Harris County Property Tax Protest

Why Choose Tax Cutter?

Tax Cutter helps property owners by providing the best property tax protest services that ensure the best savings. Meanwhile, you just sit back and relax.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Why Protest Your Property Taxes?

Harris County property taxes got you feeling trapped? Don’t just accept sky-high bills! Your home’s value sets your tax, but what if you could chop thousands off that number? Last year, we helped clients save thousands in property taxes. The Property Appraiser’s office might not always get it right, and overvalued homes mean unfair taxes. Our experts know the system inside-out of the county and can spot hidden errors that could be draining your bank account. We’ll fight for a fairer appraisal, saving your hard-earned money! So, why wait? Time is running out. Let’s team up! Get a free consultation and see how much you could save. We’re on your side, ready to win back your hard-earned cash from the county. Don’t wait, fight back today!

Chop Your Taxes And Boost Your Savings

Unsure about your skyrocketing property tax bill? Is your county tax bill leaving you gasping for air? Think your property might be unfairly valued? You’re not alone. Many homeowners unknowingly overpay thousands due to inaccurate appraisals. But there’s good news! You have the legal right to protest your property tax appraisal and potentially reclaim those wasted dollars. Tax Cutter can help you through the process, ensuring your voice is heard and your rights protected. We’re experts in the field with a proven track record of saving our clients huge amounts on their property taxes. Last year alone, we helped homeowners secure an average reduction of $24,134! Imagine that kind of breathing room in your budget. Contact us today for a free consultation, and let’s fight for a fairer tax bill together.

