Residential Market Trends and Ellis Appraisal Insights

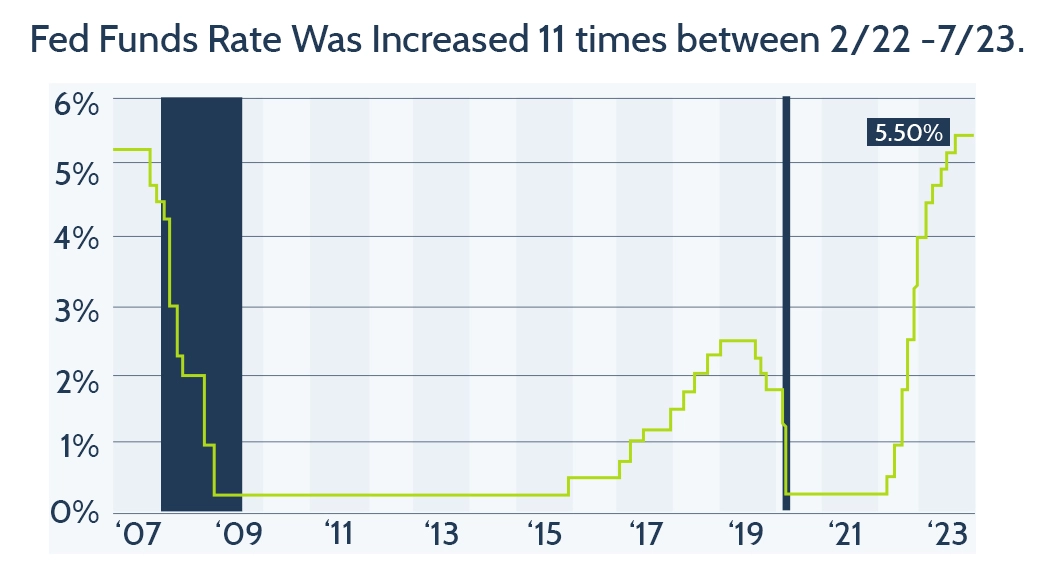

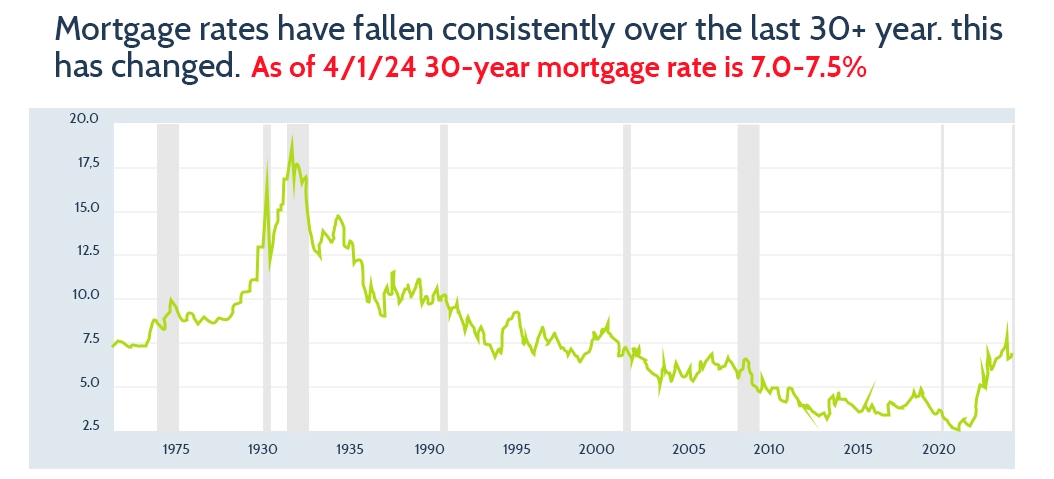

Impact of Rising Interest Rates

These shifts influence appraisals by Ellis County Appraisal District, as market activity softens and affects Ellis Appraisal valuations.

