Brazos county property tax protest

Why Choose Tax Cutter?

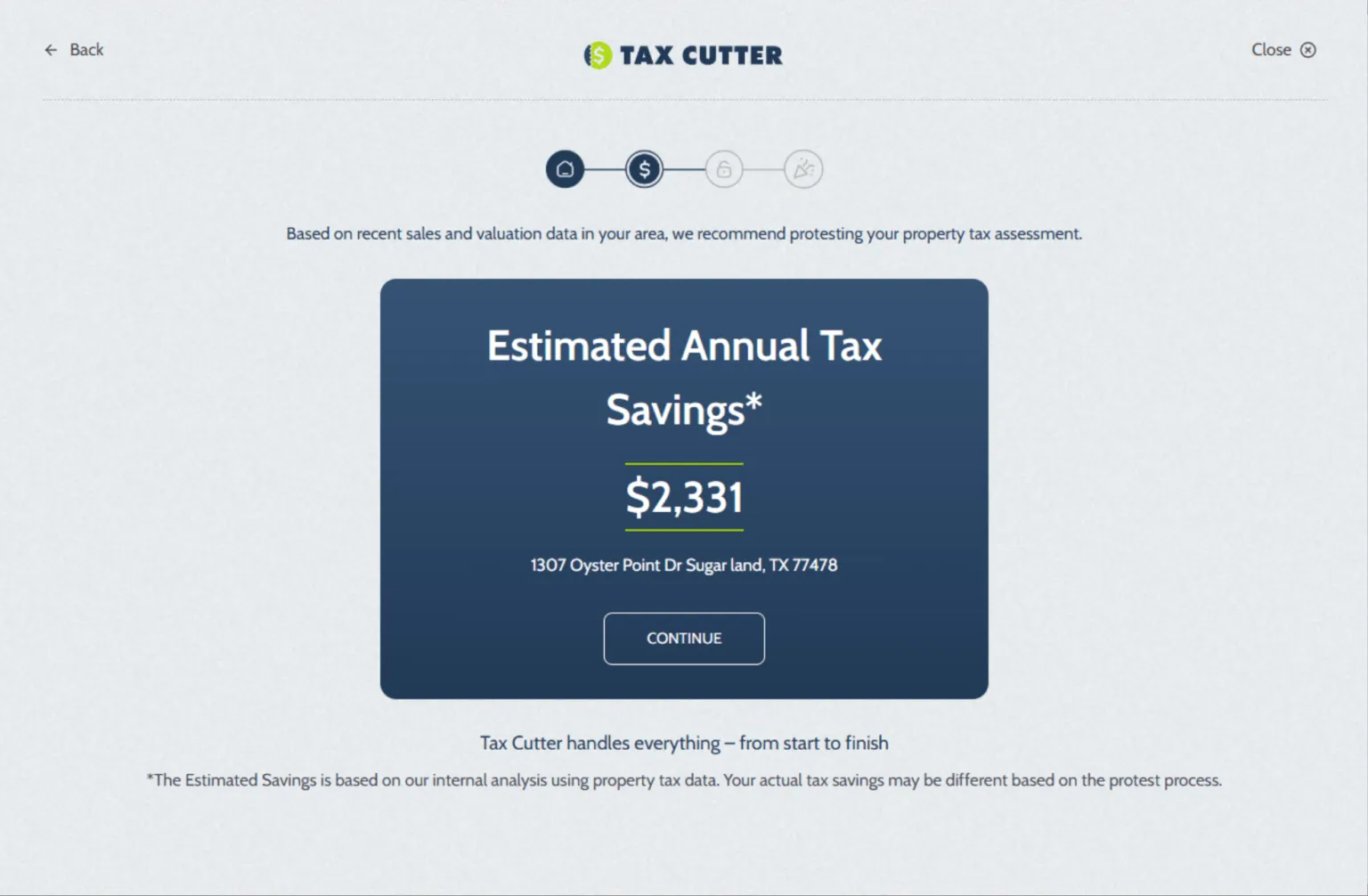

From protest to payout, Tax Cutter secures maximum savings while you stay worry-free

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Why Protest with Tax Cutter?

Feeling overwhelmed by rising Brazos County property taxes? You can challenge those high property tax bills. Your property’s assessed value directly influences how much you owe, and if it’s overestimated, you could be paying more than your fair share. At Tax Cutter, we’ve helped homeowners uncover costly appraisal errors and reduce their tax burden saving thousands in the process. The Brazos County Appraisal District doesn’t always get valuations right, and our specialists are skilled at identifying discrepancies that lead to excessive taxation. With time-sensitive deadlines and growing valuations, taking action now matters. A fair and accurate appraisal can make a significant difference.

Who We Help in Brazos County?

If you’re a property owner, Tax Cutter is here to support your savings journey. We proudly:

Our experts track real estate trends and property valuations to build strong, data-backed protest cases. We work closely with the Brazos Appraisal District to challenge unfair assessments and secure the savings you deserve.

How Tax Cutter Works?

Making the tax protest process easy and accessible is what we do best

Stories of Trust, Savings, and Success

Benefits of Choosing Brazos County Property Tax Protest Services

We specialize in delivering personalized, high-impact tax protest services

Reduces Tax Burden

If your property is overvalued, you could be paying too much. Protesting can significantly reduce your yearly tax bill.

Brings Financial Relief

Winning a Protest Means Real Savings. You’ll know you’re paying your fair share, not an inflated amount based on errors.

Boosts Property Appeal

Lower property taxes make your home more attractive to buyers, helping increase its overall market value.

Streamlines the Process

With our experts by your side, the protest process becomes easy. We handle the paperwork, deadlines, and back-and-forth with the Brazos County CAD, so you don’t have to.

Smarter Tax Analysis with AI

Use of intelligent AI technology to scan your property data, identify appraisal discrepancies, and build a stronger case for tax reduction giving you a smarter path to savings.

Guided by Experts

The Brazos County property tax protest process can be confusing. Our experienced consultants offer expert insights and guide you every step of the way.

Your Guide to All Things: Navigate with Ease

Lower Your Tax Bill the Smart Way. Protest and Save!

Many property owners in Brazos County pay more than necessary because of inaccurate appraisals. The good news is that a Brazos County Property Tax Protest can help you recover thousands in overpaid taxes. At Tax Cutter, we make the process simple and stress-free. With a proven track record and strong knowledge of the Brazos County, we fight for fair and accurate valuations—so you only pay what’s truly owed.

Major Texas Counties We Serve

We serve homeowners across 254 counties of Texas with residential property tax protest services. No matter your location, our team is ready to help you challenge unfair valuations. Let’s work together to lower your property tax burden.