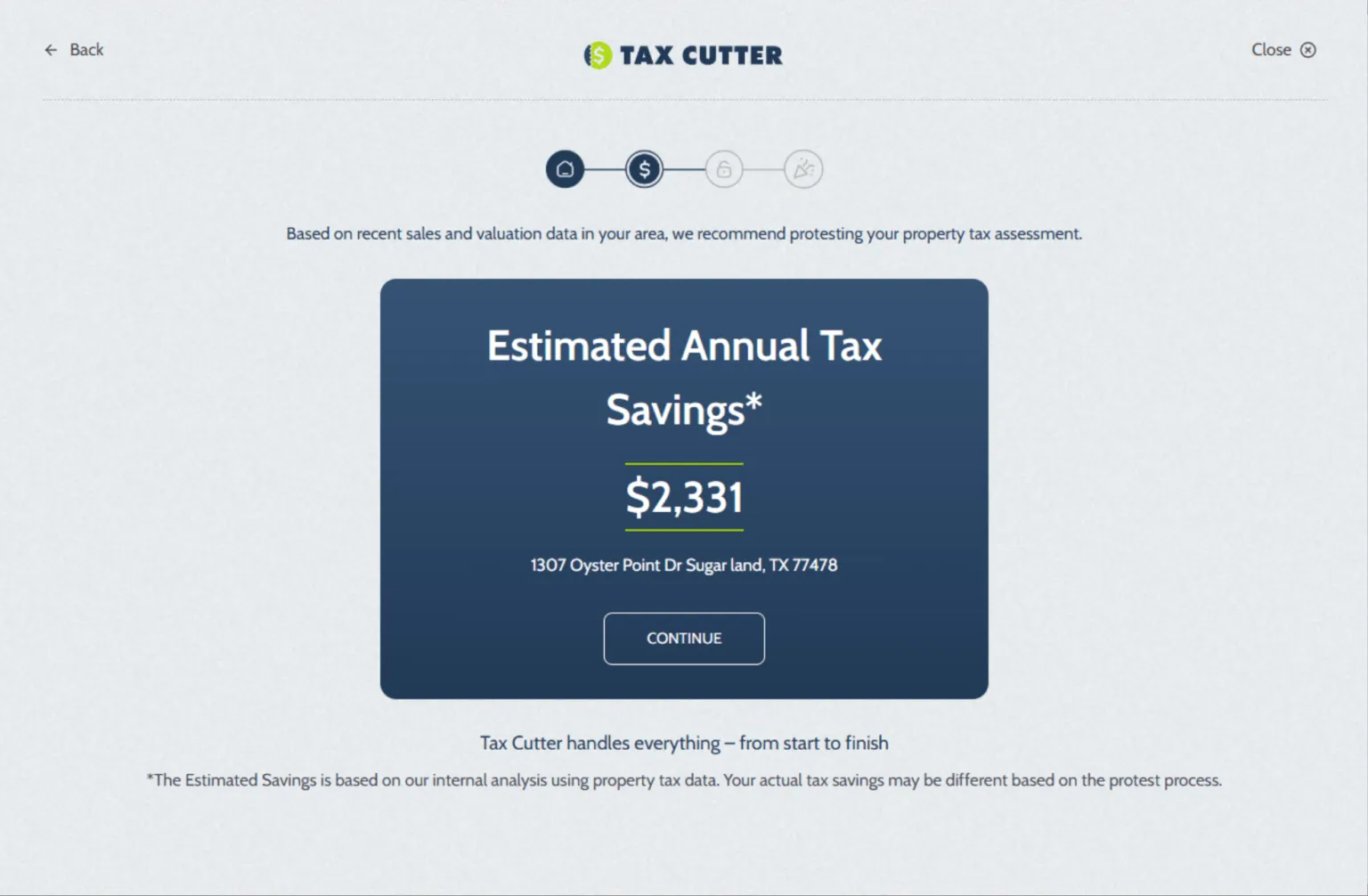

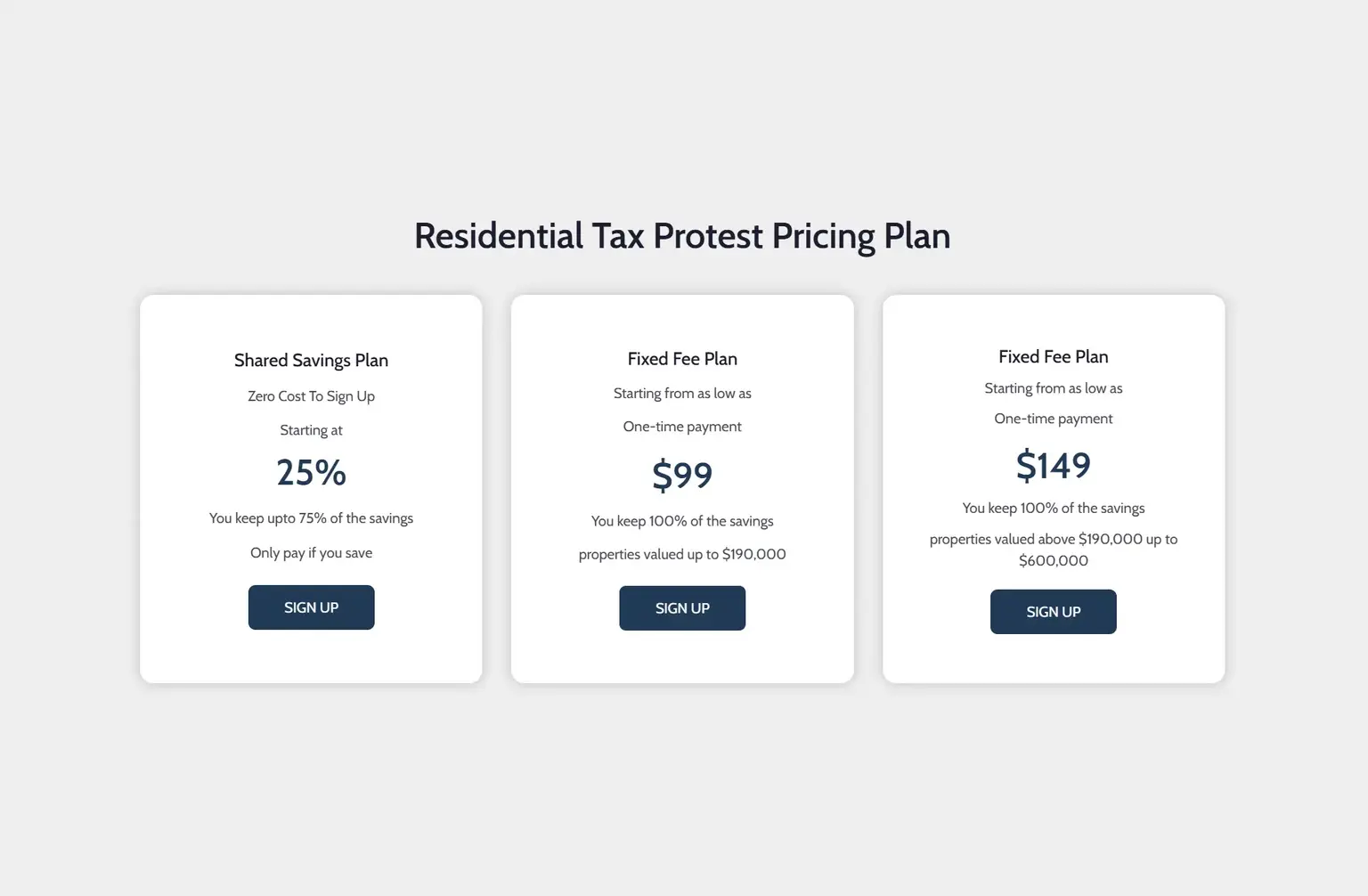

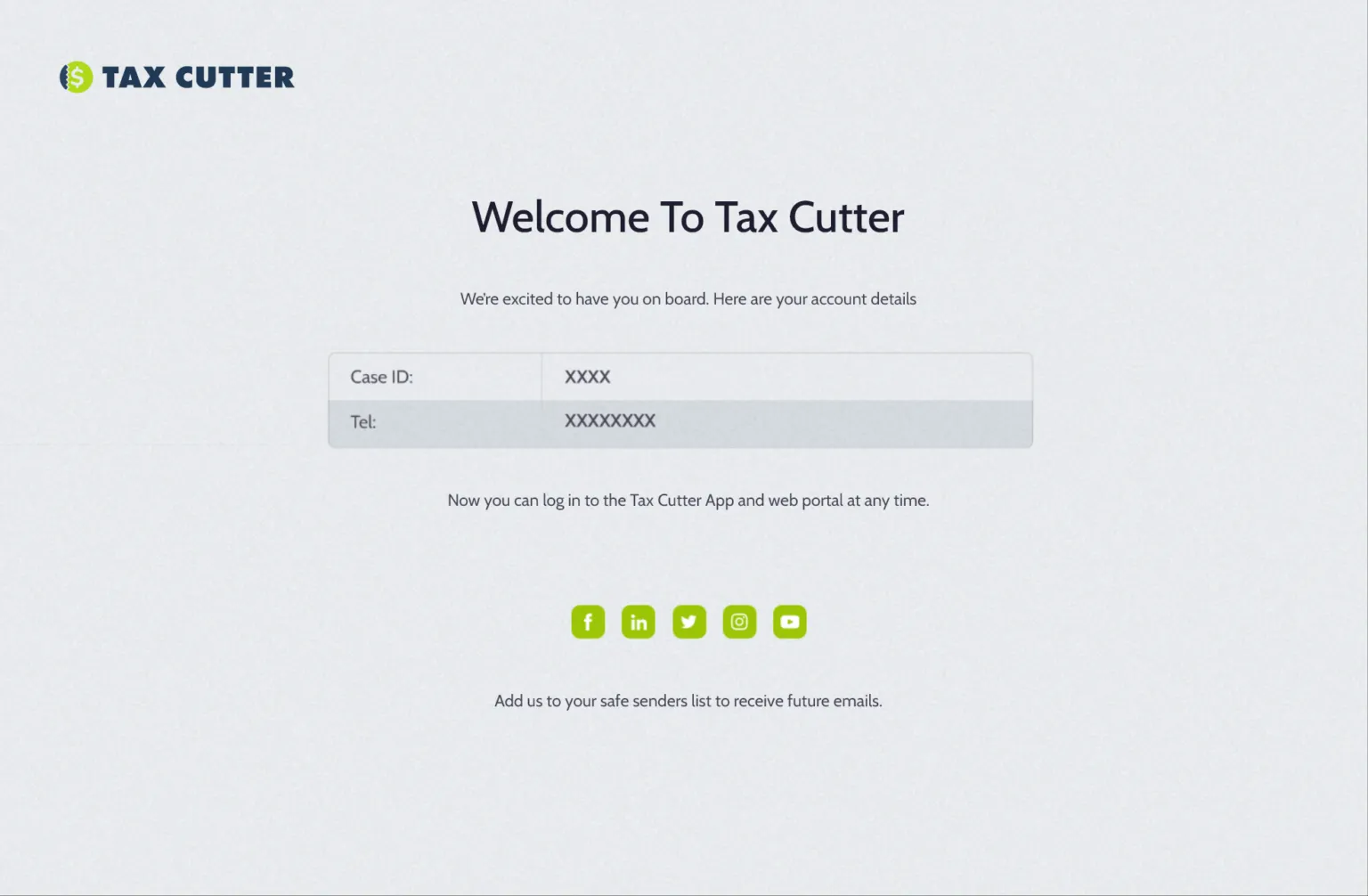

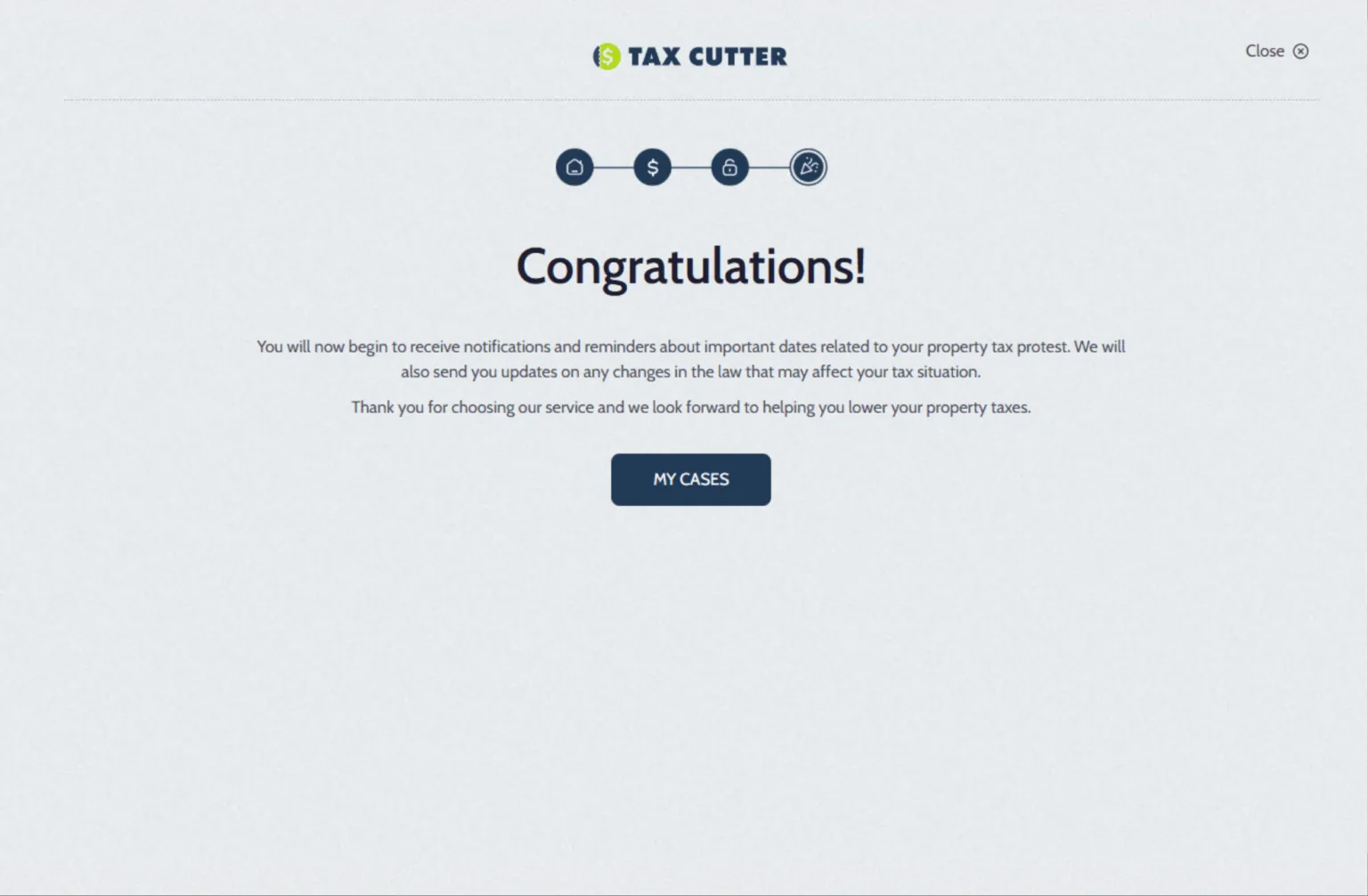

How Tax Cutter Works?

Our objective is to make the property tax protest process as easy and user-friendly as possible.

Stories of Trust, Savings, and Success

Benefits Of Choosing Our Property Tax Protest Services

We are dedicated to delivering superior tax protest services tailored to your county.

Reduces Tax Burden

If your property’s value is overestimated, protesting can lower your annual tax burden. Every dollar saved on property taxes is a dollar you can use elsewhere.

Provides Relief

