Ector County Property Tax Protest

Why Choose Tax Cutter?

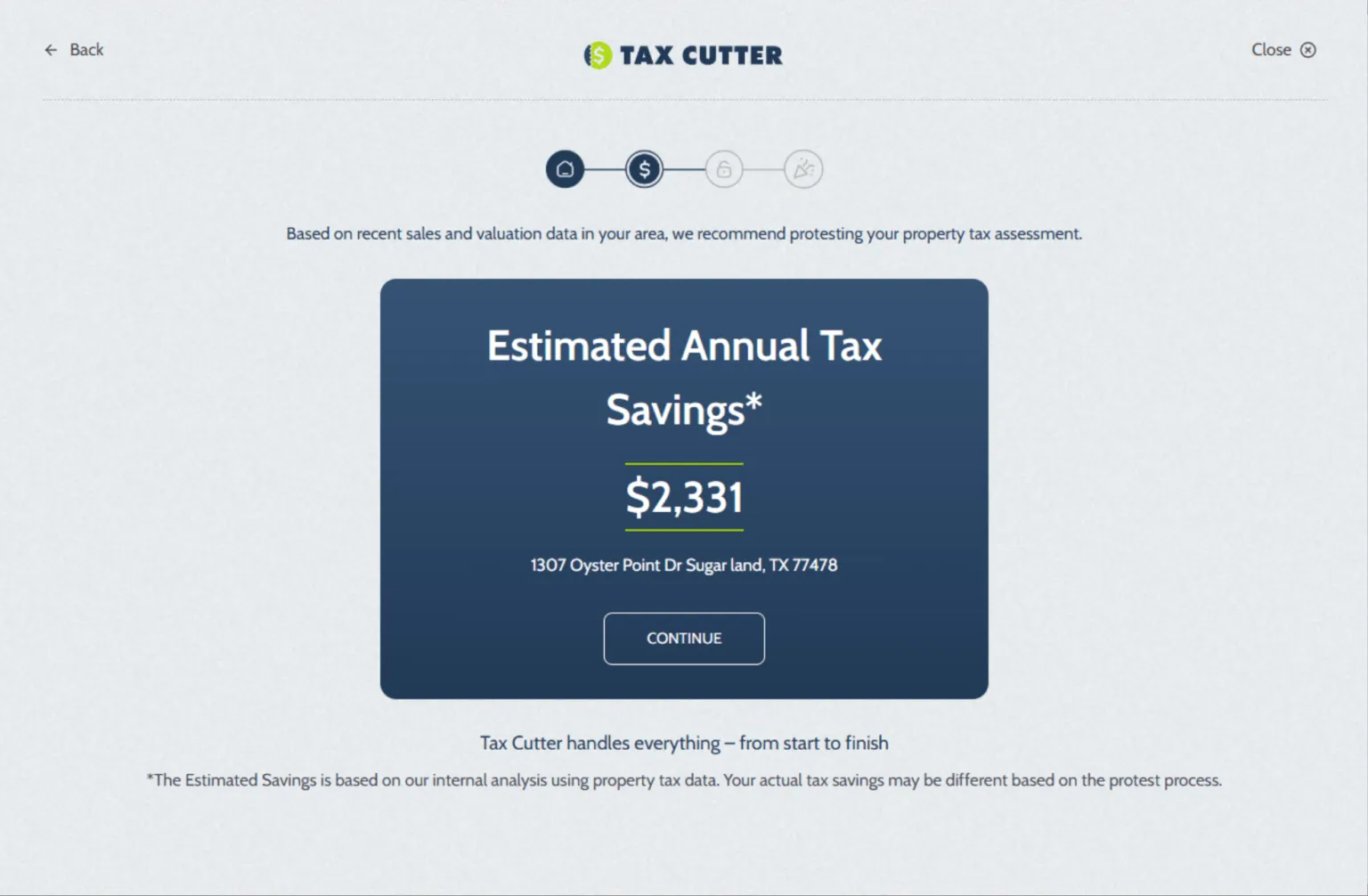

Tax Cutter provide expert services that secure the biggest savings, so you can sit back, relax, and watch your property tax burden shrink.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Why It’s Important to Protest Your Property Taxes

