Anderson County Property Tax Protest

Why Choose Tax Cutter in Anderson County?

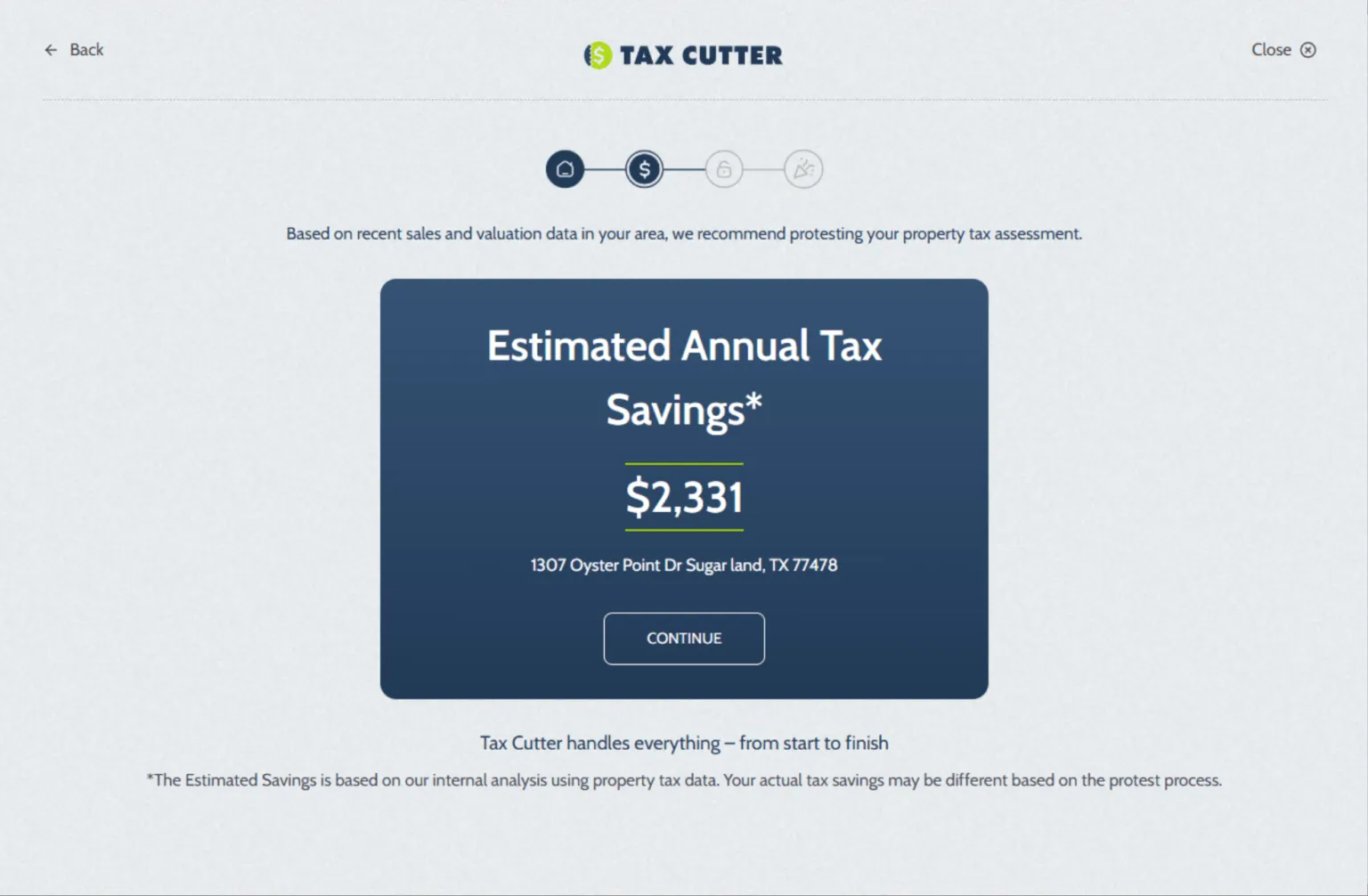

Tax Cutter makes it easy for Anderson County homeowners to save more and stress less. Our expert team handles your Anderson County Property Tax Protest from start to finish. Sit back, relax, and let us do the heavy lifting.