A successful property tax protest can bring much-needed relief, knowing you’re paying your fair share and not being burdened by an inflated tax bill. Ready to challenge your taxes in Harris County Appraisal District Our smooth process takes care of everything, maximizing your property tax savings.

Increases Property Value

Successfully protesting your property tax assessment can increase your home’s market value because a lower tax burden makes your property more attractive to potential buyers.

Simplify Taxation

By partnering with a property tax consultant, you can simplify the process and follow the necessary steps. A consultant can handle the paperwork with the county property appraiser. Tax Cutter simplifies the property tax protest process by offering a straightforward service with a history of delivering results

Avoid Overpayment

By protesting property taxes in HCAD, you can ensure you’re paying what you truly owe, not a cent more. This can free up significant cash for you. That’s right, no sign-up costs, no hidden fees – only pay when you win with our protest property taxes.

Expert Advice

A property tax protest can be complicated. A qualified property tax consultant can provide you with expert advice and guidance throughout the process.

Your Guide to All Things: Navigate with Ease

Chop Your Bill With A Tax Protest. Don’t Overpay!

You’re not alone. Many homeowners overpay due to inaccurate appraisals by the property appraiser. But there’s good news! A property tax protest can help you reclaim thousands in overpaid taxes. At Tax Cutter, we’re a dedicated property tax protest service in Harris County Appraisal District with a proven track record of success. We’ll help you with the confusing protest process and fight for a fair and accurate property valuation.

Major Texas Counties We Serve

We serve homeowners across 254 counties of Texas with residential property tax protest services. No matter your location, our team is ready to help you challenge unfair valuations. Let’s work together to lower your property tax burden.