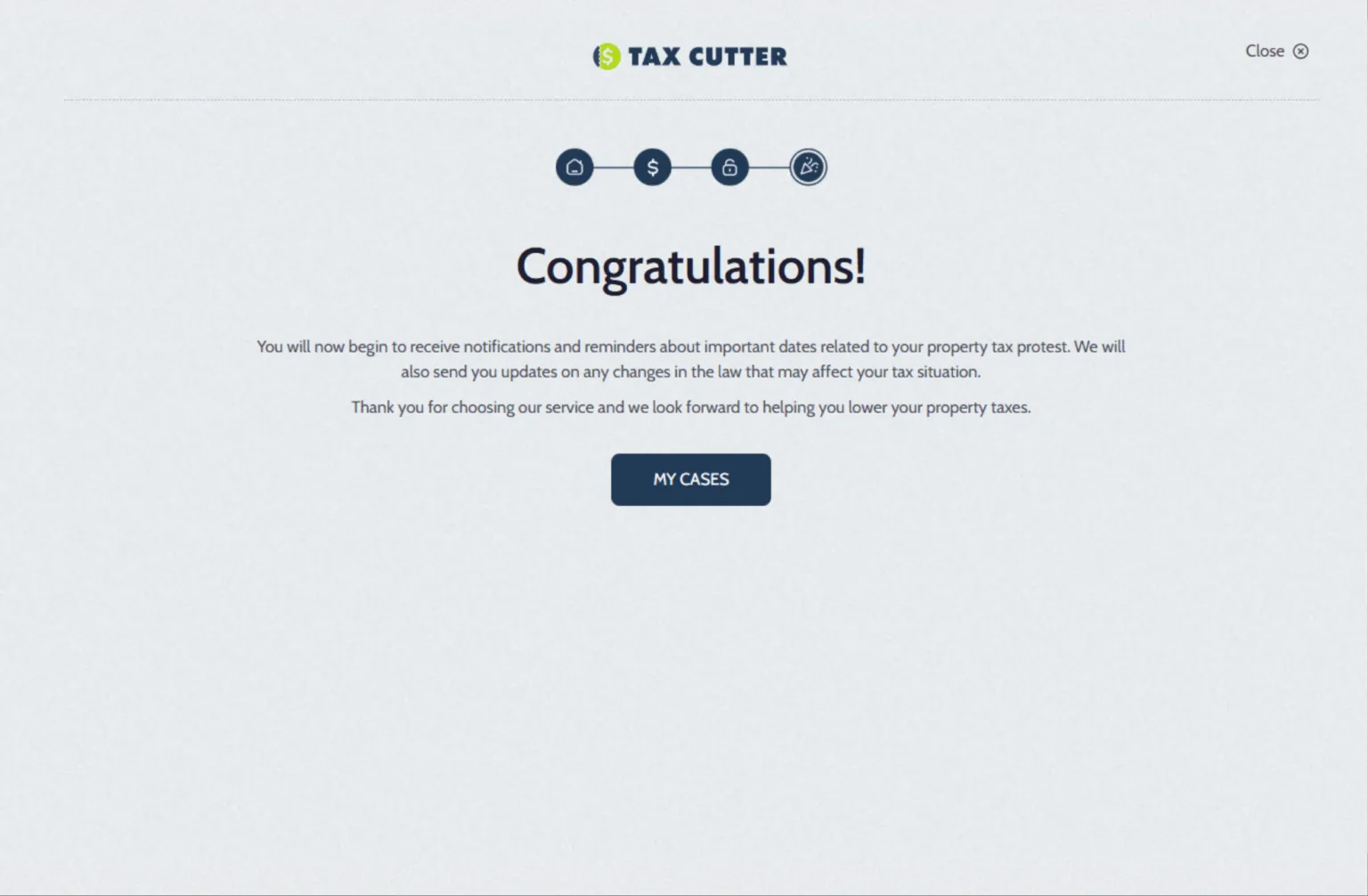

How Tax Cutter Works?