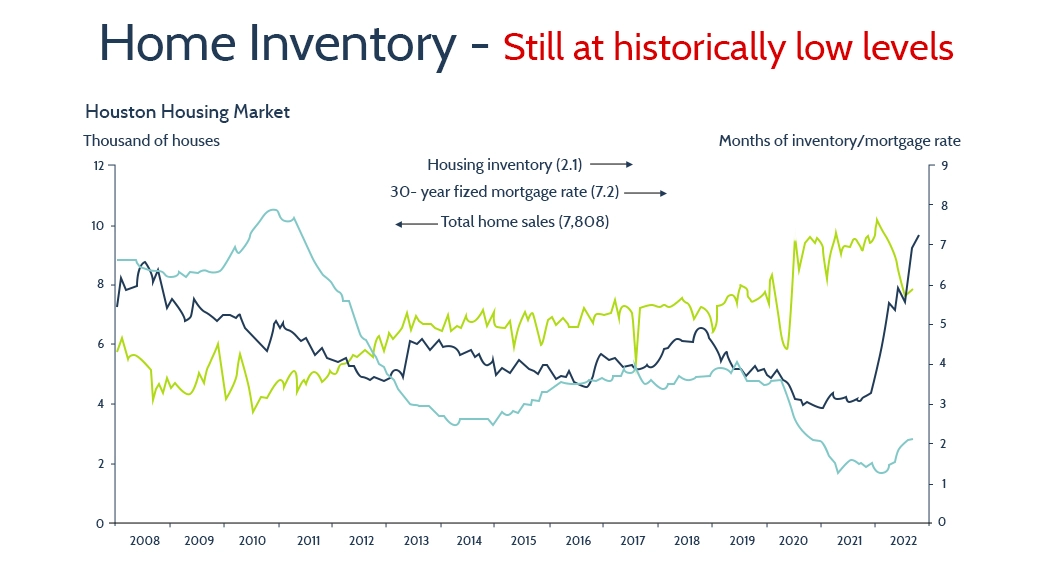

Housing Inventory Trends

These changes in housing availability directly impact pricing trends and are reflected in current property evaluations tracked by Ellis County CAD.

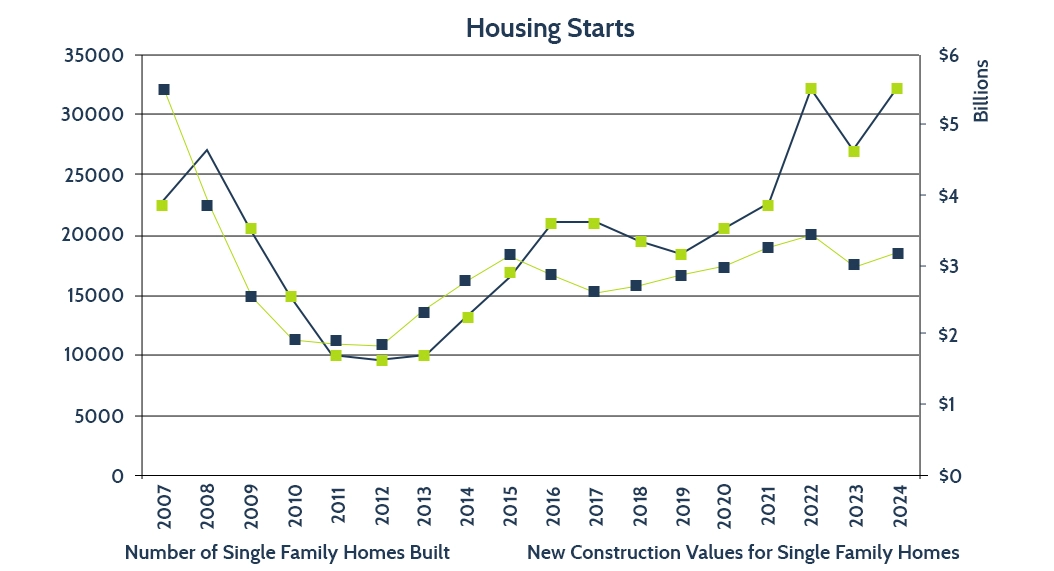

Single-Family Home Market Overview

Property records show notable changes in single-family home building and valuation trends in recent years.