Feeling trapped by high property taxes in Ector CAD? Don’t let an inflated property value cost you more than it should! Your home’s appraisal plays a big role in setting your tax rate, but what if you could lower that number and keep more money in your pocket? At Tax Cutter, we’ve helped countless homeowners save thousands by spotting errors the Appraiser’s Office might miss. Whether it’s an overvaluation or a mistake on your property’s details, our experts know the ins and outs of the Ector County appraisal process. We’ll work hard to make sure you’re not overpaying for taxes—because you deserve a fair assessment. Why pay more than you have to? Time is ticking, and we’re ready to protest for the savings you deserve. Schedule your free consultation today and let us show you how much you could save. With Tax Cutter by your side, it’s time to take control of your property taxes and keep more of your hard-earned money. Don’t wait—let’s start saving today!

Trim Your Taxes and Boost Your Financial Savings

Are you feeling the pressure from rising property taxes in Ector CAD? If your property’s value seems inflated, you could be overpaying. Many homeowners in Ector Count Appraisal district don’t realize that inaccurate appraisals can lead to excessive tax bills. The good news is that you have the right to protest your property tax appraisal and potentially recover those overpaid dollars. Tax Cutter is here to guide you through the protest process. Our team of experts is well-versed in County’s system, ensuring your case is presented clearly and effectively. We’ve successfully helped homeowners save an average of $24,134 last year alone. Don’t wait—reach out for a free consultation today, and let us help you secure a fairer appraisal and keep more of your hard-earned money. It’s time to take control of your property taxes with Tax Cutter by your side!