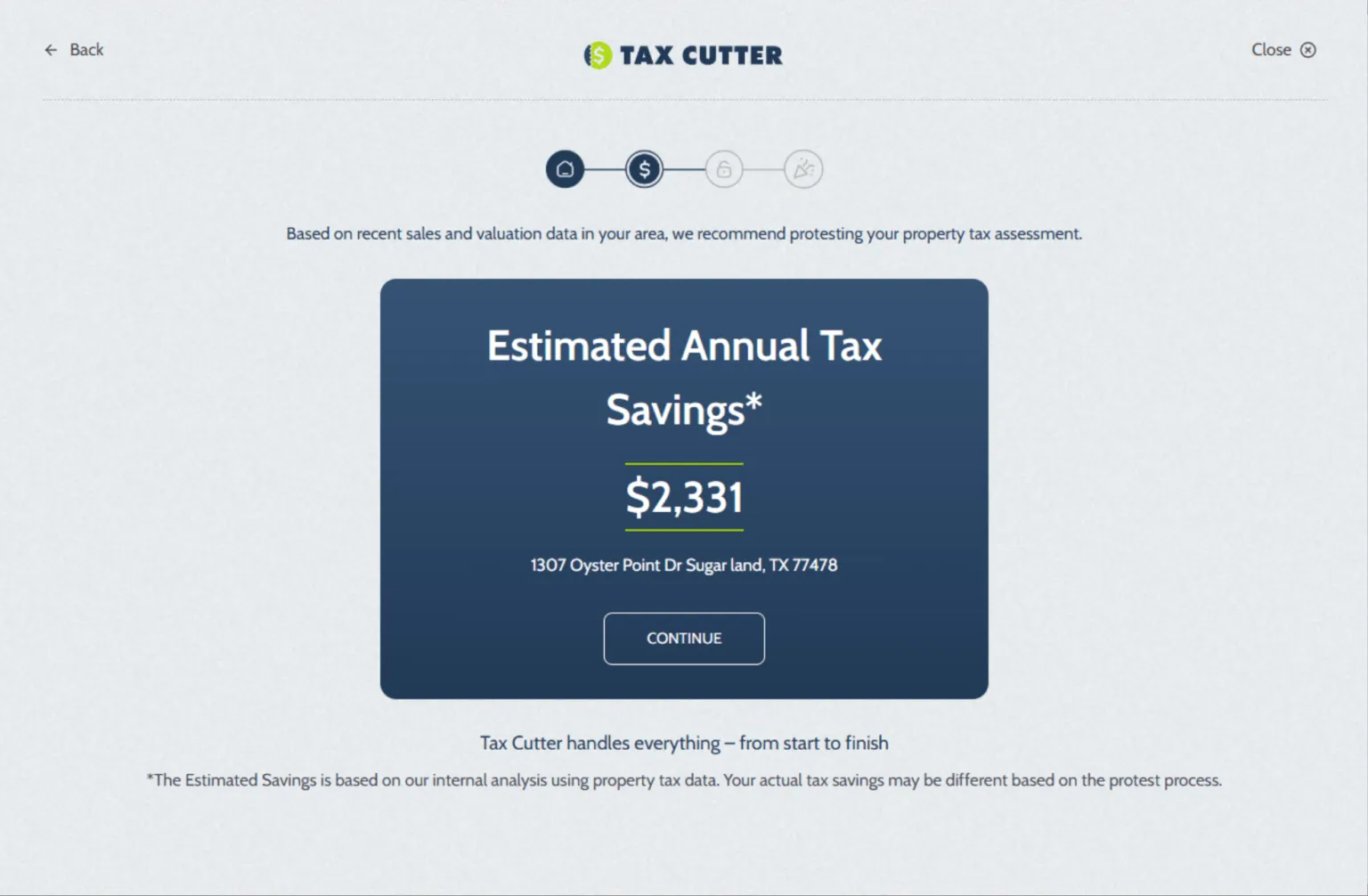

Our objective is to make the property tax protest process as easy and user-friendly as possible.

