Understanding Anderson County Property Tax and Commercial Market Growth

Value Allocation in the Anderson County Property Tax Market

Understanding the distribution of property values can provide insights into the economic health and investment opportunities within Anderson County.

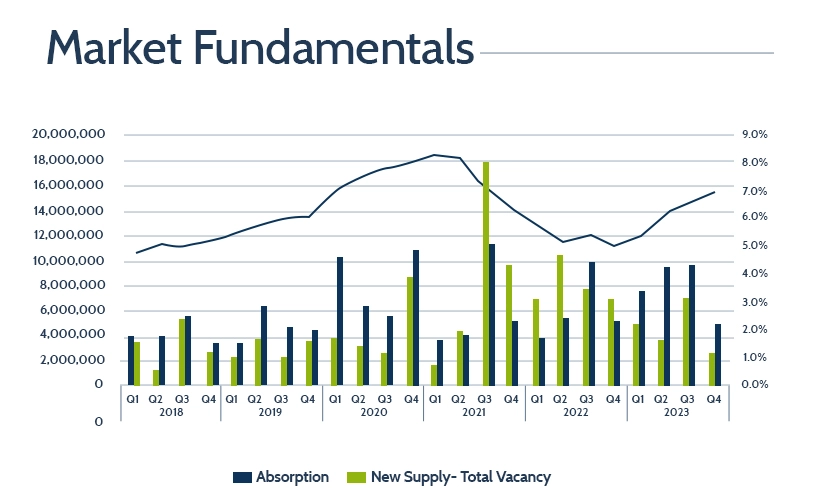

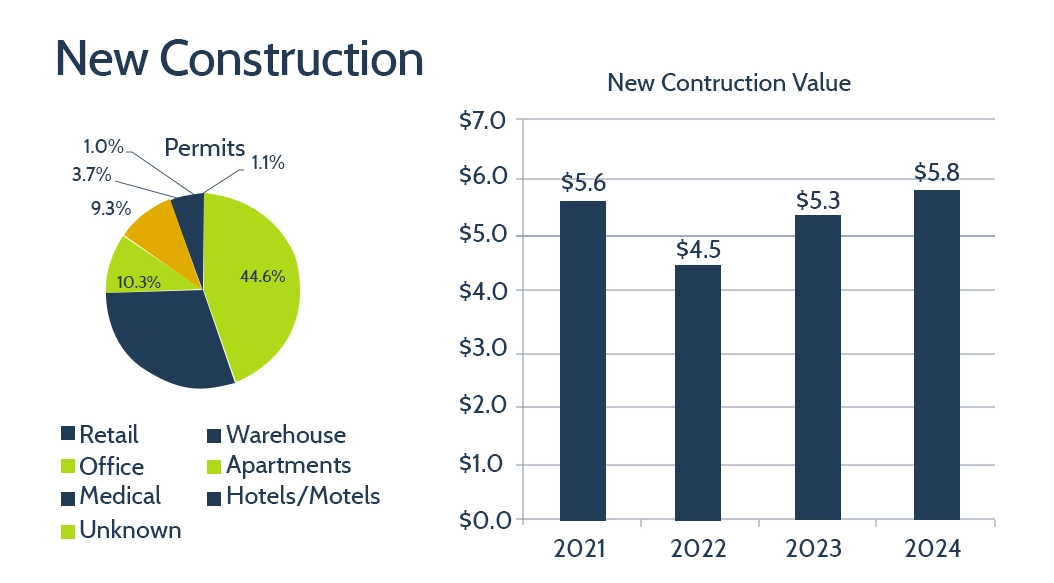

Adjustments in the Anderson County Office Market

The Anderson County office market is adapting to shifting economic conditions and the changing demands of businesses, with new construction and evolving space usage helping shape the region’s commercial landscape.

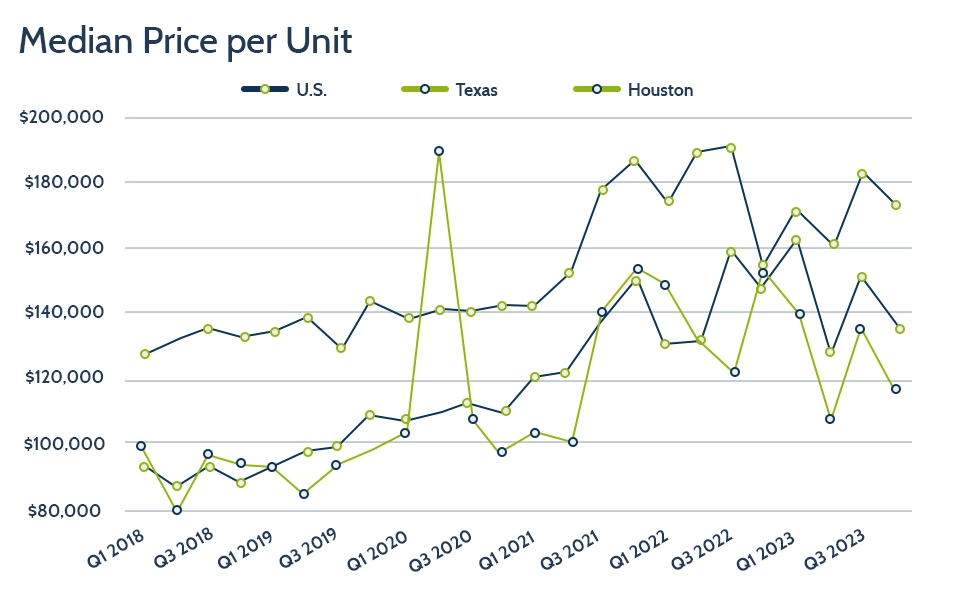

Anderson County Apartment Market Overview

The Anderson County Texas apartment market shows continued growth, driven by both new construction and a strong interest from potential tenants.

Major Texas Counties We Serve

We serve homeowners across 254 counties of Texas with residential property tax protest services. No matter your location, our team is ready to help you challenge unfair valuations. Let’s work together to lower your property tax burden.

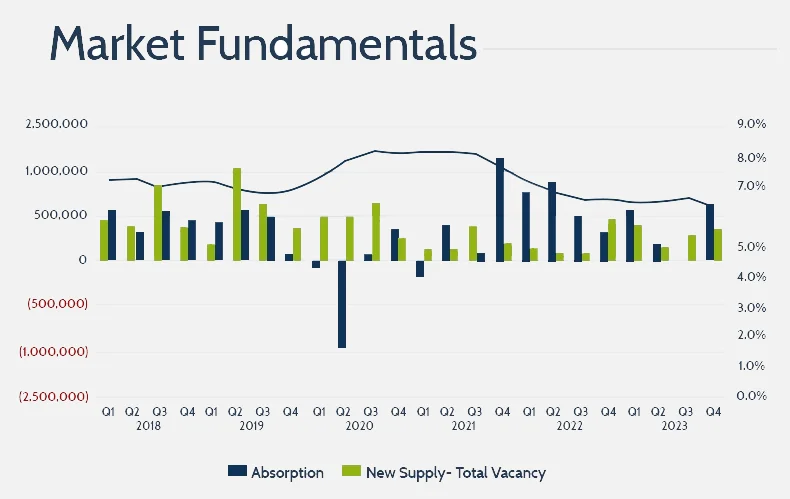

Anderson County Retail Sector

Despite market shifts, the Anderson County retail sector shows resilience, benefiting from consistent absorption and contributing to Anderson County Property Tax revenue.

Anderson County Warehouse Market

The Anderson County warehouse market shows resilience, with strong demand driven by regional logistics activity and continued growth in commercial real estate development.