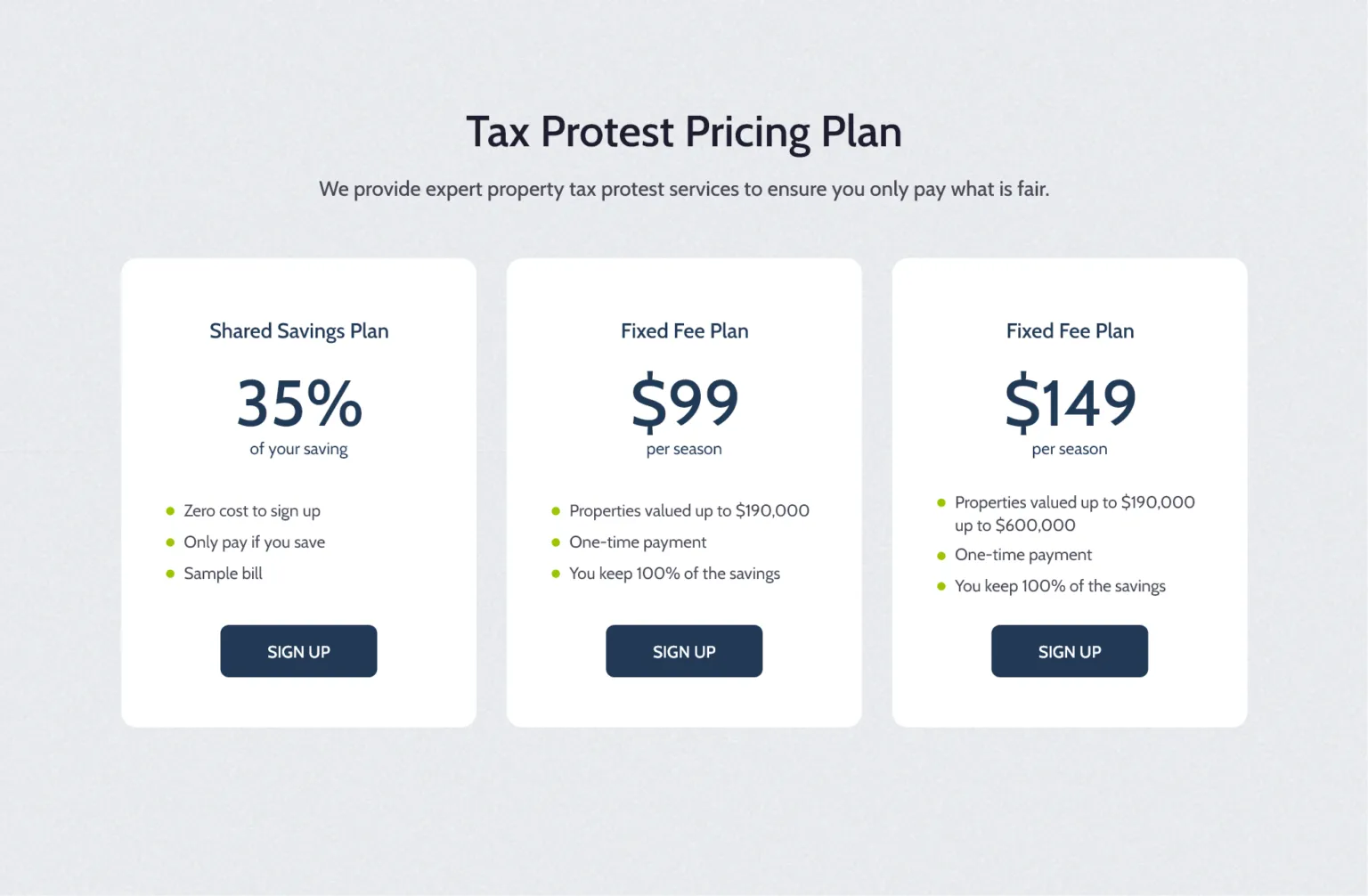

How Tax Cutter Works

We aim to streamline the Ector County property tax protest process, ensuring it’s simple and easy to navigate.

Stories of Trust, Savings, and Success

Benefits of Choosing Our Property Tax Protest Services

At Tax Cutter, we are committed to providing top-notch Ector County property tax protest services, customized to the unique needs of residents.

Reduces Tax Burden

If your property has been overvalued, protesting your assessment can significantly lower your annual tax liability. Every dollar you save on property taxes can be better spent elsewhere.

Provides Relief

Winning a property tax protest brings peace of mind, knowing that you’re paying your fair share and not bearing the weight of an inflated tax bill.

Increases Property Value

A successful protest can boost your property’s market value by reducing its property tax burden. Lower property taxes make your home more appealing to potential buyers.

Simplify Taxation

Navigating the protest process can be daunting. By partnering with a property tax expert, you can simplify the steps and let us handle the paperwork with the Ector County Appraisal District.

Avoid Overpayment

Protesting your property taxes in Ector CAD ensures you’re not paying more than what’s fair. This can result in substantial savings and allow you to redirect funds to where they’re needed most.

Expert Advice

Ector County Property tax protests can be complex, but with a qualified consultant by your side, you’ll receive expert advice every step of the way, ensuring the best possible outcome.

Your Guide to All Things: Navigate with Ease

Lower Your Bill with a Tax Protest. Don’t Pay More Than You Should!

You don’t have to accept inflated property taxes in Ector County Appraisal District! Many homeowners unknowingly overpay because of inaccurate appraisals, but the good news is, you don’t have to settle for less. An Ector county property tax protest could put thousands of dollars back in your pocket. At Tax Cutter, we specialize in protest for fair property valuations, with a proven track record of success. Our team will guide you through the entire protest process, taking the confusion out of it and ensuring your property is valued accurately in Ector CAD. Don’t let an overinflated tax bill drain your wallet—let us help you secure the savings you deserve!

Major Texas Counties We Serve

We serve homeowners across 254 counties of Texas with residential property tax protest services. No matter your location, our team is ready to help you challenge unfair valuations. Let’s work together to lower your property tax burden.