Understanding Ellis County Texas Property Tax And Commercial Market Trends

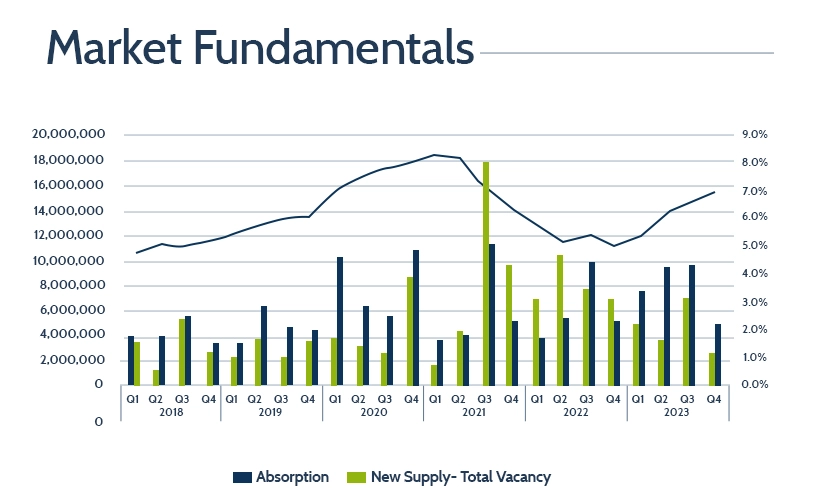

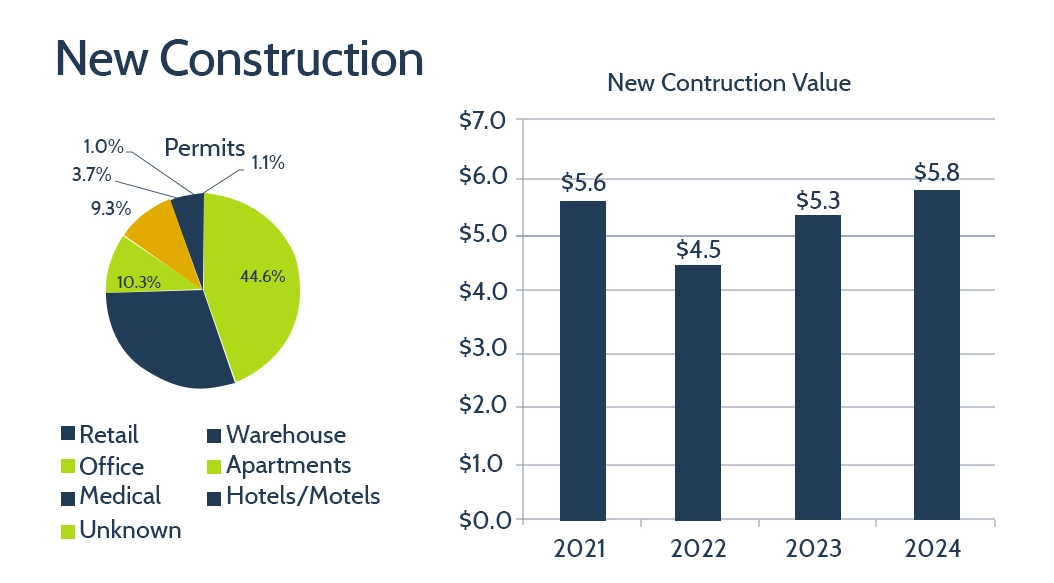

Trends in New Commercial Construction Permits and Values

New construction trends in Ellis County signal a strong demand for multi-family housing and continued growth in commercial development, as reflected in Ellis County Appraisal District assessments.

