Harris County Tax Appraisal District Residential Property Market Trends

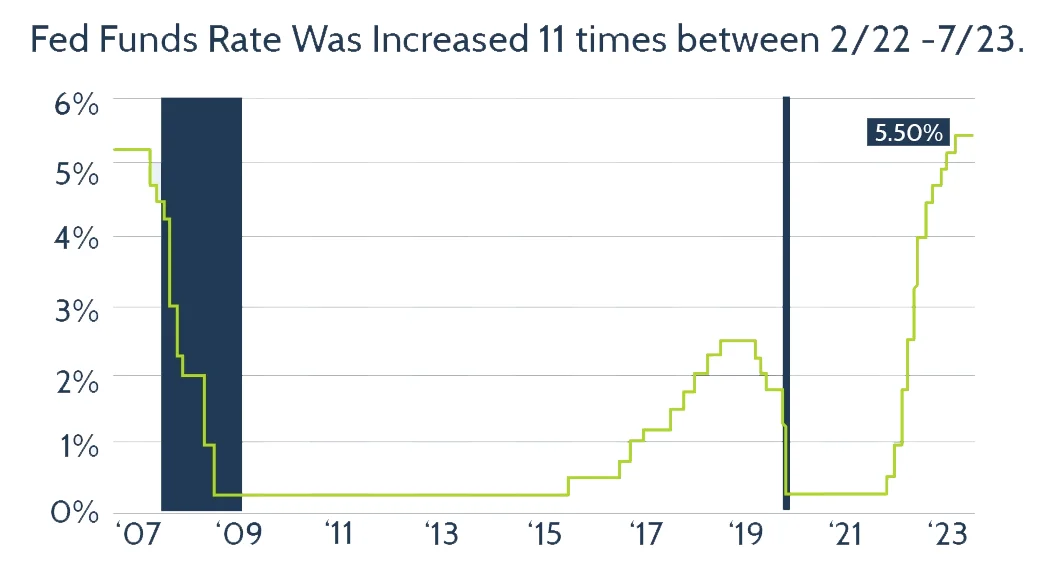

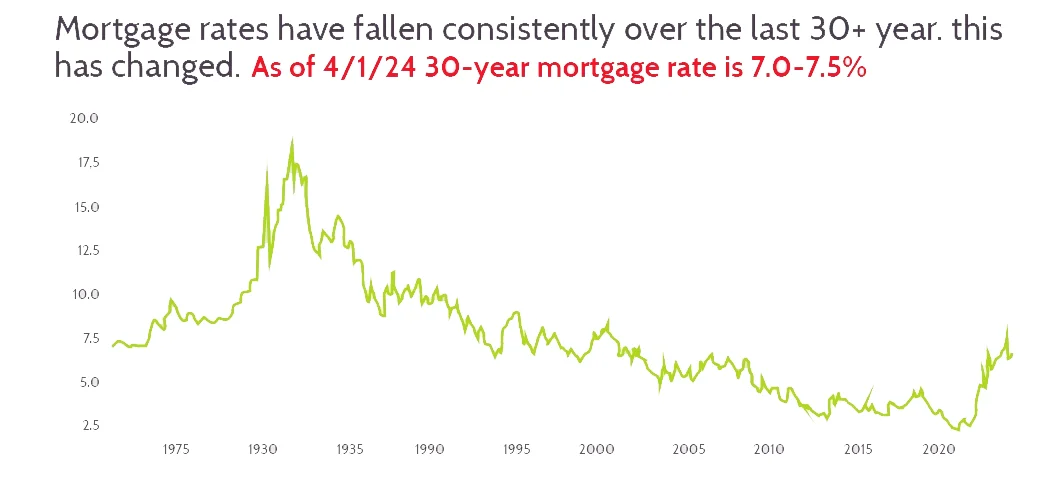

Impact of Rising Interest Rates on Harris County Property

As of April 1, 2024, mortgage rates have surged to levels not seen in recent years, driven by Federal Reserve actions, impacting housing affordability and the market, as reflected in the tax appraisal district assessments.

