Henderson County Property Tax Protest

Why Choose Tax Cutter to Review Your Henderson County Property Tax Protest?

At Tax Cutter, we provide reliable property tax solutions designed to maximize your savings while you focus on the things that matter most.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Why Protest Your Property Tax?

Is Henderson CAD putting pressure on your budget? Don’t just accept the bill protest it! The appraisal district might have placed an inflated value on your home, resulting in an unnecessarily high tax bill. Thousands of Texans have saved significant amounts through successful protests. You should never pay more than your fair share especially when errors slip in. Faulty measurements, missed repairs, or comparisons with pricier homes can unfairly raise your valuation. At Tax Cutter, we specialize in the Henderson County Property Tax Protest process and know how to spot and correct these costly mistakes. With the right approach, you could lower your annual tax burden. Don’t wait book a free consultation today and let’s get started.

Cut Your Tax — Boost Your Savings

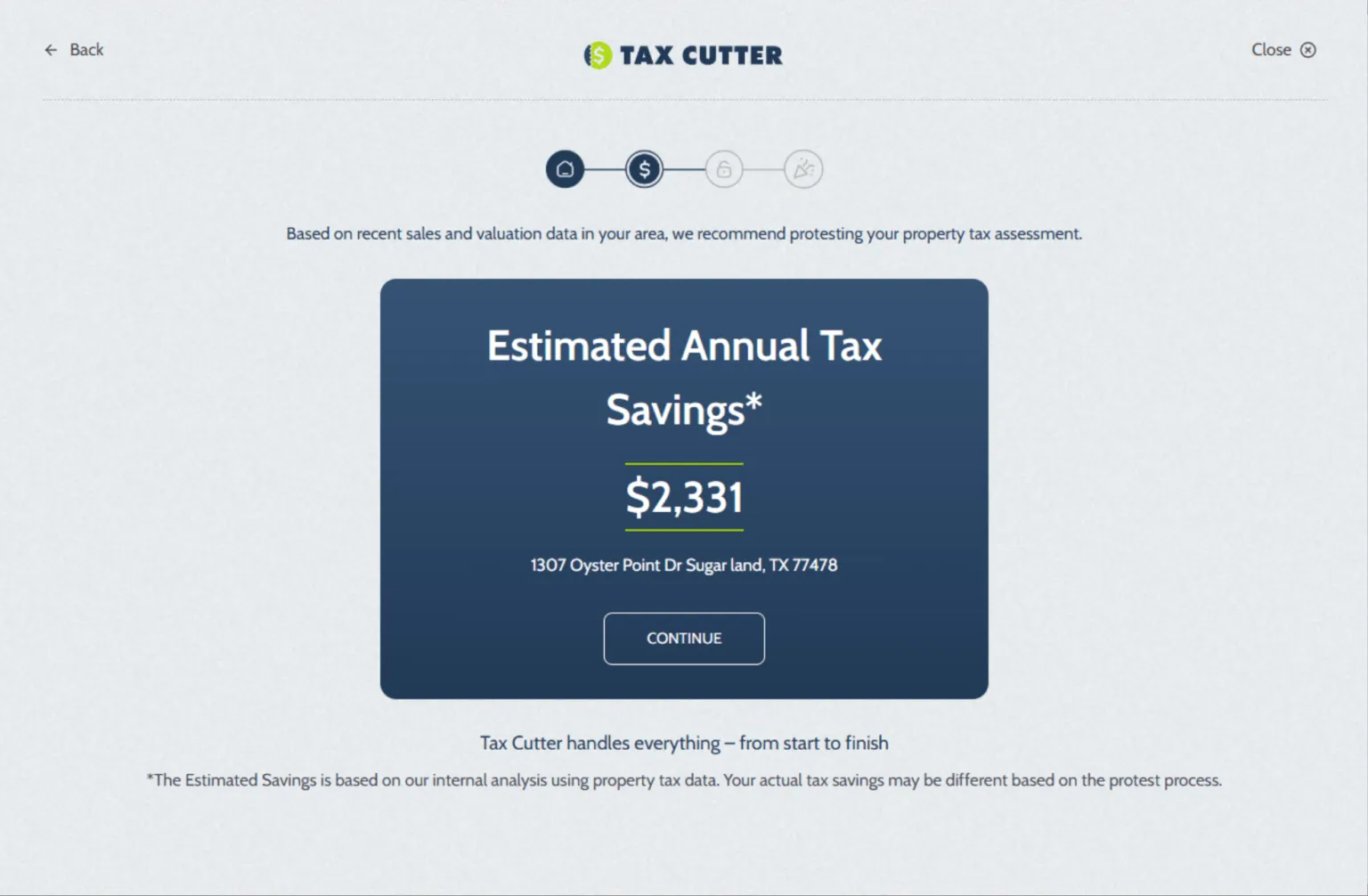

Is your tax bill higher than expected? You may be overpaying because of incorrect appraisals. The good news is you have the right to challenge your property tax and you don’t have to do it alone. Tax Cutter walks you through every step of the protest process, protecting your rights while building the strongest case possible.

With years of experience delivering results including average reductions of over $24,000 in similar counties we know how to help you achieve fair assessments. Contact us today for your free savings estimate, and let’s work together to lower your tax burden.

How Tax Cutter Works

Henderson County Property Tax Protest is easy when we handle the entire process for you:

Stories of Trust, Savings, and Success

The Benefits of Choosing Tax Cutter for Your Protest

Reduce Your Tax Burden

Stop overpaying because your home was overvalued. Even a small adjustment in value can lead to big yearly savings.

Financial Relief

Feel confident knowing you’re only paying what’s fair. We make sure your assessment reflects the true value of your property.

Boost Property Appeal

Lower taxes can make your property more attractive to buyers. Reduced carrying costs mean stronger returns.

Simplified Process

We manage paperwork, deadlines, and hearings with the Henderson County Appraisal District so you don’t have to.

Professional Guidance

Navigate the Henderson County Property Tax Protest process with experienced experts who know how to build a winning case.

Expert Advice

A property tax protest can be complicated. A qualified property tax consultant can provide you with expert advice and guidance throughout the process.

Your Guide to All Things: Navigate with Ease

Chop Your Bill with a Tax Protest. Stop Overpaying!

You’re not alone. Many Henderson County appraisal homeowners end up paying too much because of inaccurate appraisals from the property appraiser. But here’s the good news! Filing a Henderson County property tax protest can help you recover thousands in excess taxes. At Tax Cutter, we specialize in Henderson County Property Tax Protest services with a strong record of success. Our team guides you through the confusing process and fights for a fair, accurate property valuation.

Major Texas Counties We Serve

We serve homeowners across 254 counties of Texas with residential property tax protest services. No matter your location, our team is ready to help you challenge unfair valuations. Let’s work together to lower your property tax burden.