Hays County Property Tax Protest

Why Choose Tax Cutter?

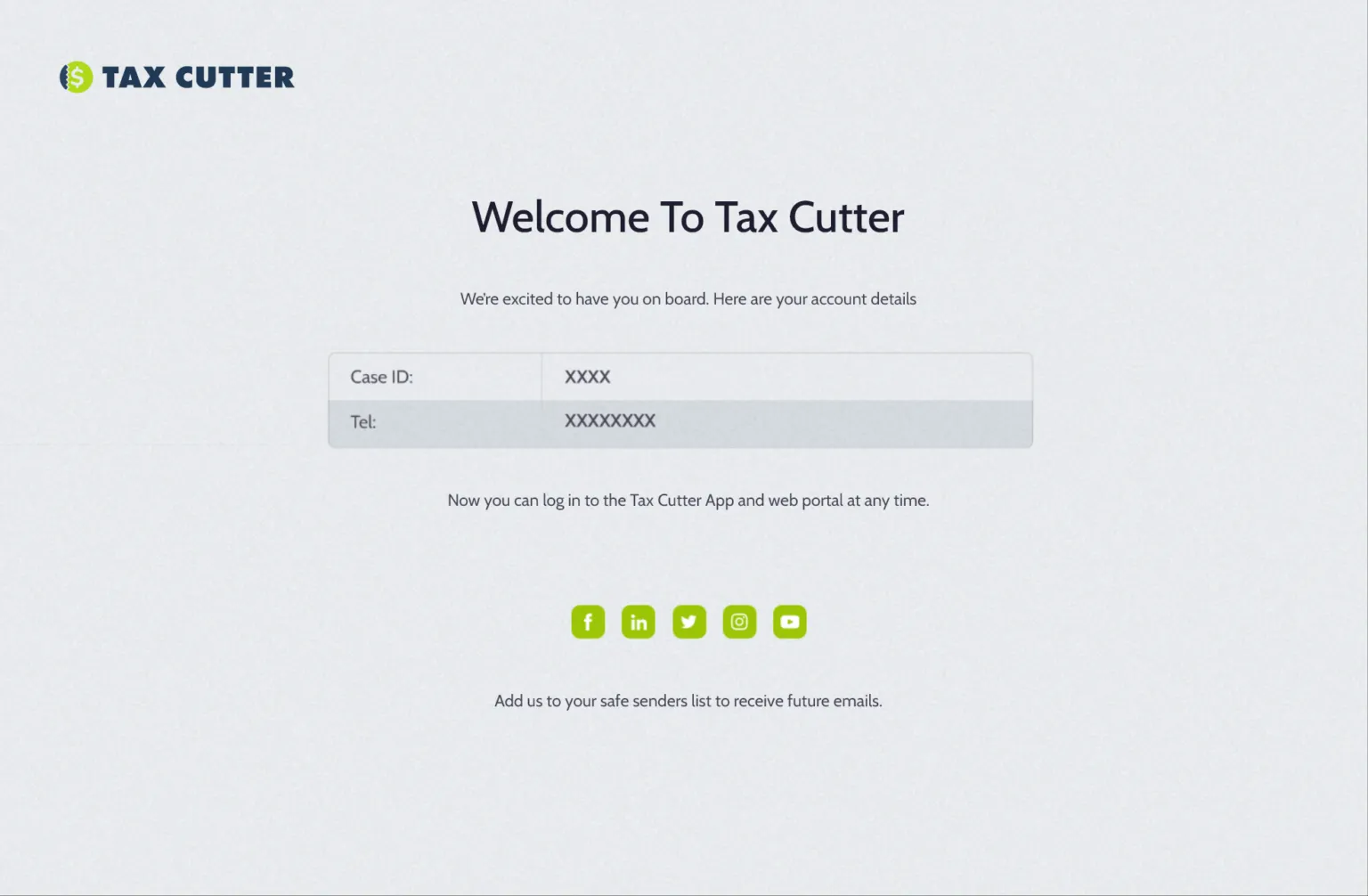

Our goal is to simplify the Hays County property tax protest process and make it hassle-free for you.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Why Protest Your Property Taxes?