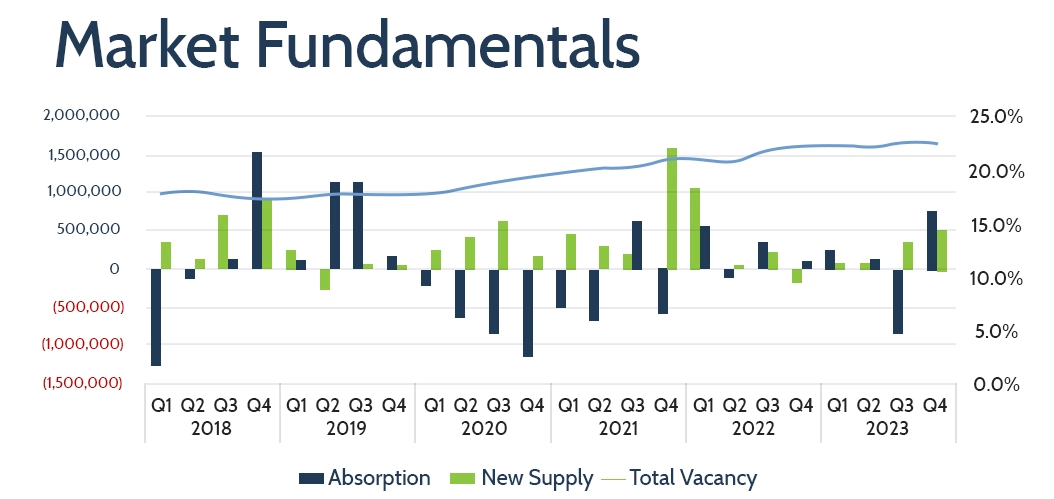

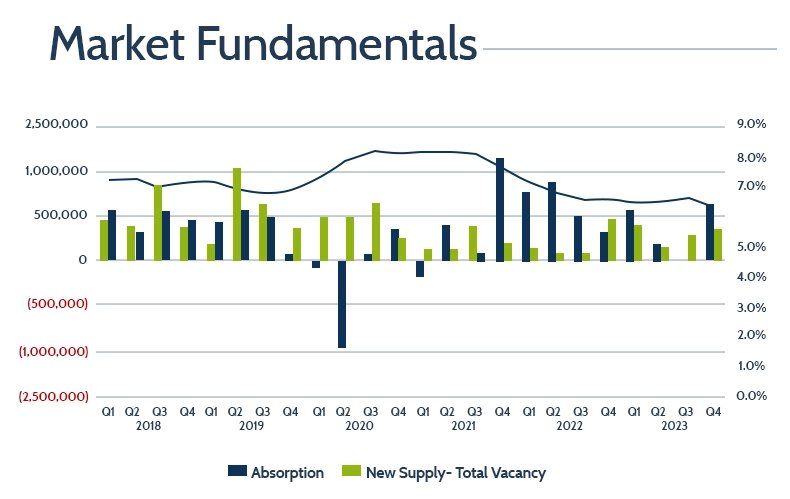

Adjustments in the Office Market

These trends indicate ongoing adjustments with shifts in construction activity, space absorption, and vacancy rates impacting property valuations and Ellis County Texas property tax assessments.

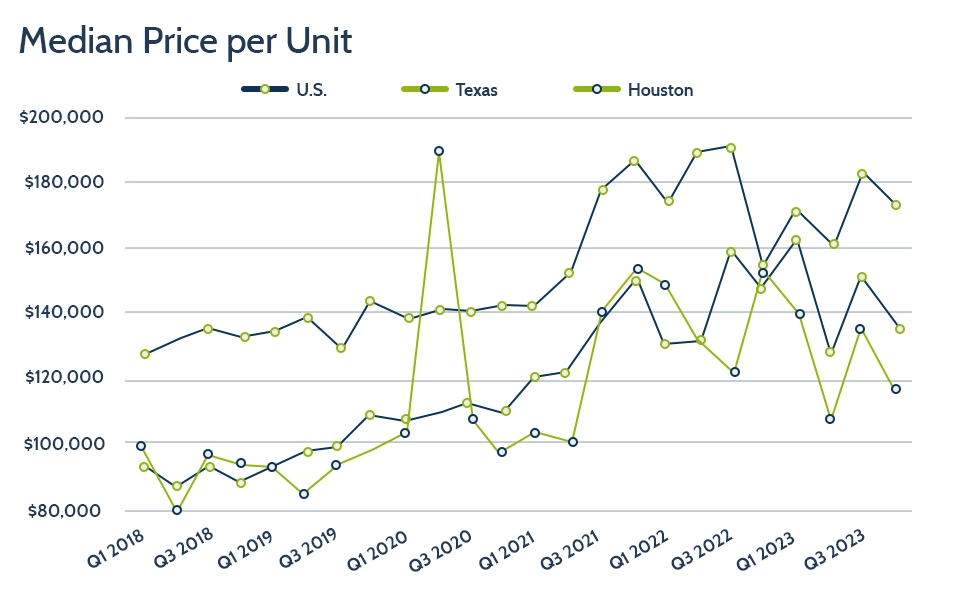

Apartment Market Overview

The apartment market ended the year with positive absorption, reflecting growth in new construction and solid demand for units. Key metrics from the Ellis County CAD show a mixed trend in rental rates and occupancy.

Texas Retail Sector

Despite some market challenges, the retail sector has demonstrated resilience with steady absorption and relatively stable rental rates. Key metrics from the Ellis County Central Appraisal District show a slight slowdown in new construction but steady demand for retail space.

Warehouse Market Overview

These trends indicate a stabilizing warehouse market with steady absorption and consistent rental rates. Key metrics from Ellis County Texas property tax assessments reflect these developments in property valuations.