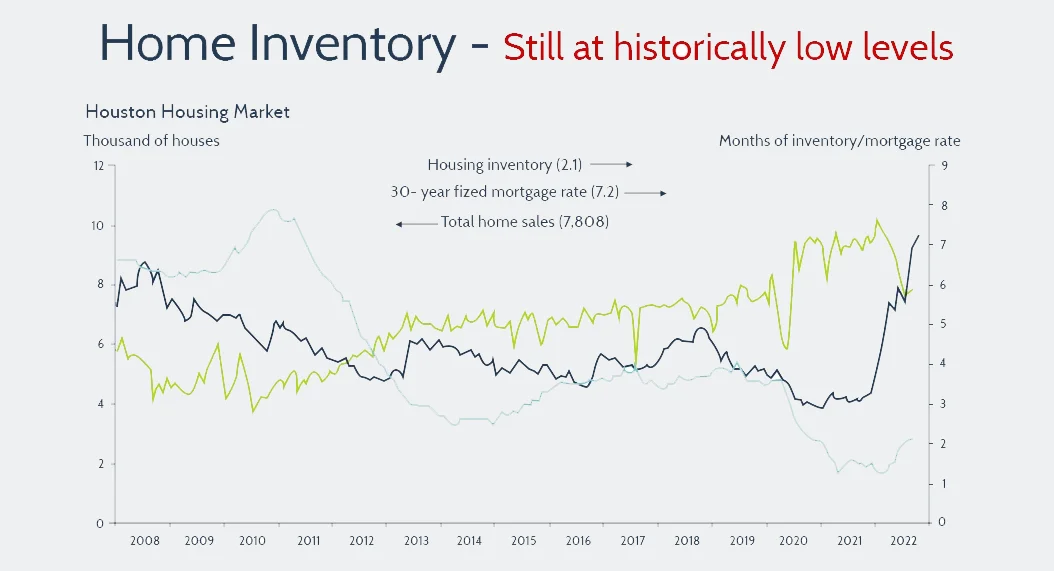

Housing Inventory Trends in Harris County

The availability of homes in Harris County has shifted significantly over the past two years, impacting housing prices and market stability, as reflected in the Harris Appraisal data.

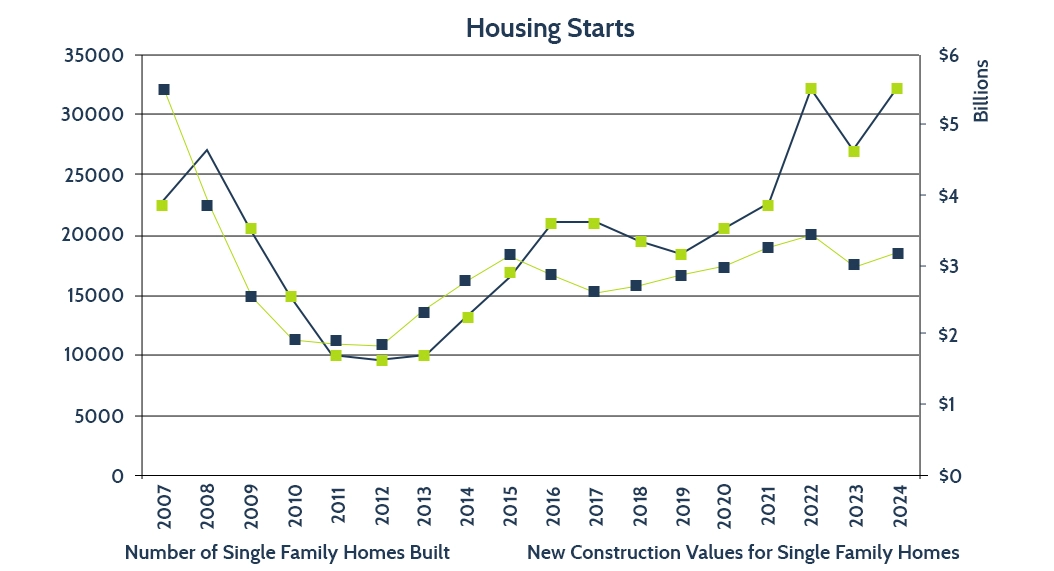

HCAD Single Family Home Market Overview

The property records show that housing market has seen significant shifts in single-family home construction and property values in recent years.

Major Texas Counties We Serve

We serve homeowners across 254 counties of Texas with residential property tax protest services. No matter your location, our team is ready to help you challenge unfair valuations. Let’s work together to lower your property tax burden.