Stories of Trust, Savings, and Success

Benefits Of Choosing Tax Cutter For Fort Bend County Property Tax Protests

We are Your Trusted Partner in Protesting Unfair Fort Bend County Property Tax Assessments

Don’t Overpay Taxes!

Thousands of Fort Bend County homeowners have saved hard-earned cash with our Fort Bend County Property Tax Protest services. We protest unfair FBCAD property appraisals to ensure you pay what’s truly owed, not a penny more. With property values increasing over 40% since 2020 in areas like Sugar Land and Missouri City, many homeowners are over assessed. Let our experts handle the Fort Bend County Property Tax Protest hassle and maximize your savings. Trust us, your savings await!

Accurate Valuations!

Worried your Fort Bend County home is overvalued? Tax Cutter helps residential and commercial owners find the fair, accurate valuation your property deserves with our Fort Bend County Property Tax Protest service. We analyze comparable sales data, property conditions, and market trends to challenge inflated assessments. Ready to challenge your taxes in Fort Bend County CAD? Our smooth process takes care of everything, maximizing your property tax savings with expert analysis and proven strategies.

Expert Property Analysis

Don’t get overcharged on your Fort Bend County property taxes! Tax Cutter helps you find the fair, accurate valuation your property deserves with a Fort Bend County property tax appeal. We handle the legwork, so you can relax. Our certified Fort Bend County Property Tax Protest consultants understand homestead exemptions, assessment methodologies, and local market conditions. Forget tax code confusion and complicated appraisals, our experts handle everything from evidence gathering to Appraisal Review Board representation.

