Orange County Property Tax Protest

Why Choose Tax Cutter?

Tax Cutter helps Orange County homeowners by offering expert property tax protest services that secure the biggest savings. Meanwhile, you simply sit back and relax.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Why Protest Your Property Tax?

Orange County property taxes can place a heavy burden on homeowners. Accepting inflated bills shouldn’t be your only option. Your home’s assessed value sets your tax, but what if you could reduce it by thousands? Each year, we help Orange CAD residents save significantly through the property tax protest process. The Appraisal District doesn’t always get valuations right, and many homes end up overvalued, leading to unnecessary costs. Our team understands the county’s system in detail and can uncover errors that may be draining your budget. We work to secure a fairer appraisal and protect your hard-earned money. Don’t delay schedule a free consultation today and discover how much you could save. With us on your side, Orange County property tax protest becomes simple, effective, and stress-free.

Lower Your Orange County Tax and Maximize Your Savings

Worried about rising Orange County property tax bills? Do you feel your home may be overvalued? You’re not alone many homeowners pay more than they should due to inaccurate appraisals. The good news is you have the right to file an Orange County property tax protest and work toward reducing those unnecessary costs. At Tax Cutter, we guide you through the entire process, ensuring your case is presented with accuracy and professionalism. With years of proven experience, we have consistently delivered results that matter. In fact, Orange County CAD homeowners working with us achieved average savings of $24,134 last year. That’s money that can go back into your household budget instead of staying with the county. Take the first step today contact Tax Cutter for a free consultation and discover how much you could save with an Orange County property tax protest.

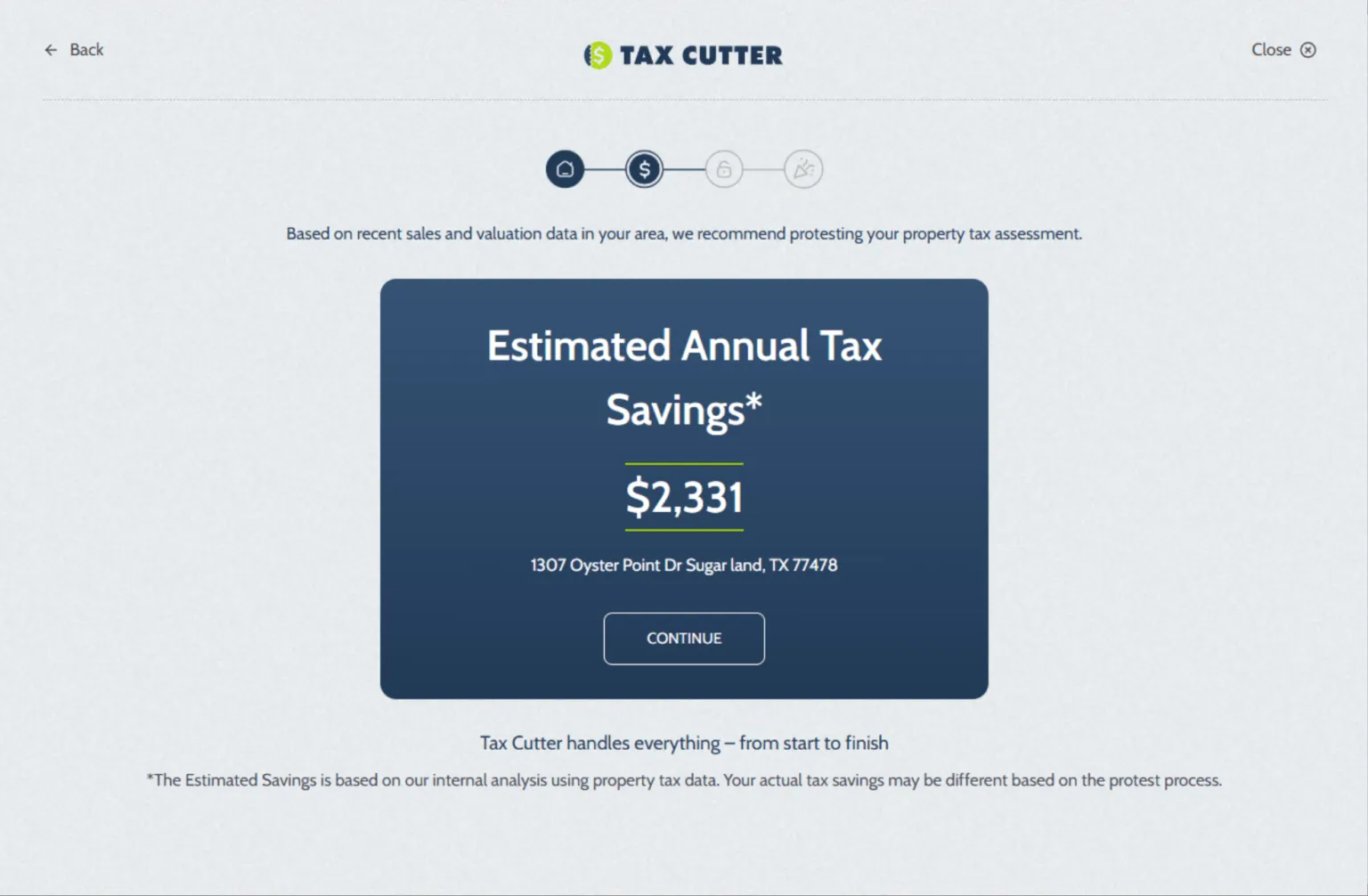

How Tax Cutter Works?

Orange County Property Tax Protest becomes simple when we manage the process from start to finish.

Stories of Trust, Savings, and Success

Benefits Of Choosing Our Orange County Property Tax Protest Services

We Are Dedicated to Delivering Superior Tax Protest Services to Orange County.

Reduces Tax Burden

If your Orange County property is overvalued, protesting can lower your yearly tax bill. Every dollar saved on property taxes is money you can use elsewhere.

Provides Relief

A successful protest brings peace of mind, knowing you’re paying only your fair share and avoiding the stress of an inflated tax bill.

Increases Property Value

Challenging your Orange County property tax assessment can boost your home’s appeal. Lower taxes make your property more attractive to buyers.

Simplify Taxation

With a trusted consultant managing the details, the process becomes easier. We handle all the paperwork with Orange County appraisal authorities on your behalf.

Avoid Overpayment

By protesting in Orange County, you ensure you are not paying more than what’s fair. This keeps your hard-earned money where it belongs with you.

Expert Advice

Our experienced consultants provide the knowledge and guidance you need to navigate the property tax protest process with confidence.

Your Guide to All Things: Navigate with Ease

Cut Your Bill with an Orange County Tax Protest. Don’t Overpay!

You’re not alone. Many Orange County homeowners end up paying more than they should because of inaccurate property appraisals. But here’s the good news! A property tax protest can help you recover thousands in overpaid taxes. At Tax Cutter, we’re a trusted property tax protest service in Orange County Appraisal District with a strong record of results. We’ll guide you through the protest process and ensure you receive a fair and accurate property valuation.

Major Texas Counties We Serve

We serve homeowners across 254 counties of Texas with residential property tax protest services. No matter your location, our team is ready to help you challenge unfair valuations. Let’s work together to lower your property tax burden.