Ellis County Property Tax Protest

Why Choose Tax Cutter?

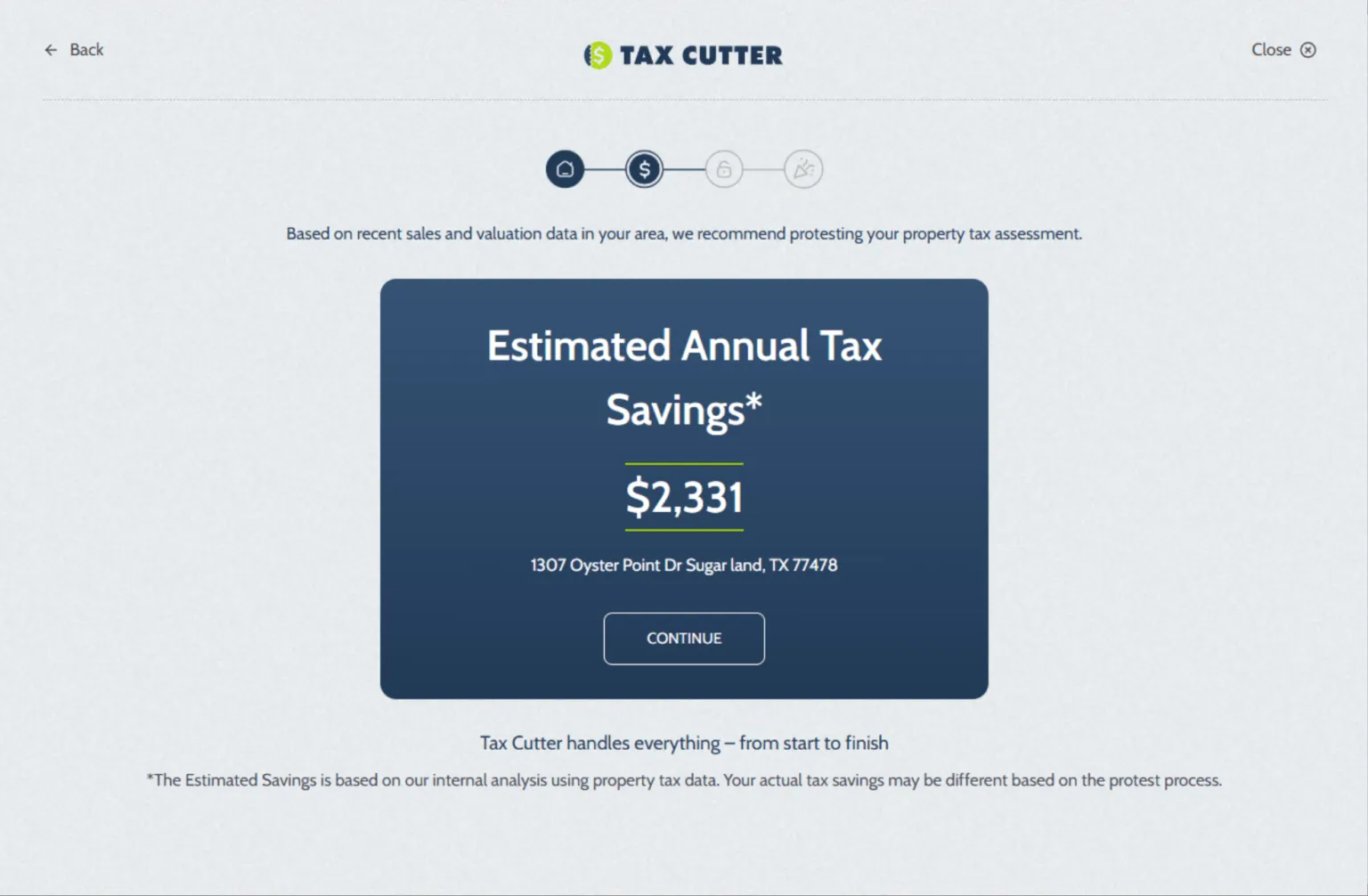

Expert service. Maximum savings. Zero hassle. We take on the county property tax protest so you don’t have to.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Why Protest Your Property Taxes?

Sky-high property tax bills aren’t always accurate. Many homes are overvalued, leading to inflated taxes that strain household budgets. Your assessed value directly impacts how much you pay and errors in that number could be costing you thousands. At Tax Cutter, we specialize in navigating the Ellis County Appraisal District process and uncovering discrepancies that others miss. With a deep understanding of the system, we challenge unfair valuations and work to lower your taxable amount. The opportunity to save is real. Sign up today and start putting money back in your wallet where it belongs.

Lower Your Taxes And Boost Your Savings

Property tax hikes can feel relentless, especially when the appraisal doesn’t reflect your home’s actual worth. Inaccuracies are more common than most realize, and they often go unchallenged. With your right to protest protected by law, Tax Cutter helps you take control of your property tax bill through a streamlined protest process with Ellis County CAD. Homeowners across Texas have saved thousands with our expert guidance. It’s time to turn that stress into savings and discover what a fair assessment could mean for your budget.

How Tax Cutter Works?

Ellis County Property Tax Protest is easy when we handle every step for you.

Stories of Trust, Savings, and Success

Benefits Of Choosing Our Property Tax Protest Services

We Are Dedicated to Delivering Superior Tax Protest Services Tailored to Ellis County.

Reduces Tax Burden

If your property is overvalued, filing a protest in Ellis County can reduce your yearly tax liability. Every saved dollar in property taxes is a dollar that stays in your pocket.

Provides Relief

Winning a property tax protest can offer relief knowing you’re paying a fair assessment and not stuck with a bloated property tax bill.

Increases Property Value

Challenging an over-assessed value in Ellis County can improve your home’s market appeal. A lower tax burden often makes your home more attractive to future buyers.

Simplify Taxation

By working with a tax expert, you can streamline the process and navigate all Ellis County paperwork smoothly. We handle the hassle for you.

Avoid Overpayment

Filing a protest with the Ellis Appraisal District ensures you don’t overpay. You pay only what you rightfully owe nothing extra freeing up extra funds.

Expert Advice

Navigating a protest can be complex. Our Ellis County tax experts offer professional guidance and clear advice from start to finish.

Your Guide to All Things: Navigate with Ease

Cut Your Tax Bill. Pay Only What’s Fair.

Thousands of homeowners are stuck paying inflated tax bills due to errors in appraisal. Tax Cutter offers professional Ellis County Property Tax Protest services to uncover inaccuracies, represent your interests, and secure fair valuations. Working with the Ellis County Central Appraisal District, we ensure that your voice is heard and your case is backed by strong data and strategy. Let us handle the complex steps and work to lower your tax burden efficiently.

Major Texas Counties We Serve

We serve homeowners across 254 counties of Texas with residential property tax protest services. No matter your location, our team is ready to help you challenge unfair valuations. Let’s work together to lower your property tax burden.