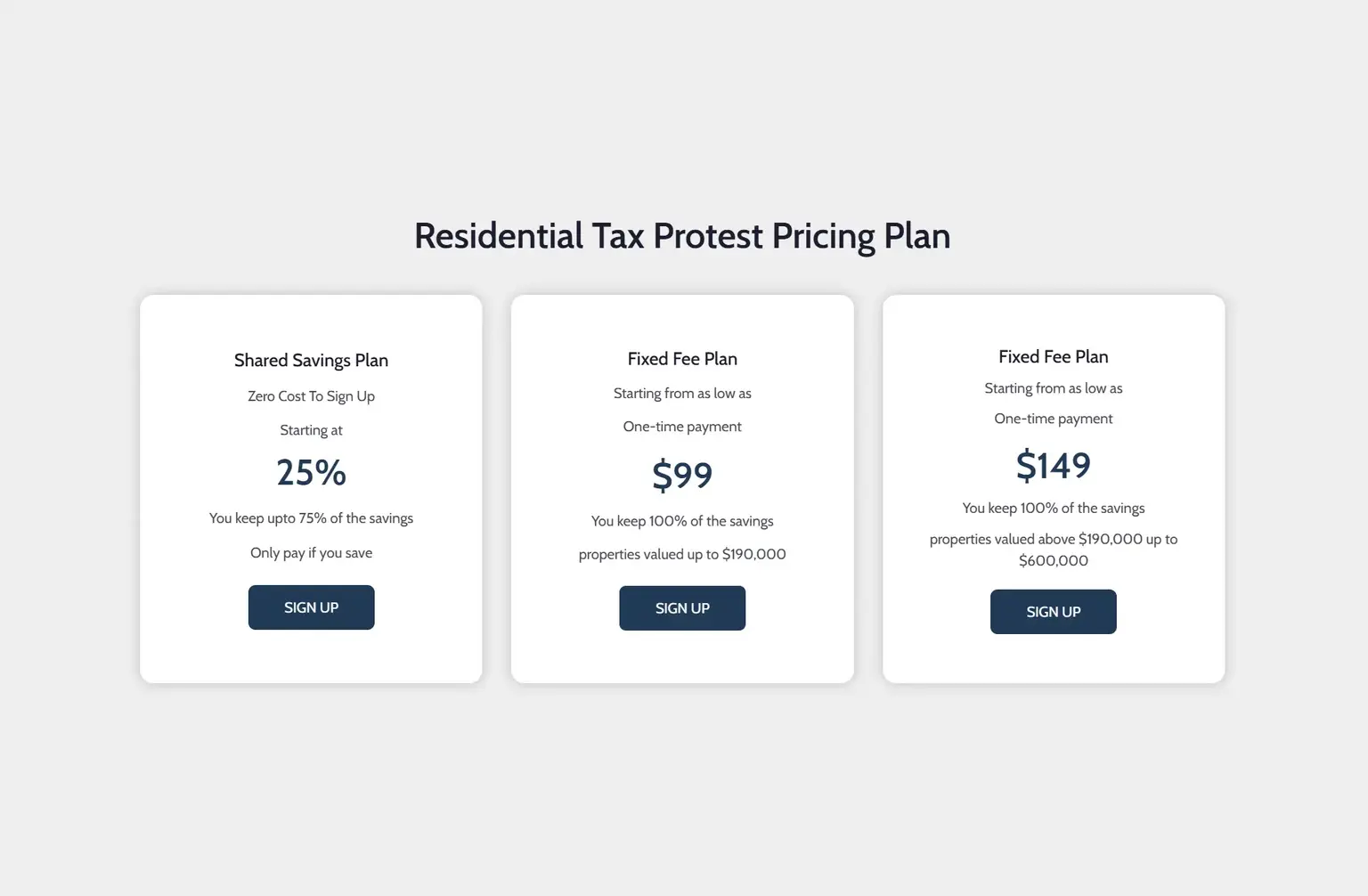

No Extra Payments

Relax! Tax Cutter doesn’t ask for a dime until you score savings on your tax bill. That’s right, no sign-up costs, no hidden fees, only pay when you win with our Fort Bend County Property Tax Protest services. We cover all filing costs and administrative expenses upfront. Trust us to fight for your fair share, knowing you have nothing to lose and everything to gain. Our contingency fee model means we are fully invested in securing the maximum reduction for you.

Experienced Suggestions

Our Fort Bend County Property Tax Protest experts know how to find legal loopholes and uncover inaccuracies that could be dragging down your home’s worth. We use advanced market analysis, local neighborhood expertise, and years of ARB hearing experience to build winning cases. The result? More money in your pocket and a valuation that’s actually fair. Win-win! Don’t settle for an unfair tax burden, protest with Tax Cutter and get the reduction you deserve.

Experts At Your Disposal

Your Fort Bend County Property Tax Protest is in good hands. At Tax Cutter, we are dedicated to making the process simple and stress-free for you. From start to finish, you will experience exceptional customer service from our team of property tax experts. We will handle everything, from filing deadlines to ARB hearings, so you can focus on what matters most. Leave the hassle and worry to us; we will take care of the rest and fight for your lowest legal assessment.

Your Guide to All Things: Navigate with Ease

Providing The Best Property Tax Protest Service In Fort Bend County

Navigating a Fort Bend County Property Tax Protest in the Fort Bend County appraisal district can be confusing and time-consuming, but that’s where Tax Cutter comes in. As local Fort Bend County experts with a proven track record of success, we empower property owners to secure fair tax assessments, with no upfront costs and transparent communication at every step.

Our expertise in property tax protest strategies allows us to identify overvaluations, gather compelling evidence, and build strong cases that get results. We understand the property tax reduction process inside and out, from informal hearings to Appraisal Review Board (ARB) appeals. Don’t let fear or paperwork prevent you from exercising your legal right to protest!

Major Texas Counties We Serve

We serve homeowners across 254 counties of Texas with residential property tax protest services. No matter your location, our team is ready to help you challenge unfair valuations. Let’s work together to lower your property tax burden.