Residential Property and the Ellis Appraisal District

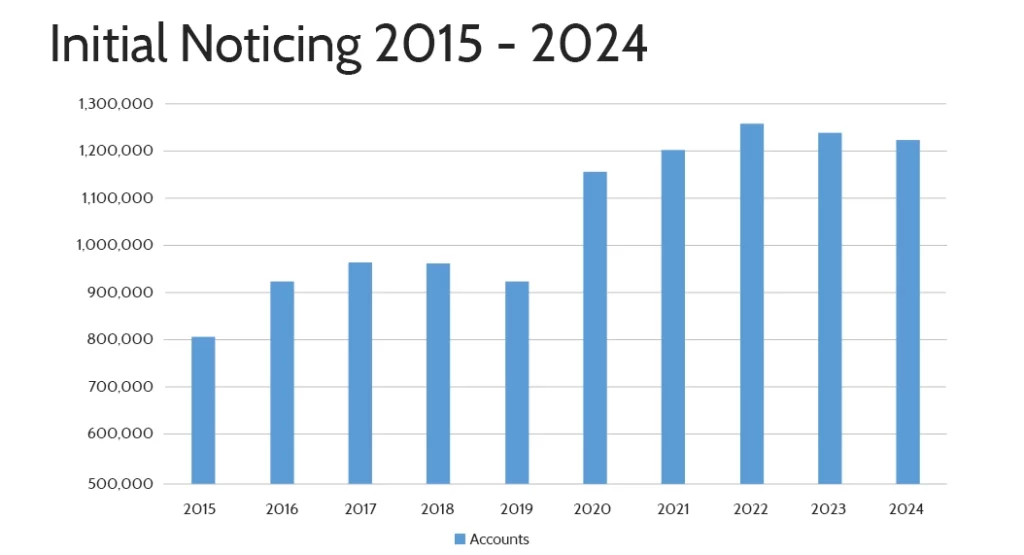

Trends in Initial Noticing Accounts

Overall, growth in notices signals more homeowners undergoing Ellis County CAD assessments and preparing to engage in potential protests.

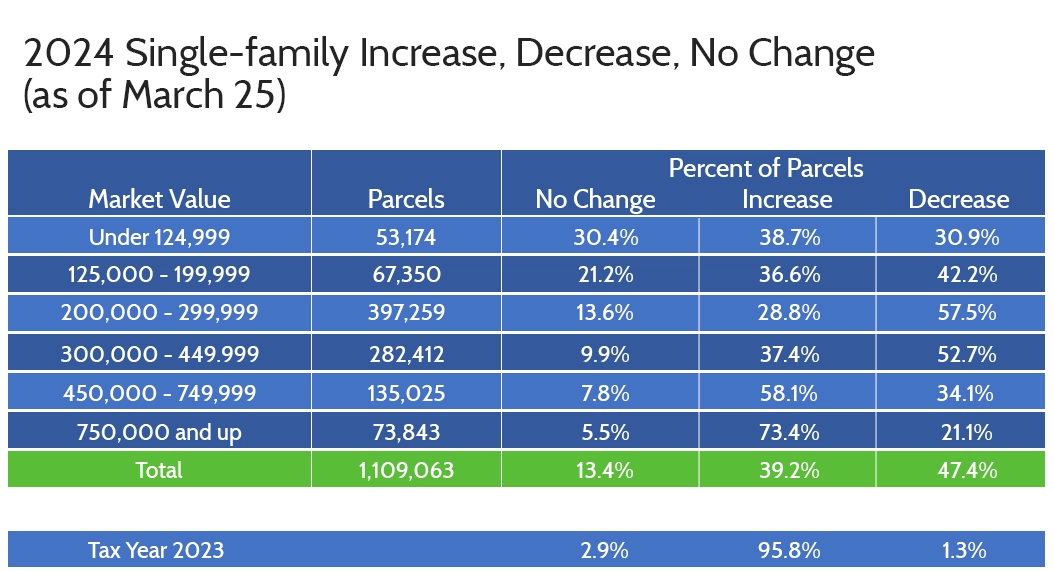

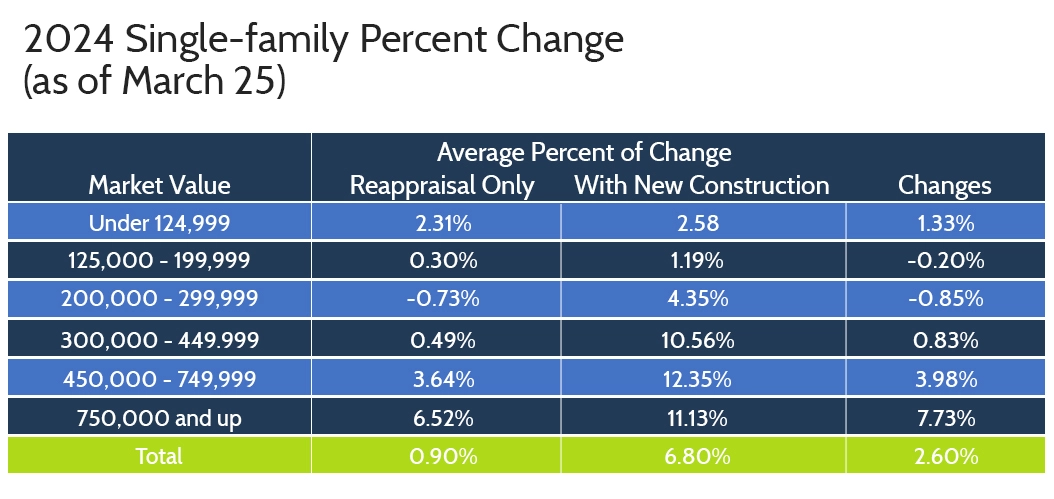

Market Value Trends for Single-Family Homes

The market continues its upward trajectory, driven especially by new builds and high-value residential segments.

Maximize Your Savings with Tax Cutter

Take charge of your property taxes with help from our dedicated professionals. We simplify every step of the protest process ensuring real savings without the stress. So, sign up today and let us handle everything for you