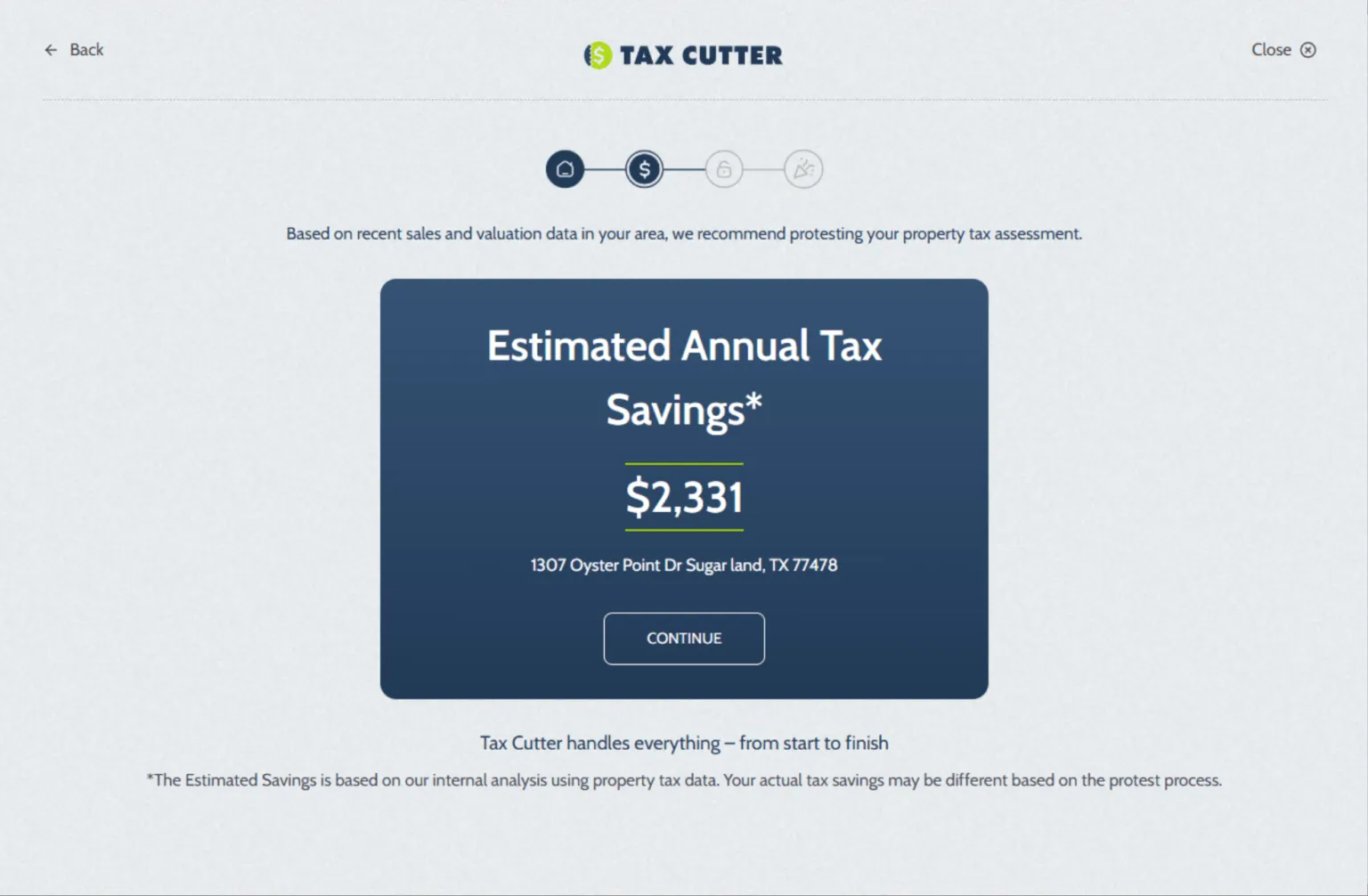

Soaring property tax bills often don’t reflect your home’s true value. Many properties are over-assessed, resulting in higher taxes that stretch your budget. Since your assessed value directly affects what you owe, even small errors can cost you thousands. At Tax Cutter, we know how to navigate the Hays County Appraisal District process and spot inaccuracies others might overlook. Our expertise helps us challenge unfair assessments and reduce your taxable value. Real savings are possible. Sign up today and keep more of your hard-earned money.

Lower Your Taxes And Boost Your Savings

Property tax increases can feel never-ending especially when your appraisal doesn’t match your home’s real value. Inaccurate valuations are more frequent than you’d think, and many go unchecked. Fortunately, your right to protest is protected by law. At Tax Cutter, we make it simple to challenge unfair assessments through a smooth and effective process with the Hays County CAD. Homeowners throughout Texas have saved thousands with our proven approach. Let us help you turn frustration into savings and find out how a fair appraisal can ease your budget.