Counties Covered In Texas

Average Property Tax Savings

Success Rate In Taxes

Why Protest Your Property Taxes?

Anderson County Property Tax got you feeling stuck? Don’t just accept inflated bills! Your home’s value drives your tax, but what if you could trim that number down? Each year, we help Anderson County District residents save thousands through our trusted Anderson County Property Tax Protest services. The local Property Appraiser’s office isn’t perfect, sometimes homes are overvalued, meaning you could be paying more than you should. Our experienced protest team knows every rule and loophole in the county system to uncover mistakes and fight for a fairer value. So why wait? Request a free consultation today and see how much you could save. Let’s get your hard-earned money back where it belongs, in your pocket!

Anderson County Homeowners: It’s Time to Cut That Tax Bill

Worried about your rising property tax bill in Anderson County? Think your home might be overvalued or taxed unfairly? You’re not alone — many homeowners pay more than they should because of inaccurate appraisals. Here’s the good news: you can fight back. Through our Anderson County Property Tax Protest service, you have the chance to challenge your appraisal and reclaim your money. Tax Cutter makes the process smooth and stress-free, ensuring your case gets the attention it deserves. With years of proven success and thousands saved for clients, we know how to get results. Last year alone, homeowners saw average savings of $24,134! Contact us today for a free consultation and let’s work together to cut your taxes and keep more of your money where it belongs.

How Tax Cutter Works?

We have made the Anderson County Property Tax Protest process fast, easy, and stress-free.

Stories of Trust, Savings, and Success

Benefits of Choosing Our Anderson County Property Tax Protest Services

We’re committed to delivering exceptional Anderson County Property Tax Protest solutions designed specifically for your county.

Reduces Tax Burden

If your property’s value is set too high, protesting can lower your annual tax load. Every dollar saved through your Anderson County Texas protest is one you can invest back into your home or family.

Provides Relief

Winning a property tax protest in Anderson County means peace of mind, knowing you’re paying only your fair share. Our team handles everything from start to finish with the Anderson County Appraisal District Texas, so you can relax while we maximize your savings.

Increases Property Value

When your tax assessment is accurate, it can actually make your property more attractive to buyers. Lowering an inflated tax bill gives your home stronger market appeal and more financial flexibility.

Simplify Taxation

Working with our experts means you don’t have to navigate the confusing paperwork or deadlines alone. We simplify the process, ensuring every step is handled smoothly and professionally.

Avoid Overpayment

Through our Anderson County Property Tax Protest service, you can make sure you’re only paying what’s truly owed, nothing more. Avoid overpaying and free up extra cash for what matters most.

Expert Advice

Our seasoned consultants know the ins and outs of Anderson County Property Tax laws. From documentation to negotiations, we’ll guide you every step of the way to help you achieve the best results possible.

Your Guide to All Things: Navigate with Ease

Cut Your Tax Bill with an Anderson County Tax Protest!

You’re not alone. Many Anderson County homeowners pay more than they should because of inaccurate property appraisals. But there’s good news, a property tax protest in Anderson County Texas can help you reclaim those overpaid dollars. At Tax Cutter, we specialize in Anderson County Property Tax Protest services with a proven record of success. We’ll handle the paperwork, represent you with the Anderson County Appraisal District, and ensure your property is assessed fairly. Let our experts fight for a fair and accurate valuation, so you only pay what’s truly owed.

Major Texas Counties We Serve

We serve homeowners across 254 counties of Texas with residential property tax protest services. No matter your location, our team is ready to help you challenge unfair valuations. Let’s work together to lower your property tax burden.