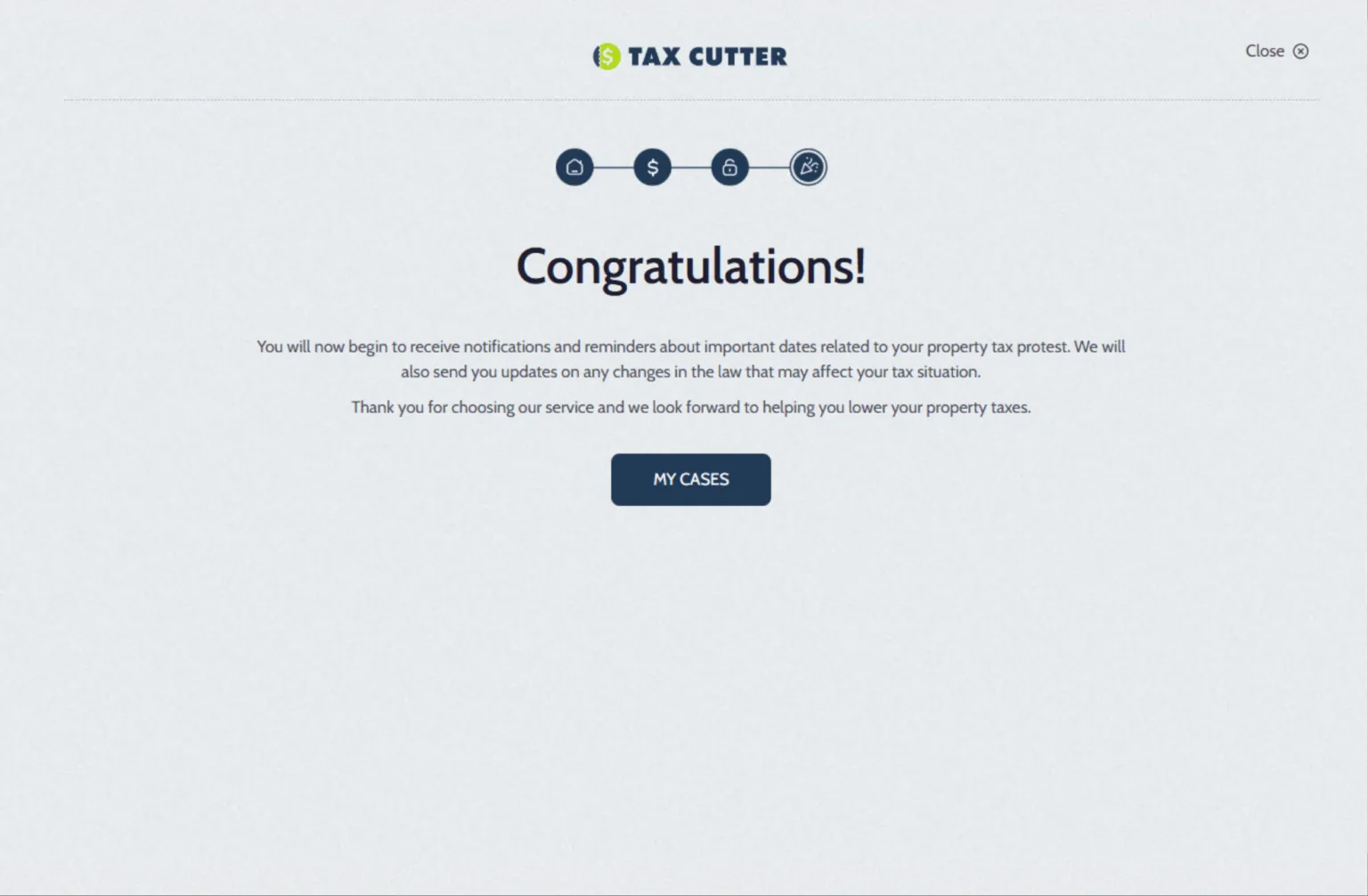

How Tax Cutter Works?

Our objective is to make the property tax protest process as easy and user-friendly as possible.

Stories of Trust, Savings, and Success

Benefits Of Choosing Our Services

We’re dedicated to delivering top-tier property tax protest services tailored specifically for Hays County CAD homeowners.

Reduces Tax Burden

When your property is overvalued, you’re likely overpaying. A successful protest can lower your property tax bill, saving you money for what matters most.

AI-Powered Accuracy

Our cutting-edge AI technology reviews your property data, detects valuation errors, and helps build a compelling case with speed and accuracy.

Increases Property Value

Lower property taxes can enhance your home’s appeal to buyers. A fairer assessment often translates into a stronger market position.

Simplify Taxation

Working with an expert tax consultant streamlines the process. We manage the paperwork and work closely with the Hays County appraisal district on your behalf.

24/7 Client Support

Our team is available any time to answer questions, provide updates, and walk you through each stage of your protest.

Expert Advice

Property tax laws can be complex. Our experienced consultants guide you with the insight needed to navigate the protest process with confidence.

Your Guide to All Things: Navigate with Ease

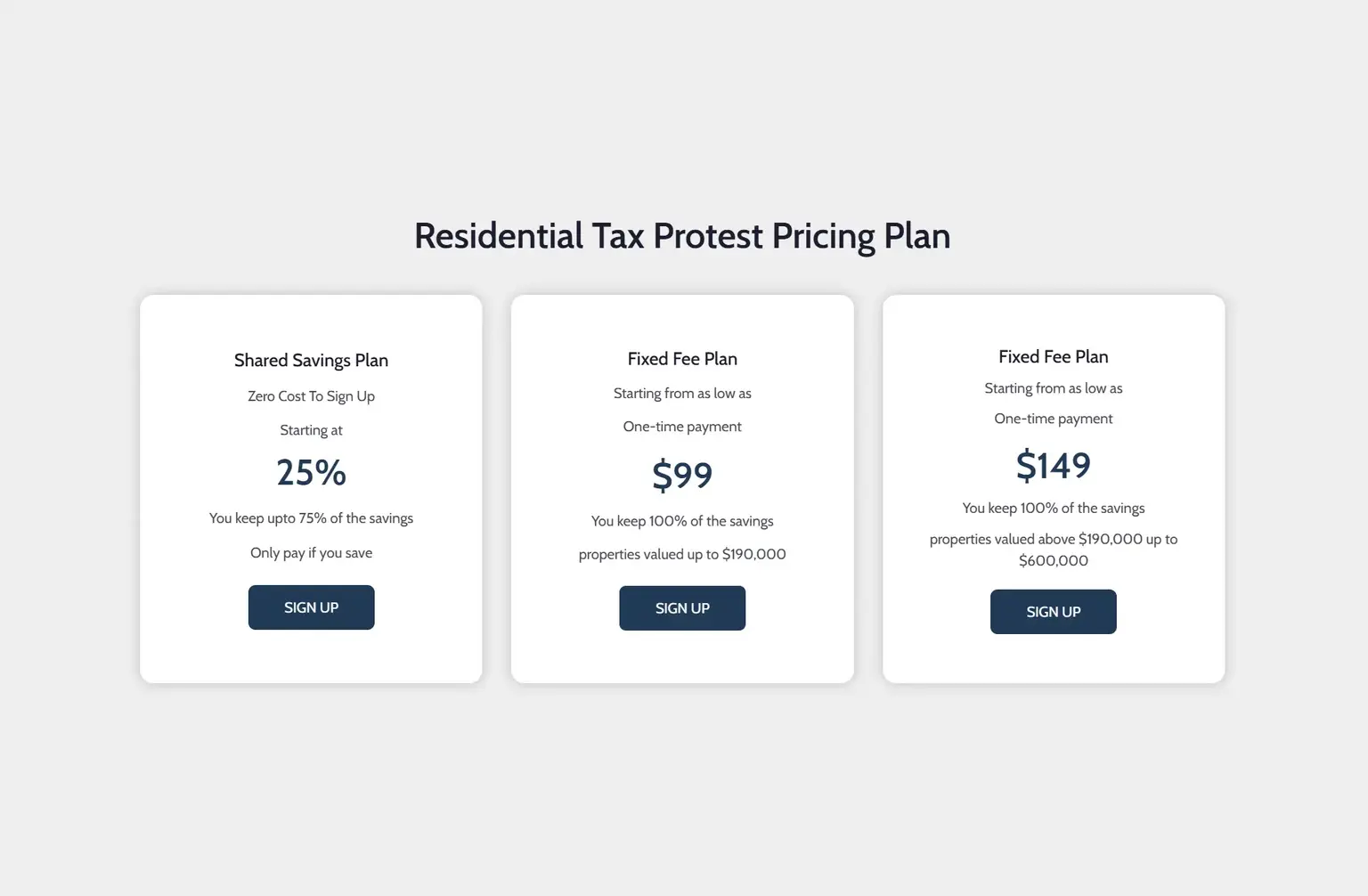

Cut Your Tax Bill. Pay Only What’s Fair.

Thousands of homeowners end up overpaying due to mistakes in their property appraisals. Tax Cutter provides professional Hays County Property Tax Protest services to identify errors, advocate on your behalf, and pursue fair, accurate valuations. We work directly with the Hays County Central Appraisal District to make sure your case is heard, supported by solid data and proven strategies. Let us take care of the process and help reduce your tax burden effectively.

Major Texas Counties We Serve

We serve homeowners across 254 counties of Texas with residential property tax protest services. No matter your location, our team is ready to help you challenge unfair valuations. Let’s work together to lower your property tax burden.